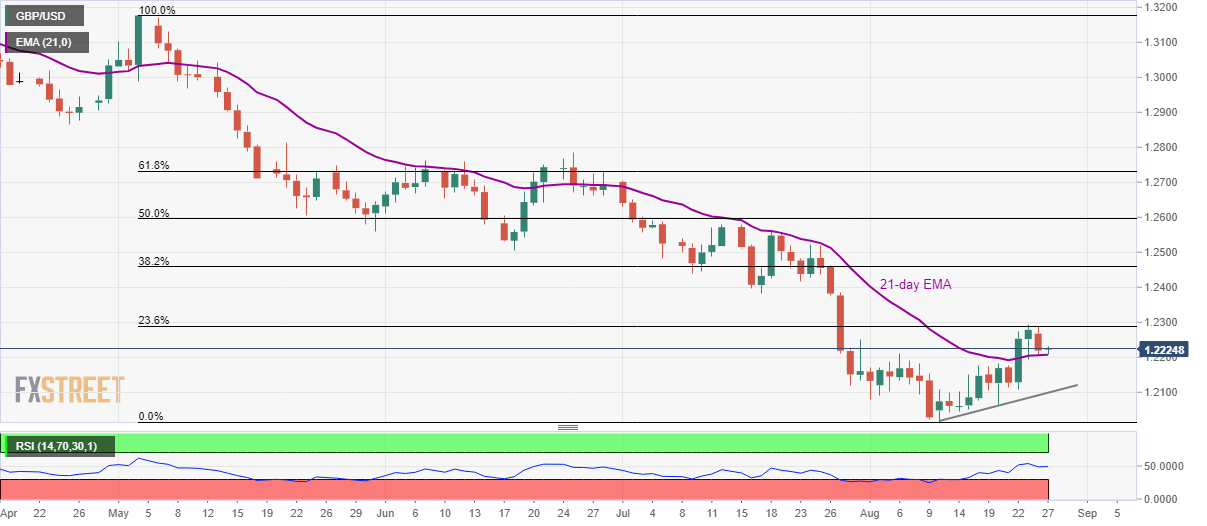

- GBP/USD refrains from declining below 21-day EMA.

- 23.6% Fibonacci retracement of May-August declines limit short-term advances.

GBP/USD struggles between 23.6% Fibonacci retracement of its three-month-old downpour and 21-day exponential moving average (EMA) as it trades near 1.2225 ahead of the UK open on Tuesday.

While pair’s failure to extend two-week long recovery beyond immediate resistance increases the odds of its south-run, 21-day EMA and a fortnight old rising trend-line question sellers.

In doing so, 1.2207 and 1.2100 acts as nearby supports ahead of monthly bottom surrounding 1.2015.

If the pair manages to cross 1.2290 resistance level, including 23.6% Fibonacci retracement, July 17 low near 1.2382 and 38.2% Fibonacci retracement around 1.2460 might as well lure buyers.

GBP/USD daily chart

Trend: Sideways