- GBP/USD has been resuming its gains amid upbeat news from the vaccine front and US politics.

- Concerns about restrictions around Christmas limit the pound’s gains.

- Brexit negotiations may morph into an interim deal.

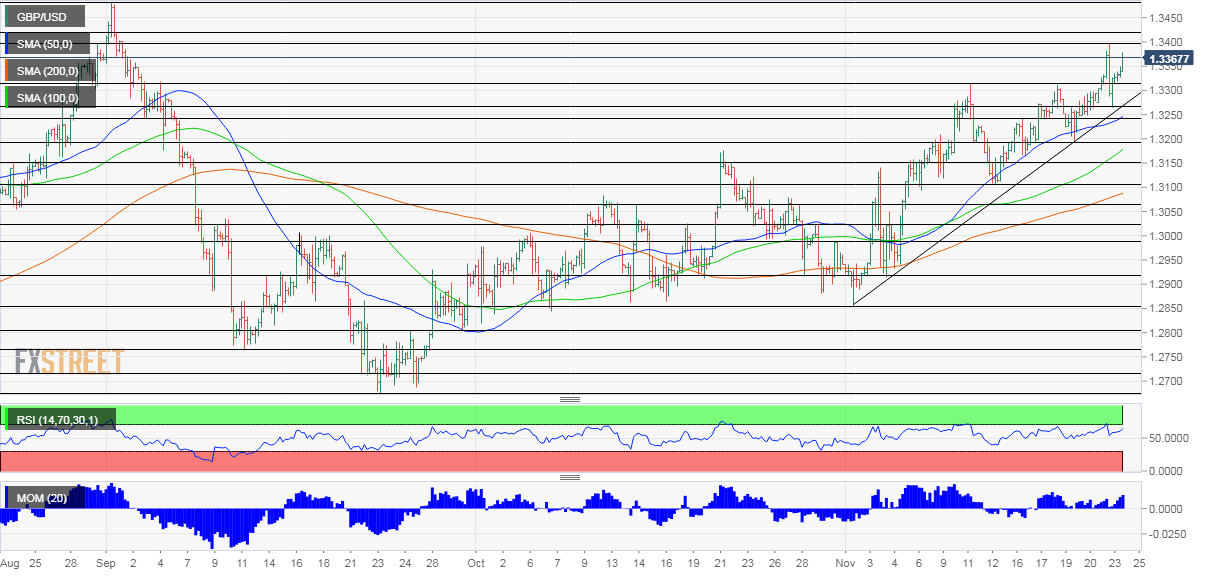

- Tuesday’s four-hour chart is painting a bullish picture.

More upside than downside – but is it sufficient to break above 1.34? Monday’s upside move failed to break that round level, but sterling has another chance. There are several moving parts that can be categorized into The Good, The Bad, and The Ugly.

The good – Three factors

Vaccine: AstraZeneca and the University of Oxford published promising results from their Phase 3 coronavirus vaccine trial. While the different dosage figures caused some confusion, markets are more optimistic now and await the final figures. The British-grown immunization scheme is the third out of three vaccines and emergency authorization is likely in the UK as early as next week.

Transition: President-elect Joe Biden will be able to begin his transition after outgoing PResident Donald Trump gave the green light to the move. The authorization removes political tensions and would allow for better control of the pandemic and the economy. The safe-haven dollar dropped in response to the news.

Janet Yellen, the highly regarded former Federal Reserve Chair, will likely be America’s next Treasury Secretary. Her probable nomination has also been cheered by markets as she would support fiscal stimulus yet without endangering free trade.

The bad two adverse developments for GBP/USD

London lockdown? UK Prime Minister Boris Johnson announced the end of the nationwide lockdown in December but the localized tier system will likely be stricter than the previous one. Moreover, it is still unclear if London, one of the world’s financial capitals, will be under severe restrictions.

The UK’s case curve is falling, yet mortalities remain elevated.

Dollar reacts to data: The second adverse factor for cable stems from encouraging US figures – Markit’s Purchasing Managers’ |Indexes beat estimates and pointed to strong growth in November. The US dollar shot higher in a surprising reaction to usually second-tier figures.

The ugly – Brexit

Brexit negotiations remain around “95% done” – while higher than AstraZeneca’s best efficacy figures, the lack of a breakthrough on the most contentious issues is becoming worrisome as the clock ticks down to year-end, when the transition period expires.

Will the EU and the UK kick the can down the road? The idea of an interim agreement floated on Monday, adding a layer of complication. Headlines range from hints of an imminent accord to a collapse in talks, adding to the confusion.

Overall, most factors point to the upside, yet risks loom large.

More GBP/USD Three reasons to expect a sustained Santa rally for sterling

GBP/USD Technical Analysis

Pound/dollar has been benefiting from upside momentum on the four-hour chart and is trading above the 50, 100 and 200 Simple Moving Averages. The Relative Strength Index is still below 70, thus outside overbought conditions.

Overall, the bulls are in full control. Resistance is at Monday’s peak of 1.3397. The next lines to watch date back to the summer when 1.3420 and 1.3510 played a role in holding GBP/USD down.

Support is at 1.3310, the former double-top, and then by 1.3265, Monday’s trough. Further down, 1.3245 is the next level to watch.

More When the market shivers, the Fed delivers? Where next for markets