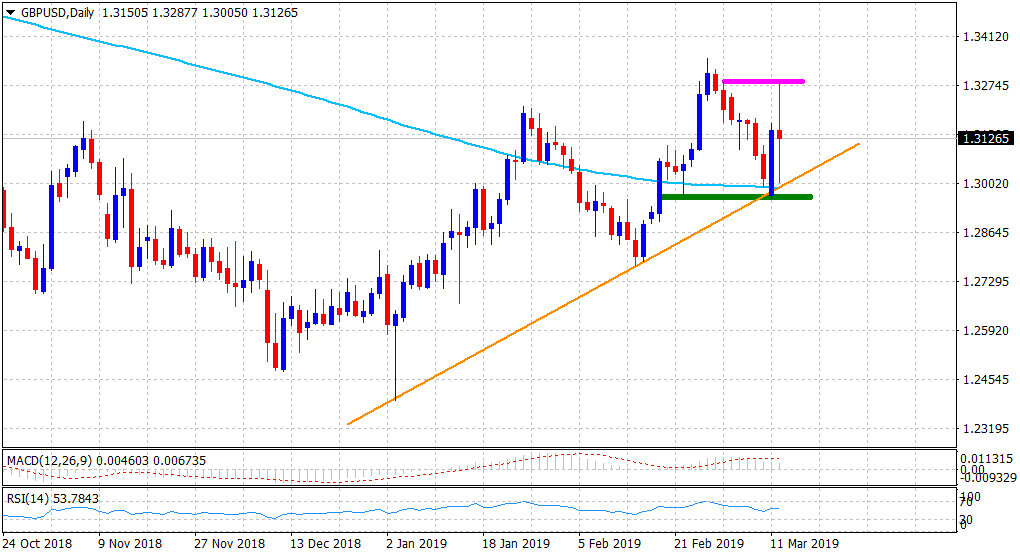

“¢ The pair stalled its sharp intraday downfall near the very important 200-day SMA and staged a remarkable recovery of around 130-140 pips from the key 1.30 psychological mark.

“¢ The pair’s resilience near the mentioned support clearly points to traders reluctant to place any aggressive bets ahead of the crucial vote on May’s amended withdrawal agreement.

“¢ The mentioned support coincides with a short-term ascending trend-line – extending from early-Jan./mid-Feb. swing lows, and should continue to act as a tough nut to crack for bears.

“¢ Hence, it would be prudent to wait for a convincing break through the mentioned support before traders start positioning aggressively for a further near-term depreciating move.

“¢ A sustained weakness below the said handle is likely to accelerate the fall further towards the 1.2900 round figure mark before the pair eventually slides further towards the 1.2800 handle.

“¢ Meanwhile, technical indicators on 4-hourly/daily charts maintained their bullish bias, through bulls are likely to wait for a convincing break through the 1.3285-90 horizontal resistance.

GBP/USD daily chart

GBP/USD

Overview:

Today Last Price: 1.3146

Today Daily change: -6 pips

Today Daily change %: -0.05%

Today Daily Open: 1.3152

Trends:

Daily SMA20: 1.3073

Daily SMA50: 1.298

Daily SMA100: 1.2884

Daily SMA200: 1.2986

Levels:

Previous Daily High: 1.3171

Previous Daily Low: 1.296

Previous Weekly High: 1.3269

Previous Weekly Low: 1.299

Previous Monthly High: 1.3351

Previous Monthly Low: 1.2773

Daily Fibonacci 38.2%: 1.309

Daily Fibonacci 61.8%: 1.3041

Daily Pivot Point S1: 1.3018

Daily Pivot Point S2: 1.2884

Daily Pivot Point S3: 1.2807

Daily Pivot Point R1: 1.3229

Daily Pivot Point R2: 1.3305

Daily Pivot Point R3: 1.344