- GBP/USD got a 70-pip boost as US President Donald Trump said in an interview on CNBC that he doesn’t agree with interest rate hikes. CME Group FedWatch Tool’s December rate hike odds ease to 53% after Trump comments.

- GBP/USD has now reclaimed the 1.3000 figure and found resistance just at the 1.3049 level.

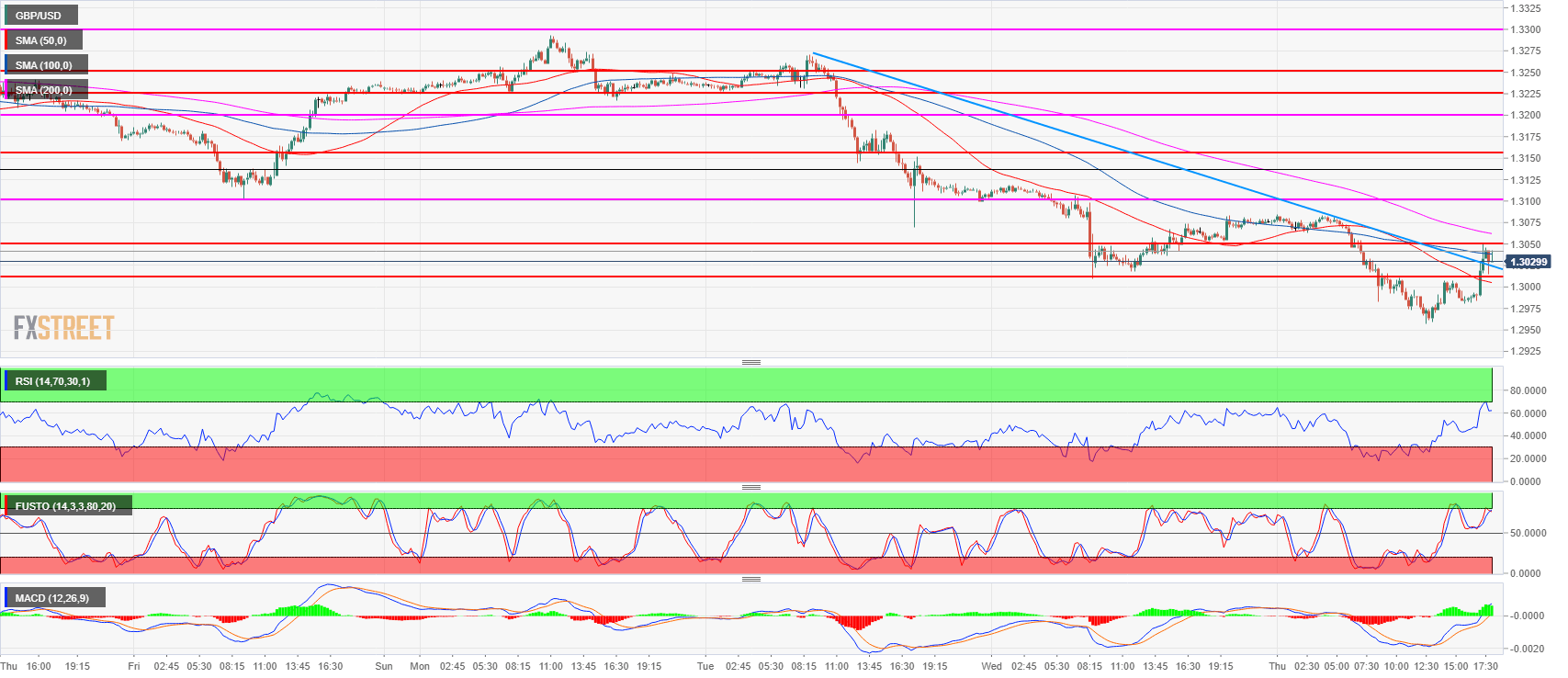

- While this can be seen as a selling opportunity the current momentum has switched momentarily to neutral as GBP/USD broke above the 50-period simple moving average and the trendline. A fail breakout above 1.3049 would be seen as a positive sign for bears.

GBP/USD 15-minute chart

Spot rate: 1.3030

Relative change: -0.30%

High: 1.3084

Low: 1.2957

Trend: Bearish

Resistance 1: 1.3049 June 28 low

Resistance 2: 1.3100 figure

Resistance 3: 1.3155 former breakout point

Support 1: 1.3010 July 18 low

Support 2: 1.2957 current 2018 low

Support 3: 1.2908 September 5, 2017 low

Support 4: 1.2774 August 24, 2017 low