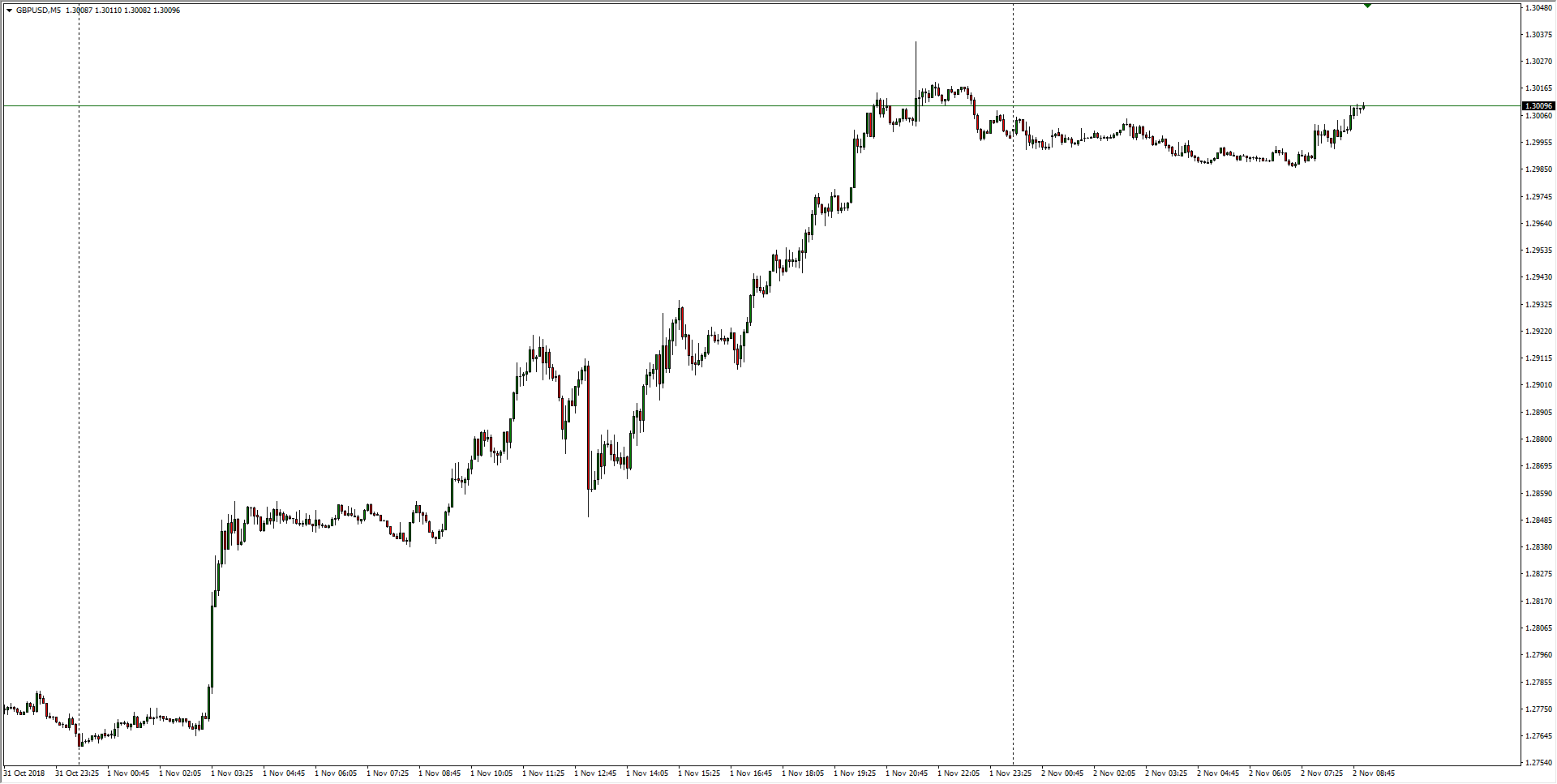

- The GBP/USD remains pinned to the 1.3000 handle after Thursday’s 250-someodd pip rise on refreshed Brexit hopes, and the pair remains pushed into near-term highs.

