- Sterling continues to stick to recent lows as economic data for the UK disappoints traders, sending the GBP spiraling into nine-month lows.

- Slumping economic figures are piling onto already-bearish market sentiment as Brexit squabbles within the UK continue to go nowhere.

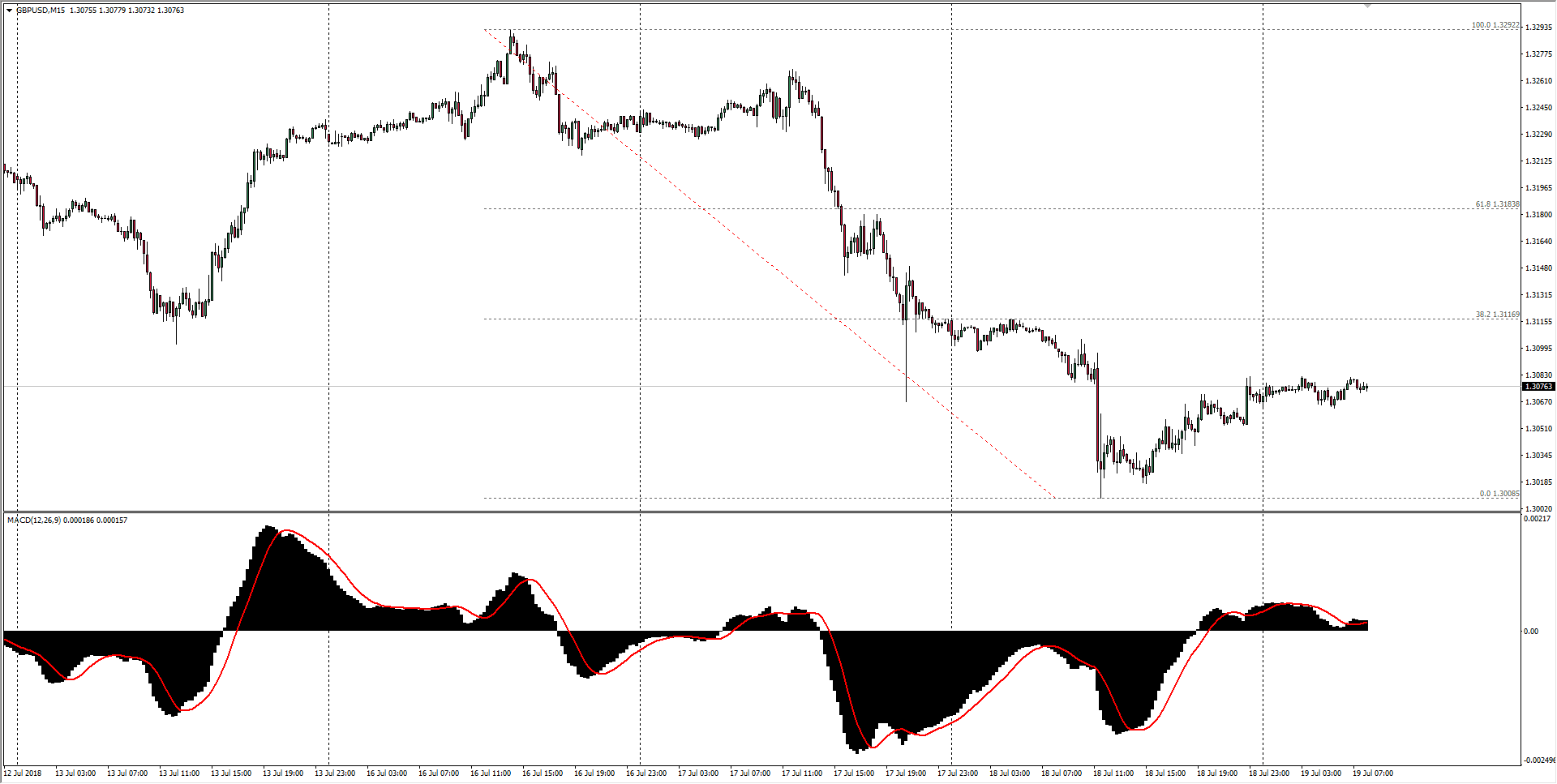

- Daily candles have the GBP/USD pair firmly in a downside trend, and pullbacks should be seen as an opportunity to re-short.

- Thursday’s Retail Sales figures for the UK provide one more chance for sellers to make one more push to crack the 1.30 key level.

| Spot rate: | 1.3076 |

| Relative change: | 0.06% |

| High: | 1.3082 |

| Low: | 1.3063 |

| Trend: | Bearish |

| Support 1: | 1.3049 (June low) |

| Support 2: | 1.3008 (current week low; critical technical bottom) |

| Support 3: | 1.2950 (S2 daily pivot) |

| Resistance 1: | 1.3116 (previous day high) |

| Resistance 2: | 1.3183 (61.8% Fibo retracement level) |

| Resistance 3: | 1.3292 (current week high) |