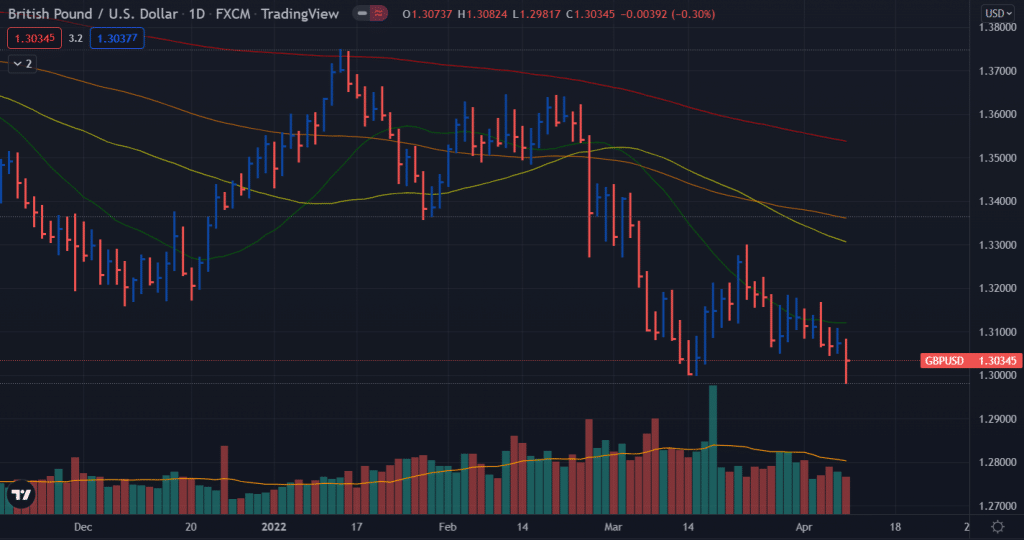

- In the face of policy divergences, the GBP/USD pair hit multi-month lows below 1.3000.

- New sanctions have been imposed by the United Kingdom on Russian banks, and oil and coal imports.

- UK and US inflations have become more prominent due to looming Ukrainian risks.

The GBP/USD weekly forecast is bearish ahead of an eventful week. The dominance of the US dollar remains intact, keeping the pound at its backfoot.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Fed policy and risk aversion enabled GBP/USD bears to hold on. Thanks to a crash in the US bond market, Cable fell to its lowest level since November 21, below 1.3000. The risks of a fall in the currency pair remain unchanged next week, with inflation dropping in the UK and US.

Risk aversion adding plight to sterling

After a week of consolidation, risk-off flows and demand for the dollar rekindled GBP/USD’s decline. Despite rising tensions between the West and Russia over Ukraine, the GBP/USD pair has held steady this week. In the Ukrainian city of Bucha, Ukraine accused Russia of killing civilians in mass numbers over the weekend. Russian officials have denied that any crimes against humanity have been committed. US, European, and British sanctions were subsequently issued against Moscow due to this escalation in tensions.

Meanwhile, risk aversion has supported demand for the dollar due to rising expectations that the European Union (EU) will impose a ban on Russian energy imports. As a result, the pair made new monthly lows below 1.3050 on Wednesday as Treasury yields along the curve continued to increase, supporting the US dollar’s regained strength.

The UK has also announced that it will freeze the assets of Russia’s largest bank and has halted all imports of Russian coal and oil until the end of 2022.

Policy divergence to support bears

A hawkish statement from famed Bank of England (BOE) Governor John Cunliffe underscored the need for “further monetary tightening to curb inflation.” Cable extended its bullish move on Tuesday, testing the 1.3100 level.

In the meantime, expectations of a 50-basis point Fed rate hike in May have been boosted by Friday’s upbeat US jobs report and remarks from San Francisco Fed Chair Mary Daly. In May, Lael Brainard called for higher interest rates and a smaller balance sheet, strengthening the yield rally and the dollar.

The Fed’s March meeting minutes surprised sterling bulls with a hawkish outlook. The minutes reported that board members were planning on reducing the company’s balance sheet by more than $1 billion a year while raising interest rates. In addition to hawkish Fed comments and robust US services data, this led to a 50-basis point Fed rate hike in May, reflecting policy divergence between the BOE and Fed.

GBP/USD weekly data/events ahead

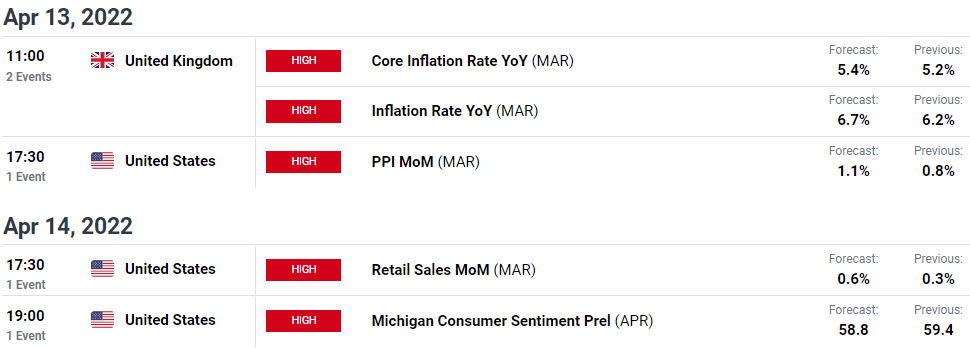

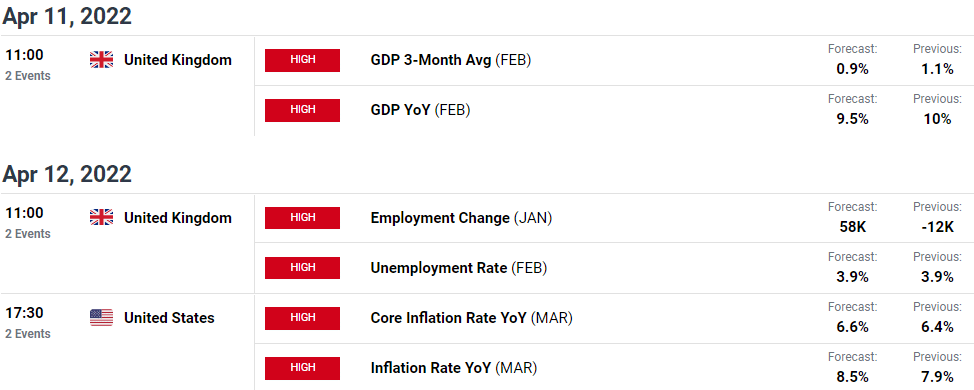

The last was quite dull, but we expect the next week to be full of events. However, European markets will enjoy a bank holiday on Friday amid Good Friday.

On Monday, we have UK GDP and manufacturing and industrial production data. Secondly, the UK’s jobs report is another big event for the week. It will be on Tuesday. On the other hand, we have US CPI and PPI data due next week.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

GBP/USD weekly technical forecast: Bullish trend reversal

The GBP/USD daily chart shows an interesting scenario. The pair broke the double bottom at 1.3000 but quickly recovered back. The pair is set to post some meaningful recovery next week. Friday’s down bar closed off its lows and the declining volume of the previous down bars provides a clue for a bullish trend reversal. The key hurdle for the bulls will be 1.3100 ahead of the double top at 1.3220 and finally 1.3300. Any sustained move beyond 1.3300 will change the bias to bullish. Otherwise, the broader bearish trend will remain intact.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money