GBP/USD M5

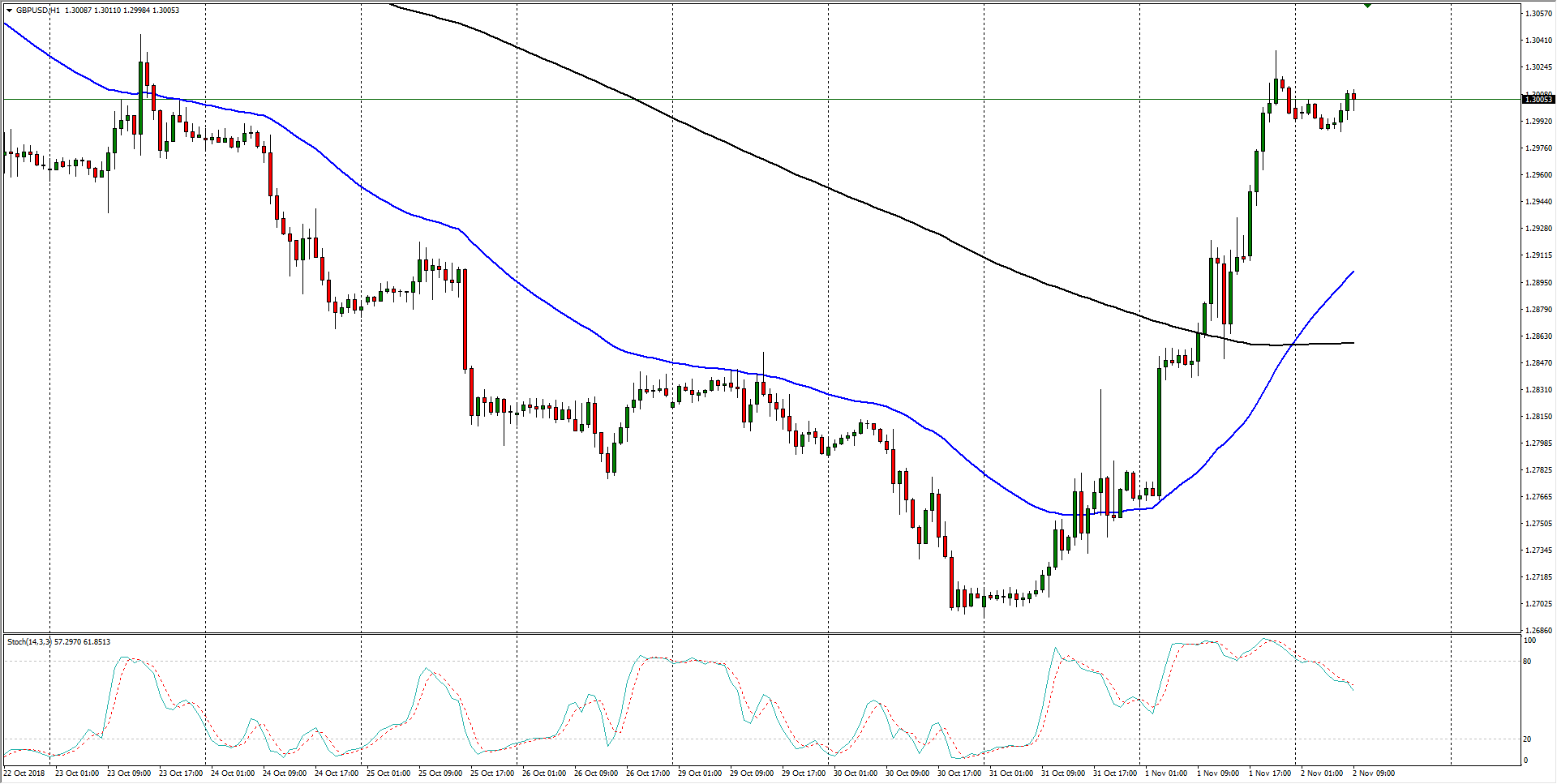

Hourly candles show the Cable has blown right past the 200-hour moving average at 1.2860, and the 50-hour moving average has inverted the pair’s near-term bias, setting in a potential floor at the 1.2900 handle.

