- GBP/USD struggles to hold recent strength as it trades near 1.3220 ahead of London open on Tuesday.

- The pair rose to 1.3290 during early-day increase after Brexit optimists welcomed the meeting between the UK PM Theresa May and the EU Commission Chief Jean-Claude Juncker.

- However, prices failed to remain strong and are witnessing pullback at press time.

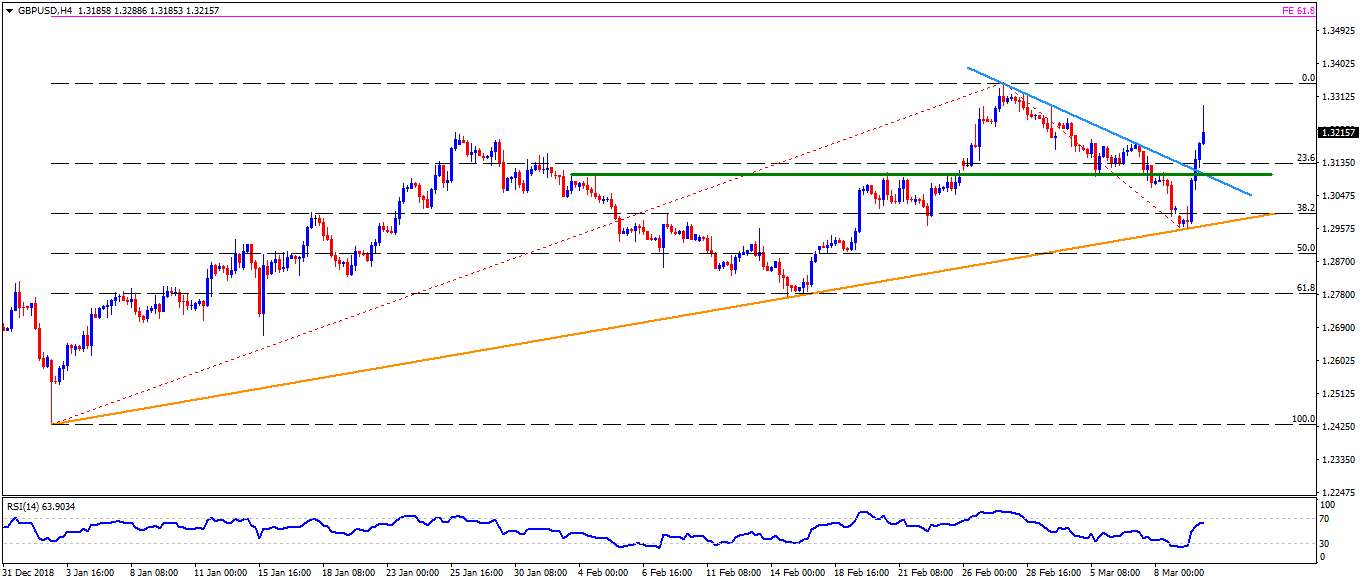

- Should there be a dip beneath 1.3180, sellers may aim for 1.3105/1.3100 horizontal-region comprising important reversal points since early February.

- Given the pair’s sustained downturn under 1.3100, 1.3030 can act as intermediate halt ahead of highlighting ten-week-old support-line, at 1.2970.

- Alternatively, successful trading beyond 1.3300 could escalate recent recovery towards February month high near 1.3350.

- During the pair’s extended rise past-1.3350, 61.8% Fibonacci expansion (FE) of its latest moves, at 1.3530, seems next big resistance for the pair traders to watch. Though, 1.3380, 1.3410 and 1.3460 may meanwhile entertain short-term traders.

GBP/USD 4-Hour chart

Addiitonal important levels:

Overview:

Today Last Price: 1.3252

Today Daily change: 100 pips

Today Daily change %: 0.76%

Today Daily Open: 1.3152

Trends:

Daily SMA20: 1.3073

Daily SMA50: 1.298

Daily SMA100: 1.2884

Daily SMA200: 1.2986

Levels:

Previous Daily High: 1.3171

Previous Daily Low: 1.296

Previous Weekly High: 1.3269

Previous Weekly Low: 1.299

Previous Monthly High: 1.3351

Previous Monthly Low: 1.2773

Daily Fibonacci 38.2%: 1.309

Daily Fibonacci 61.8%: 1.3041

Daily Pivot Point S1: 1.3018

Daily Pivot Point S2: 1.2884

Daily Pivot Point S3: 1.2807

Daily Pivot Point R1: 1.3229

Daily Pivot Point R2: 1.3305

Daily Pivot Point R3: 1.344