- GBP/USD has been falling amid safe-haven dollar flows.

- Fears about mass UK firings are weighing on the pound.

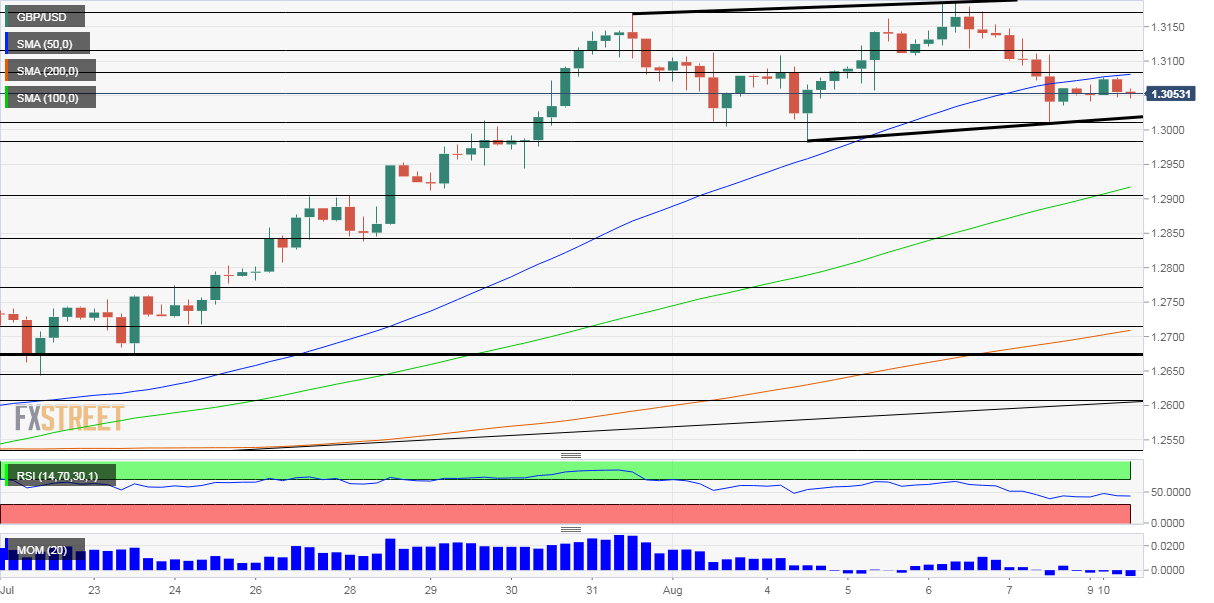

- Monday’s four-hour chart is showing the currency pair is at the bottom of the uptrend channel.

A third of UK employers are considering layoffs – by October. The depressing survey conducted by the Chartered Institute of Personnel and Development (CIPD) have been on the pound. Britain’s labor market is holding up well thanks to the government’s successful furlough scheme, which pays employees most of their salaries while they are unable to work.

That emergency program has likely kept unemployment depressed in June. Tuesday’s labor figures are set to paint a rosy picture – despite the hardship inflicted by the COVID-19 crisis.

See UK Jobs Preview: Feeble figures still furloughed? Another robust report may boost BOE-fueled rally

GBP/USD is also a feeling of dollar strength. The latest surge in safe-haven demand is coming from China’s announcement that it will sanction US officials – including Senators Marco Rubio and Ted Cruz. The two former presidential candidates are fierce critics of Beijing. The Chinese move came in response to Washington’s sanctioning of Hong Leader Carrie Lam.

The world’s largest economies are also at loggerheads over Taiwan. China sent a fighter jet briefly across the median line of Taiwan Strait – expressing its anger to US Health Secretary Alex Azar in Taipei. Negotiators will meet late in the week to take stock of the trade deal.

The greenback is benefiting from the ongoing fiscal impasse in Washington. President Donald Trump sought to break the deadlock by signing four executive orders, providing unemployment benefits and other support. His move – which may not have legal backing – may push Republicans and Democrats to strike a deal.

However, the recent decline in the US coronavirus case curve – albeit remaining high – and the upbeat jobs report could cause complacency among policymakers. The US gained 1.763 million jobs in July, a substantial drop from June, yet beating estimates.

See NFP Analysis: Slow hiring downbeat for the dollar, good for gold, no silver lining

The JOLTs job openings figures for June may provide more insights about America’s labor market, but the main focus is on politics – internal and external.

See 2020 US Election: August is for calculating, September for campaigning

GBP/USD Technical Analysis

Pound/dollar is trading in an uptrend channel, setting higher highs and higher lows. However, the downdrift toward the bottom of the range has resulted in losing momentum on the four-hour chart, as well as the 50 Simple Moving Average.

That uptrend support line is at 1.3025 at the time of writing, nearly converging with Friday’s low. The next cushion is at 1.2985, followed by 1.29 and 1.2845.

Resistance is at 1.3085, the daily high, followed by 1.3115 and 1.3170, before August’s high of 1.3183.