- GBP/USD has been held back by concerns about a hedge fund consolidation.

- Britain’s reopening and the unblocking of the Suez Canal are set to support cable.

- Bulls are eyeing the 1.39 level, which is a significant convergence level.

Thirty million Brits have received at least one vaccine dose – and that serves as a shot in the arm to sterling. The success of the UK’s immunization campaign is not only encouraging for the future but also has implications for the present. The nation now allows larger gatherings and other activities that were prohibited until now, moving cautiously while cases continue falling.

Tensions between the EU and the UK over exports of vaccines are not resolved, and Britain is still set to face a slowdown in supplies. Nevertheless, hospitals in London are doing far better than those in Paris, and that impacts economic activity as well.

Broader markets are gripped by two other stories, one positive for the market mood and the other weighing on it. Good news comes from Egypt, where authorities are refloating the previously stranded Ever Given mega-ship, and allowing global trade to gradually return to normal. While the six-day blockade has hit the movement of some 450 vessels, the traffic jam has likely caused only limited damage.

Fears come from the rapid liquidation of Archegos Capital, a hedge fund that took leveraged loans and its collapse is now hitting the balance sheets of several banks. While the dust is about to settle around that firm, some worry that there are additional such distressed companies. A highly-leveraged trade that goes against the trader has caused a margin call – this time to a $20 billion account rather than a $1,000 retail one. The same logic applies.

Worries boost the safe-haven dollar while optimism weighs on it. For cable, Britain’s reopening serves as a tiebreaker that pushes GBP/USD higher while the greenback is grinding between these two forces.

GBP/USD Technical Analysis

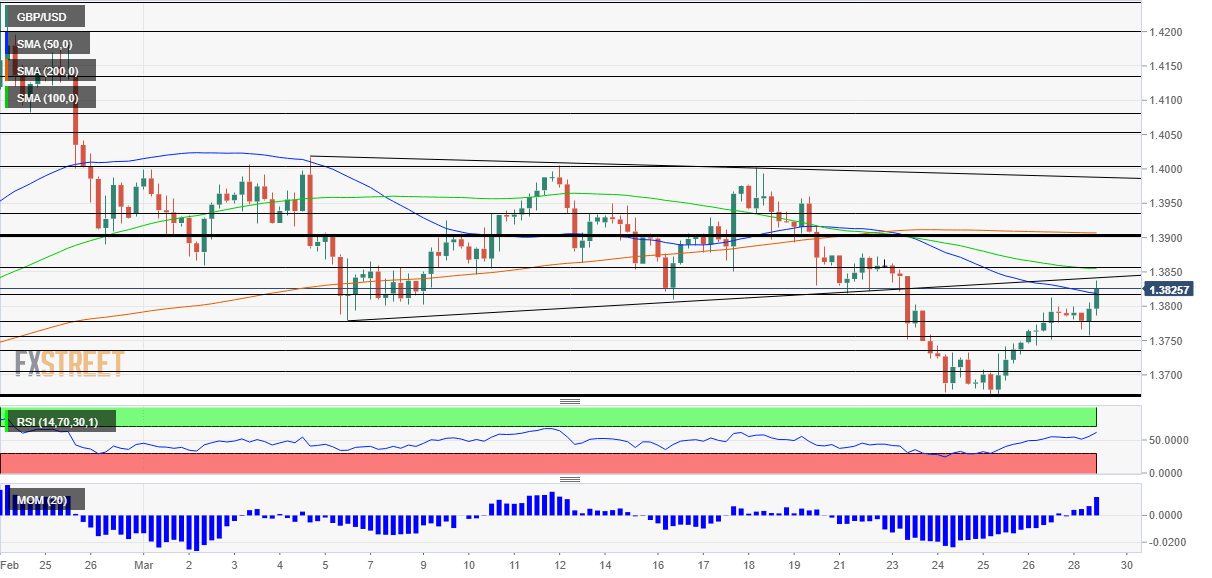

Momentum on the four-hour chart has flipped to the upside, a bullish sign, Cable is currently attacking the broken uptrend support line, trying to recapture it.

After surpassing the 50 Simple Moving Average, Some resistance is at 1.3850, where the 100 SMA awaits it. Critical resistance is at 1.39, which is where the 200 SMA converges with a support line from mid-March. The next lines to watch are 1.3935 and 1.40.

Some support awaits at 1.3810, which provided support last week, followed by 1.3775, a cushion from early March. The next lines to watch are 1.3760, 1.3740 and 1.3670.

More GBP/USD Weekly Forecast: Sterling set to suffer from Biden going big again, upbeat US jobs data