- The incoming disappointing UK macro data/Brexit uncertainties continue to weigh on the GBP.

- The downside seems limited as traders seemed reluctant to place any aggressive bearish bets.

The GBP/USD pair extended its sideways consolidative price action, well within this week’s broader trading range, and moved little following yet another disappointing release of UK services PMI for September.

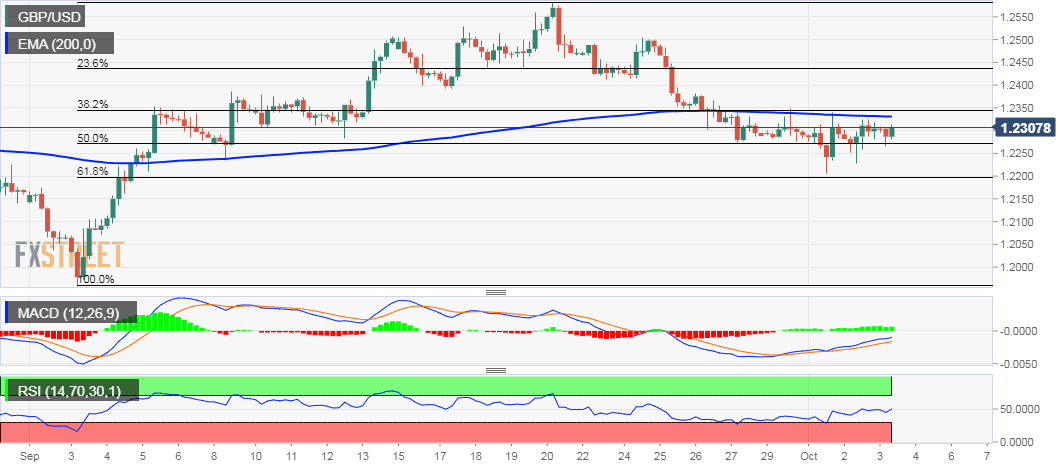

Given that the pair has repeated failed to capitalize on its attempted recovery towards the 1.2340-50 confluence region, the near-term bias remains tilted in favour of bearish traders amid Brexit uncertainties.

The mentioned barrier comprises of 38.2% Fibonacci level of the 1.1958-1.2583 strong move up and 200-period EMA on the 4-hourly chart, which should continue to act as a key pivotal point for short-term traders.

Meanwhile, technical indicators on 4-hourly/daily charts are yet to gain any meaningful negative momentum and thus, warrant some caution before positioning aggressively for any further depreciating move.

In the meantime, the 1.2270-65 region (50% Fibo. level) now seems to protect the immediate downside, below which the pair is likely to accelerate the slide back towards challenging the 1.2200 handle (61.8% Fibo. level).

On the flip side, a sustained break through the said 1.2340-50 confluence barrier might negate the near-term bearish outlook and set the stage for a move back towards reclaiming the 1.2400 round-figure mark.

GBP/USD 4-hourly chart