- The Sterling is trading into familiar territory for the week ahead of the Bank of England’s highly-expected rate hike.

- BoE rate hike might not go off with slumping economic data for the UK, which could see the Sterling heading for new 2018 lows.

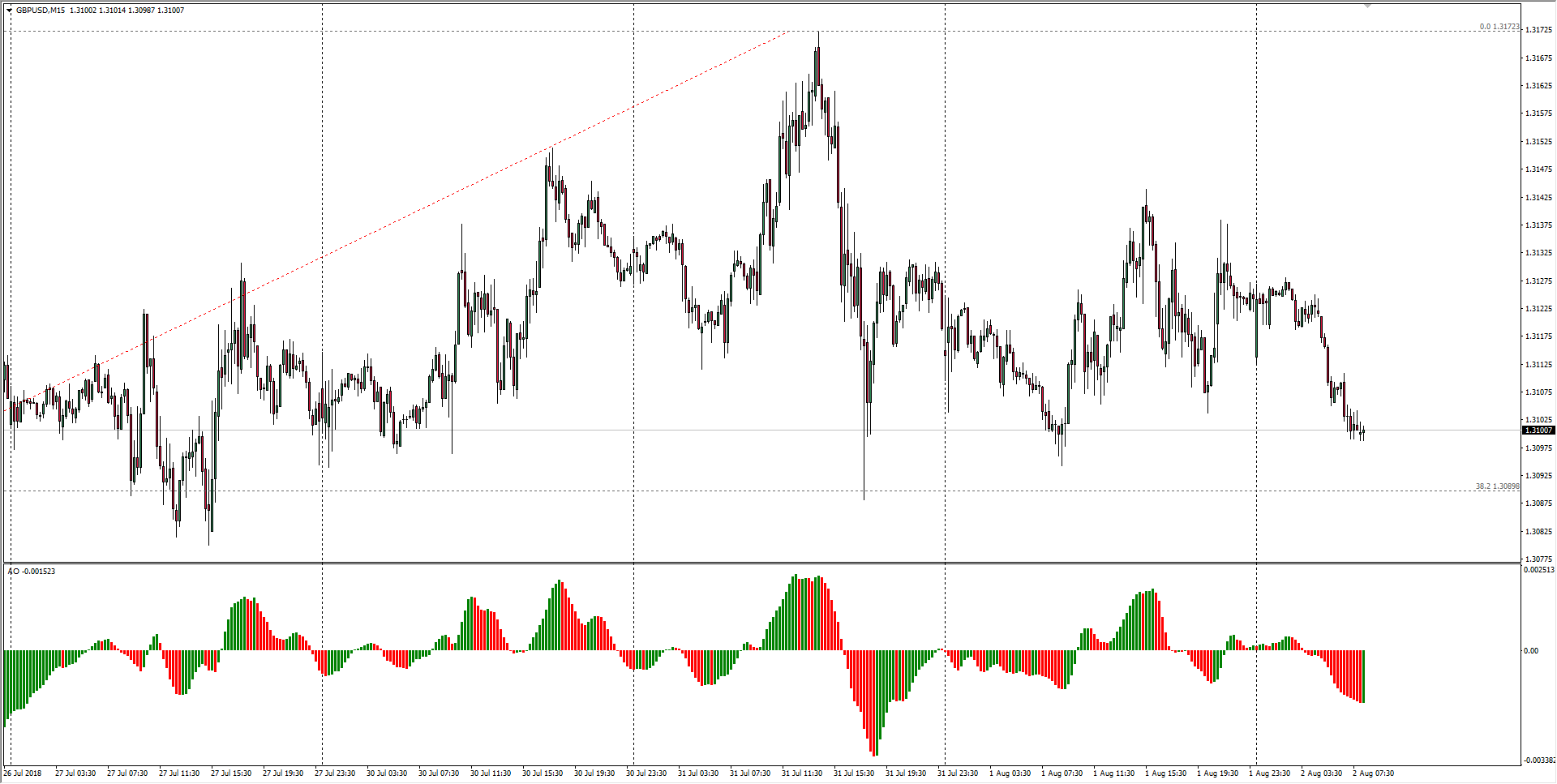

- THe GBP/USD saw July end the month near where it started as momentum bleeds out of the major pair on a still-muddy Brexit.

| Spot rate: | 1.3100 |

| Relative change: | -0.10% |

| High: | 1.3128 |

| Low: | 1.3098 |

| Trend: | Flat to bearish |

| Support 1: | 1.3088 (current week low) |

| Support 2: | 1.3054 (61.8% Fibo retracement level) |

| Support 3: | 1.2956 (two-week low; technical bottom) |

| Resistance 1: | 1.3128 (current day high) |

| Resistance 2: | 1.3172 (current week high) |

| Resistance 3: | 1.3212 (previous week high) |