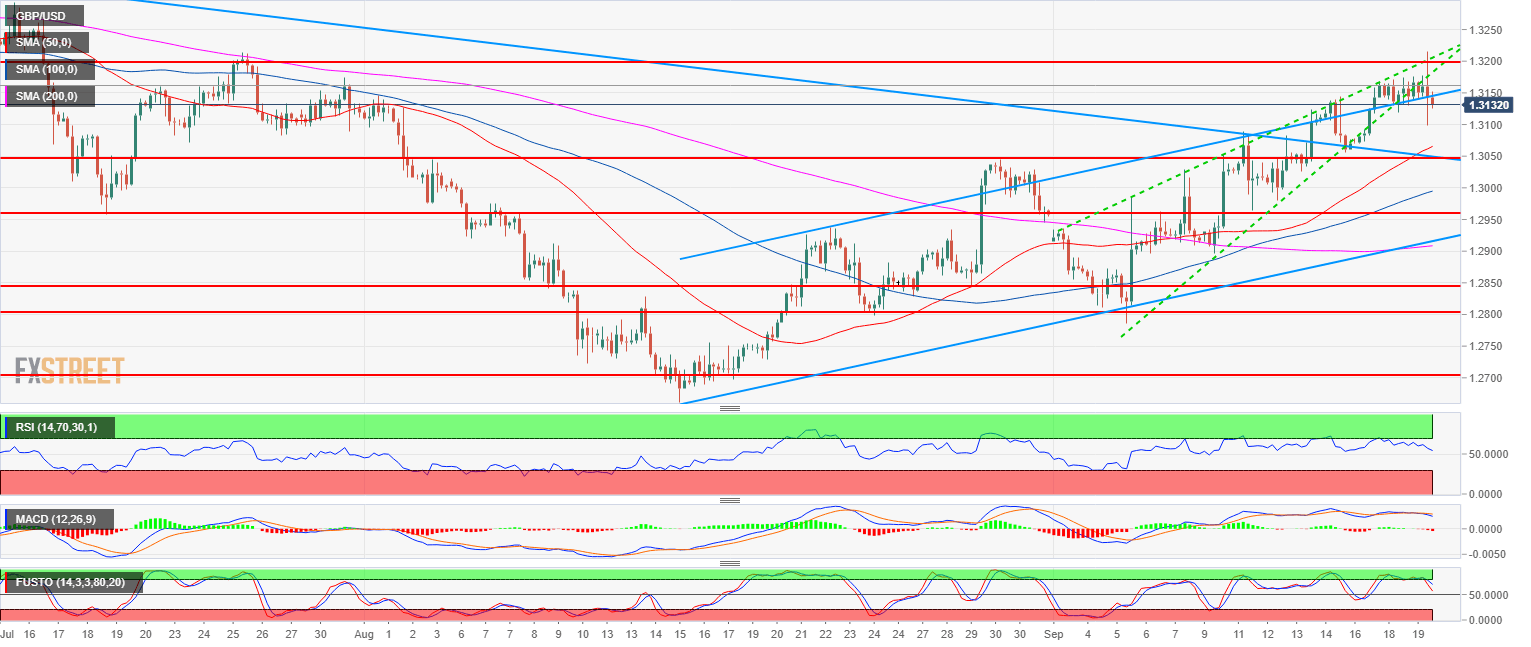

- GBP/USD main bear trend has been on hold since mid-August.

- GBP/USD is breaking to the downside from the rising wedge pattern after rejecting the 1.3200 figure. The RSI, the MACD and the Stochastics indicators are decelerating, all suggesting that the current bull leg might be setting up for a correction in the near-term.

- Level of supports are seen near 1.3050 and 1.3000 figure.

GBP/USD 4-hour chart

Spot rate: 1.3135

Relative change: -0.08%

High: 1.3215

Low: 1.3098

Main trend: Bearish

Resistance 1: 1.3144 last week high

Resistance 2: 1.3200 figure (key support/resistance)

Resistance 3: 1.3300 figure

Resistance 4: 1.3472 June 7 high

Support 1: 1.3082-1.3100 supply/demand level and figure

Support 2: 1.3050 August 30 swing high, key level

Support 3: 1.3000 figure