- GBP/USD bulls are keeping up in the short run.

- UK data came up with positive figures, lending support to the British Pound.

- Fed meeting minutes can catalyze the market.

- Technically, bulls are keeping control.

The GBP/USD pair maintains the bid tone in the Asian session on Tuesday after a long weekend. It looks like the Dollar correction is getting a little steeper.

UK data front

Business activity in the UK services sector surged sharply in June on the back of a release of pent-up demand that eased restrictions led to, according to IHS Markit final data released on Monday.

The CIPS Services Purchasing Managers Index was 62.4 in June, down slightly from 62.9 in May. However, the current value was the second-highest since October 2013. In addition, the index was above the preliminary estimate of 61.7.

In June, the index remained above 50.0 for the fourth straight month. Another sharp rise in new orders helped boost production in the services sector. However, there was a slight decrease in export sales among service companies due to restrictions on international travel and uncertainty over quarantine policies.

Despite the steady and accelerated growth in the number of jobs, difficulties arose in fulfilling the current volume of orders. Nevertheless, job creation has been at its highest since June 2014.

In terms of prices, the study found that inputs and prices drove inflation in June. Service providers noted that higher staff salaries, higher raw material prices and higher transportation costs were the main drivers of cost increases.

Fed meeting minutes this week can provide fresh impetus to the pair. We will be interested to know about the consensus on rate hikes and monetary tightening.

GBP/USD technical view: More rise on cards

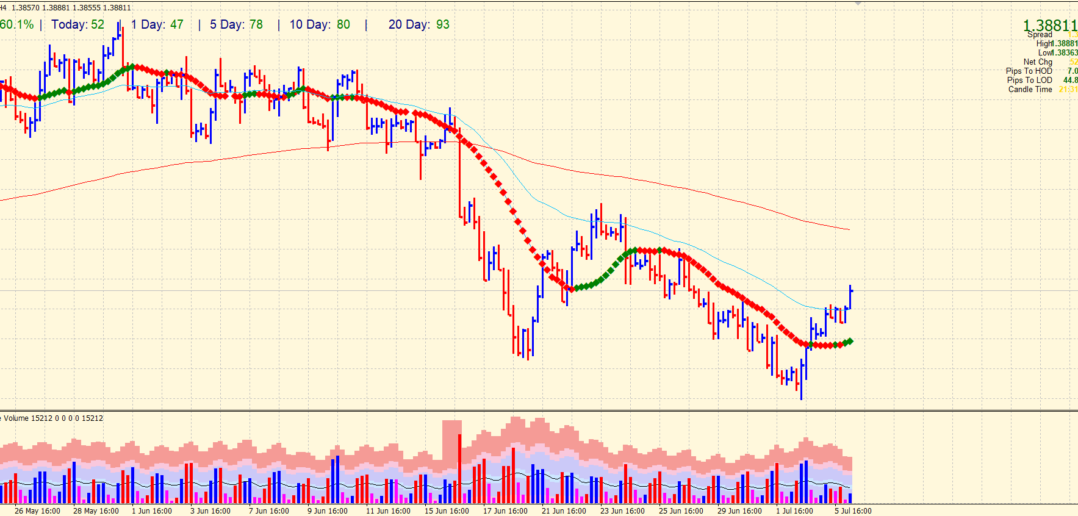

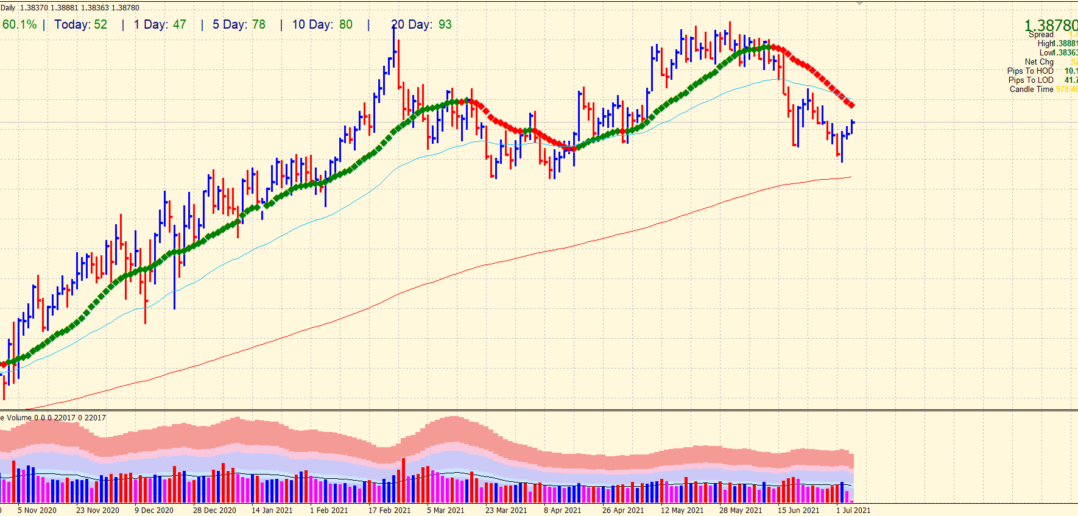

With the opening of trading in Asia on Tuesday, the currency pair is trading with a confident increase in quotes. However, the pair remains within the current support level at 1.3792 and the resistance level at 1.3938. Moreover, the daily chart progresses in the area between moving averages with 20 and 50 days, showing a growing advantage for buyers in the short term.

On the four-hour chart, the moving averages have turned upward and maintained a slight divergence, which indicates the upward potential of this market in the short term.

4-hour chart of GBP/USD

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.