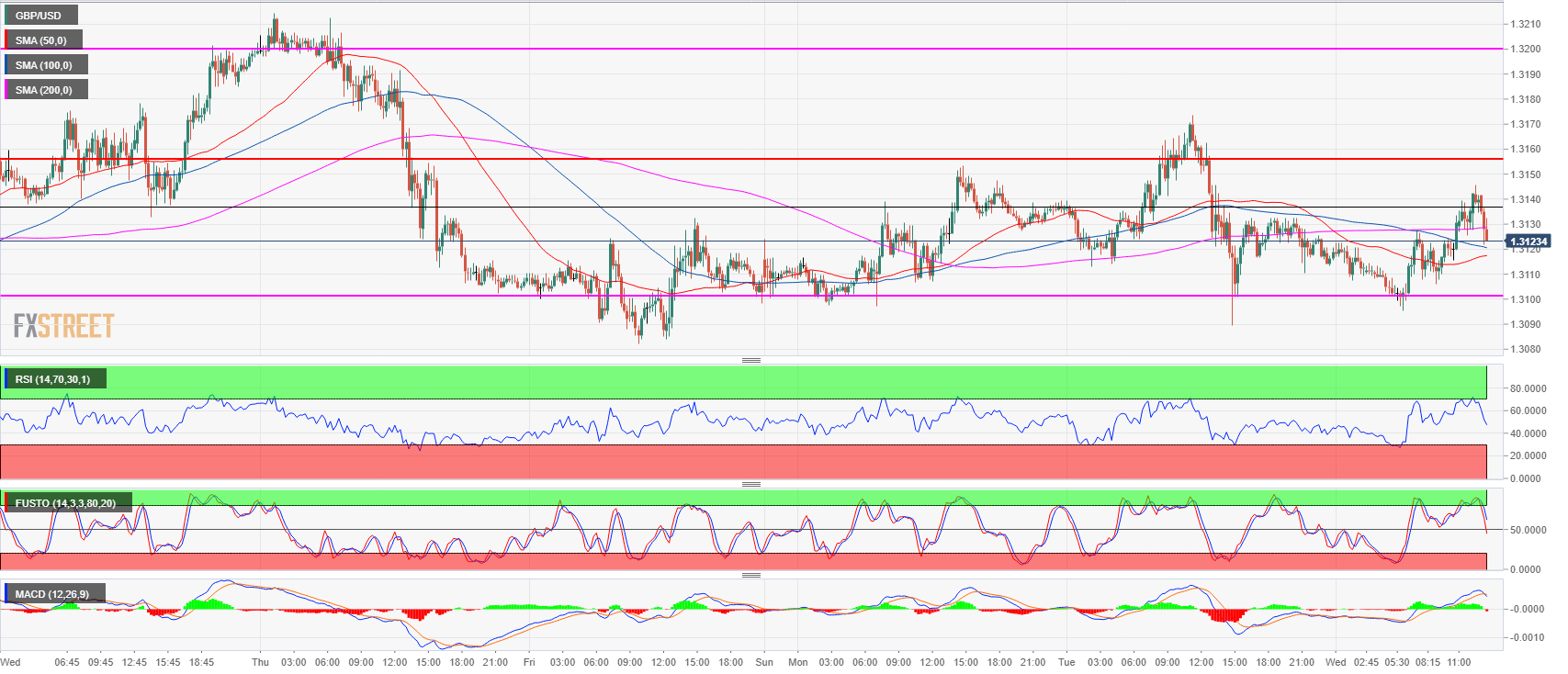

- GBP/USD found some resistance near the 1.3145 level as GBP/USD is in its fourth day of consolidation. Bulls objective is to breakout above 1.3200 figure if they wish to reverse the bear trend and start a bullish one.

- On the other hand, bears need a strong bear breakout below 1.3100 in order to resume the multi-month bear trend. In the near-term bulls have a small advantage as long as GBP/USD stays above the 1.3100 level.

- The Fed’s Monetary Policy Statement is set to be released at 18:00 GMT. The event usually leads to volatility in the market.

Spot rate: 1.3119

Relative change: -0.04%

High: 1.3145

Low: 1.3095

Trend: Bearish / Bullish above 1.3200

Resistance 1: 1.3155 former breakout point

Resistance 2: 1.3200 figure

Resistance 3: 1.3230 supply level

Resistance 4: 1.3250 June 4 high

Support 1: 1.3100-1.3076 area, figure and weekly low

Support 2: 1.3049 June 28 low

Support 3: 1.3010 July 18 low

Support 4: 1.2957 current 2018 low

Support 5: 1.2908 September 5, 2017 low