GBP/USD H1

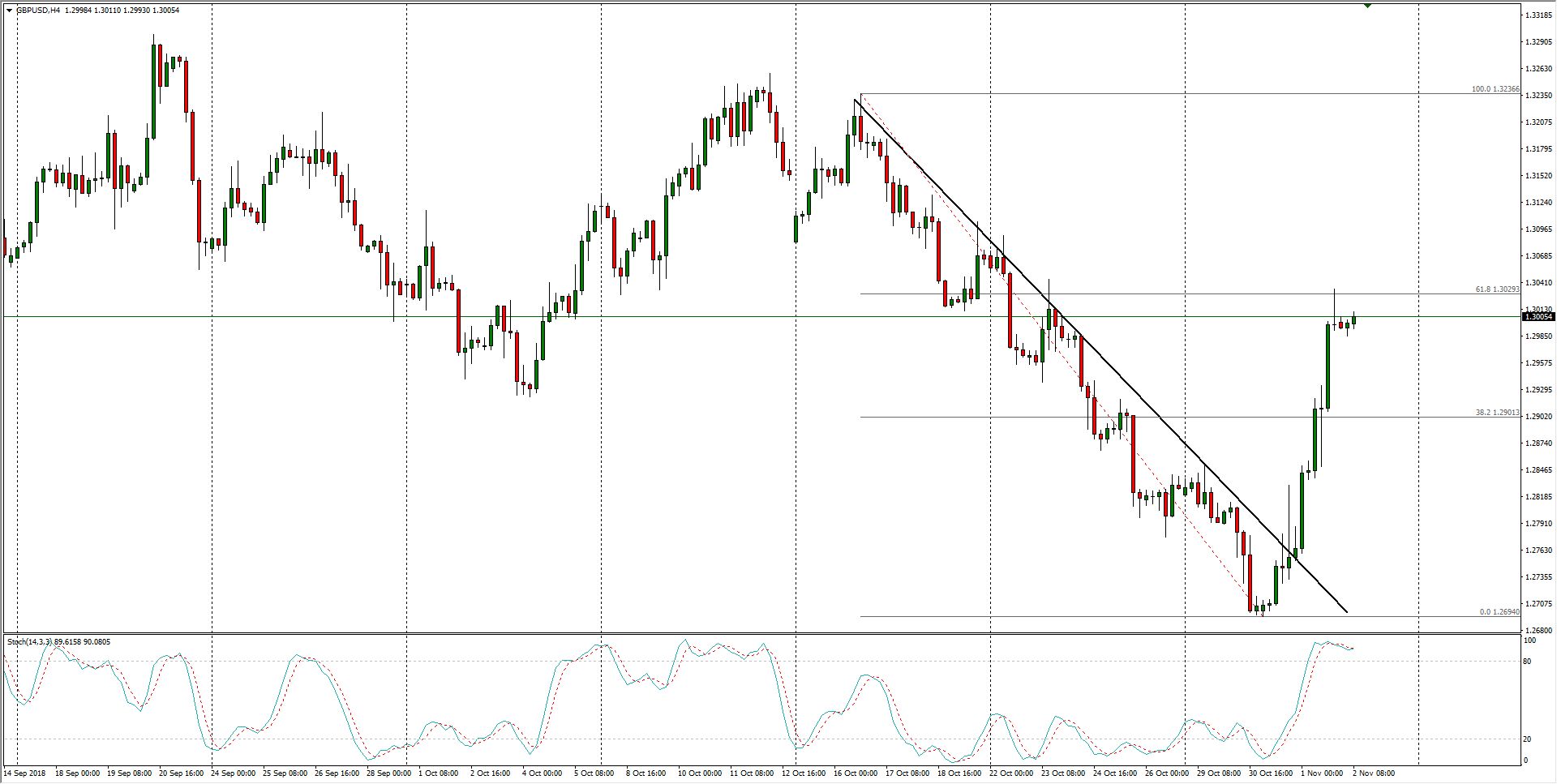

- The past three weeks have seen the Cable steeply off of early October’s highs, and yesterday’s trendline break sees the GBP/USD making a clean challenge of the 61.8% Fibo level neat 1.3030, and buyers could see challenges heading into Friday’s action.

GBP/USD H4

Don’t forget to check out FXStreet’s own live chart to see instant updates on the GBP/USD!

GBP/USD

Overview:

Last Price: 1.3006

Daily change: 1.0 pips

Daily change: 0.00769%

Daily Open: 1.3005

Trends:

Daily SMA20: 1.3011

Daily SMA50: 1.3019

Daily SMA100: 1.3045

Daily SMA200: 1.3436

Levels:

Daily High: 1.3036

Daily Low: 1.2762

Weekly High: 1.3092

Weekly Low: 1.2777

Monthly High: 1.326

Monthly Low: 1.2696

Daily Fibonacci 38.2%: 1.2932

Daily Fibonacci 61.8%: 1.2867

Daily Pivot Point S1: 1.2833

Daily Pivot Point S2: 1.266

Daily Pivot Point S3: 1.2558

Daily Pivot Point R1: 1.3107

Daily Pivot Point R2: 1.3209

Daily Pivot Point R3: 1.3382