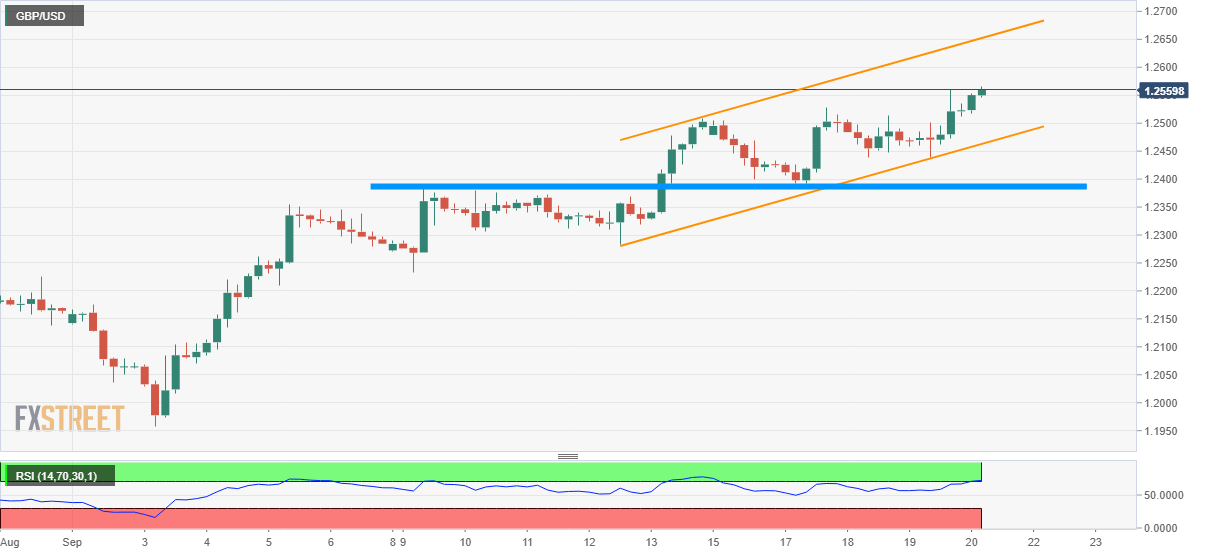

- GBP/USD trades at the two-month top, inside a one-week-old rising trend-channel.

- Overbought RSI might trigger pair’s pullback to channel support.

Overbought conditions of 14-bar relative strength index (RSI) creates doubts on the GBP/USD’s further advances as it trades near 1.2555 ahead of the UK open on Friday.

While looking at the last week’s movement, the pair forms rising channel pattern, which in turn favors the pair’s gradual upside. However, contrasting RSI signal could trigger a pullback towards the channel support figure of 1.2460, with 1.2500 being immediate support.

Should sellers fetch the quote below 1.2460, 1.2385/80 horizontal-area including last week’s top and current week’s bottom will be in the spotlight.

On the upside, multiple highs marked in May month close to 1.2585/80 and 1.2600 can question buyers ahead of taming them with the channel resistance figure of 1.2655.

GBP/USD 4-hour chart

Trend: pullback expected