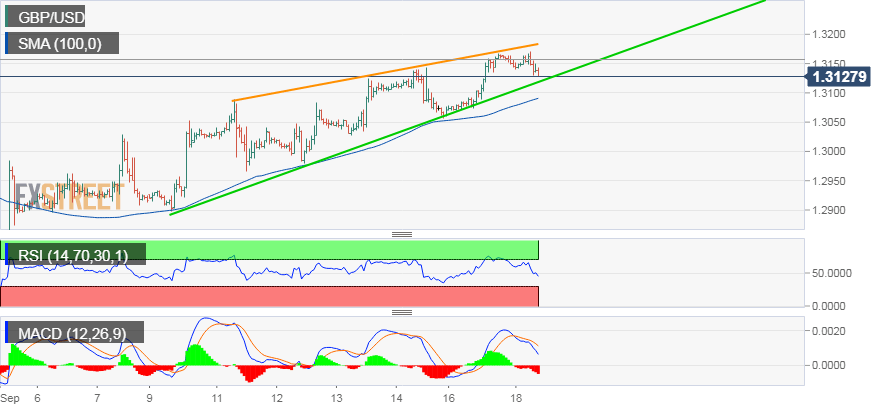

“¢ The pair stalled its recent upsurge to six-week tops and started retreating from an important confluence region, comprising of 100-day SMA and a short-term ascending trend-line on the 1-hourly chart.

“¢ The corrective fall has now dragged the pair back towards another ascending trend-line support, which has been acting as an important support over the past two weeks or so.

“¢ A combination of two converging ascending trend-lines constituted towards the formation of a bearish ‘Rising Wedge’ chart pattern, indicating that the recent bullish momentum might have already ended.

“¢ A convincing break through the mentioned support, leading to a subsequent weakness below 100-hour SMA will reinforce the bearish formation and prompt some aggressive long-unwinding trade.

Spot Rate: 1.3128

Daily High: 1.3171

Trend: Turning bearish

Resistance

R1: 1.3176 (100-day SMA)

R2: 1.3200 (round figure mark)

R3: 1.3228 (R2 daily pivot-point)

Support

S1: 1.3110 (ascending trend-line support)

S2: 1.3090 (100-period SMA H1)

S3: 1.3035 (S2 daily pivot-point)