- The Sterling heads into Monday’s London market session sticking close to Friday’s lows near 1.3055 as Brexit tensions deflate the GBP.

- Weekend headlines over the possibility of a snap election this year were talked down by the UK’s Brexit minister ahead of the day’s market open, and thin early session volumes thanks to a confluence of long weekends across Australia, China, and Japan helped to keep market volatility in a sedate stance for the open.

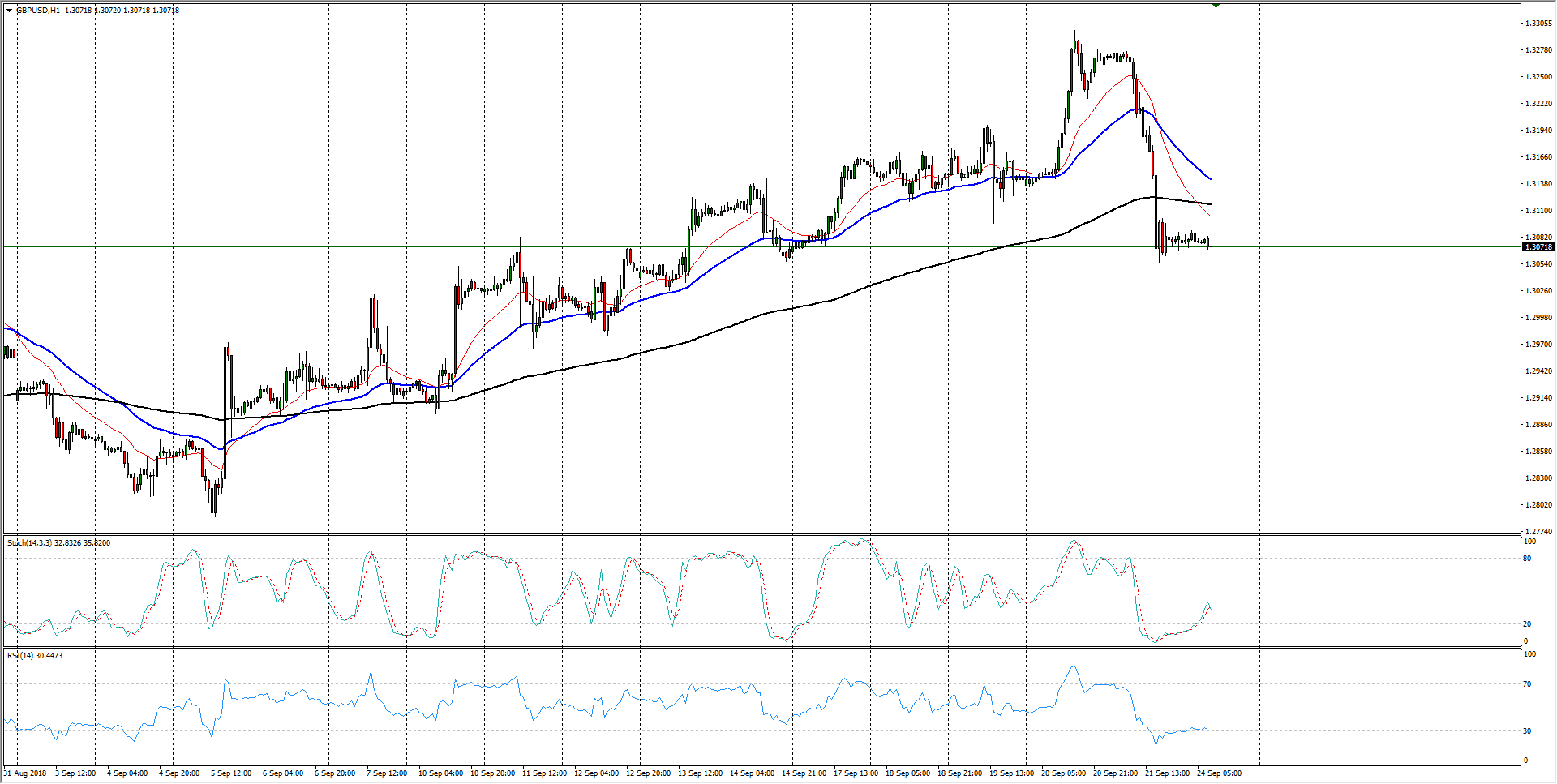

- Friday’s downturn is firming up as a rejection from the major 200-day EMA, and support is currently packed in at the confluence of the 21- and 50-day EMAs, though with the pair failing to break past the last major swing high from July’s peaks at 1.3360, further downside could be on the cards this week for the GBP/USD as markets head into another showing by the US Fed, which is expected to hike up interest rates in an effort to stave off rising inflation within the US domestic economy.

| Spot rate | 1.3071 |

| Current week relative change | Negligible |

| Previous week high | 1.3298 |

| Previous week low | 1.3054 |

| Trend | Bearish |

| Support 1 | 1.3044 (50-day EMA) |

| Support 2 | 1.2950 (50- and 200-period 4-hour EMA crossover) |

| Support 3 | 1.2785 (September bottom) |

| Resistance 1 | 1.3116 (200-hour EMA) |

| Resistance 2 | 1.3142 (50-hour EMA) |

| Resistance 3 | 1.3276 (Friday high) |