- As inflation points higher in the UK and Ukraine, the GBP/USD rally couldn’t reach the 1.3300 level and fell back.

- The US NFP and Bank of England report will be released next week, significant to watch.

- Global geopolitical news and policy divergences between the Fed and Bank of England drive risk trends.

The GBP/USD weekly forecast remains bearish as the Fed’s hawkishness weighed on the risk asset while the Ukraine crisis also deteriorated the sentiment.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

The GBP/USD pair has been under pressure since the lows of 2022 due to rising inflation and tensions in Ukraine. Central bank divergence led to sterling bulls losing confidence. US jobs data, PCE inflation favored by the Fed, and Bank of England statements will be relevant in the week ahead as the war between Russia and Ukraine continues.

GBP/USD bulls succumb to bears

The GBP/USD pair gained for the second consecutive week, although it was still far from its three-week high of 1.3300. Sterling bulls took control on Tuesday after a shaky start to the new week, extending last week’s gains into early Wednesday, testing the psychological level of 1.3300.

As the US economy and jobs remain strong, the world’s most powerful central bank has also called for aggressive tightening. CME FedWatch shows a 68.3% probability of a 50-basis point hike at May’s FOMC meeting following the radical reversal.

When Ukrainian President Volodymyr Zelenskyy was invited to address a NATO summit scheduled for Thursday, the dollar strengthened, but sterling remained resilient amid markets’ optimism over the Russia-Ukraine conflict. Further, Zelenskyy said they are prepared to discuss NATO membership and the post-ceasefire status of Crimea and Donbas.

UK CPI failed to impress buyers

The relief rally evaporated on Wednesday after a better-than-expected UK inflation rate of 6.2% in February. Inflation worries exacerbated the Bank of England’s dilemma as the pound recovered from multiweek highs and broke 1.3200 again. Due to higher inflation’s negative impact on economic activity, the Bank of England was already cautious in its March policy statement. The Bank of England and the Federal Reserve engaged in divergent monetary policies, significantly affecting the cable.

US data and risk sentiment

Despite mixed Markit Manufacturing and Services PMI preliminary data, markets remained bullish ahead of the NATO summit on Thursday. In addition, a stronger response from the US and its NATO allies combined with the lack of progress on the Ukraine crisis kept weak sterling heading into the weekend. As the dollar strengthened at the expense of the pound despite less-than-expected US durable goods orders, markets shrugged off the weak US durable goods orders. In addition to the disappointing UK retail sales data for February, the major currencies gained strength during the week. The UK consumer spending fell unexpectedly 0.3% m/m in February, which was lower than the 0.6% expected.

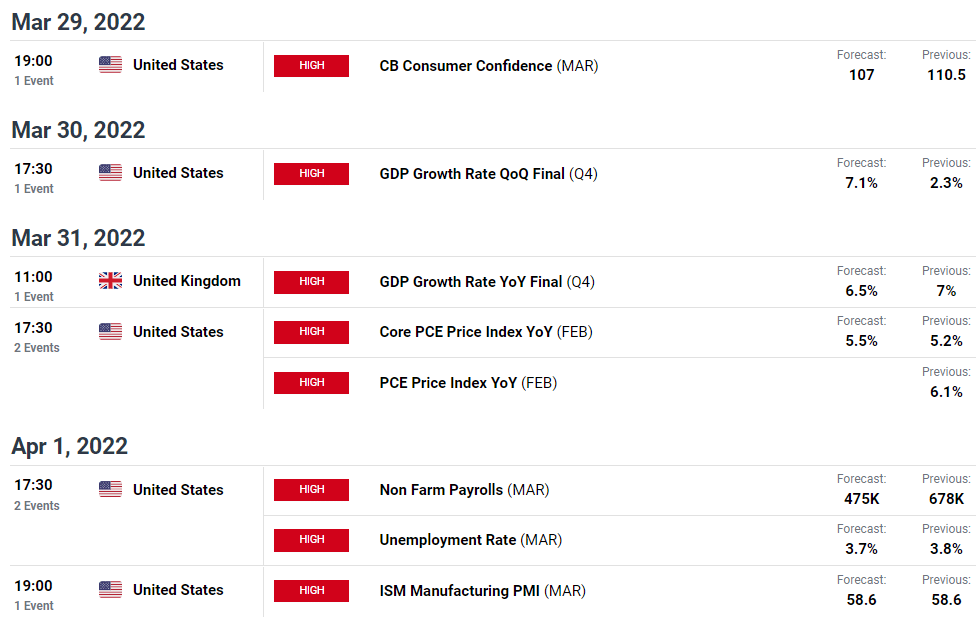

Key data for the GBP/USD weekly forecast

The GBP/USD pair is unlikely to change fundamentally in the coming week, as developments surrounding the conflict in Ukraine and central bank disagreements will likely continue to affect sentiment.

Bank of England Governor Andrew Bailey’s speech will be closely watched for any new clues to the future without tier-1 economic data from the UK. On Monday, Bauerhel Monday will host an online event featuring Bailey on macroeconomics and financial stability. The key to following the event will be the Q&A that follows his speech.

ADP US employment data is due on Wednesday, followed by a speech from Bank of England Deputy Governor Ben Broadbent. In addition, the final revisions to US and UK GDP data are likely to catch the attention of investors.

Among the important economic data, this week is Thursday’s US PCE inflation data and Friday’s main nonfarm payrolls report.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

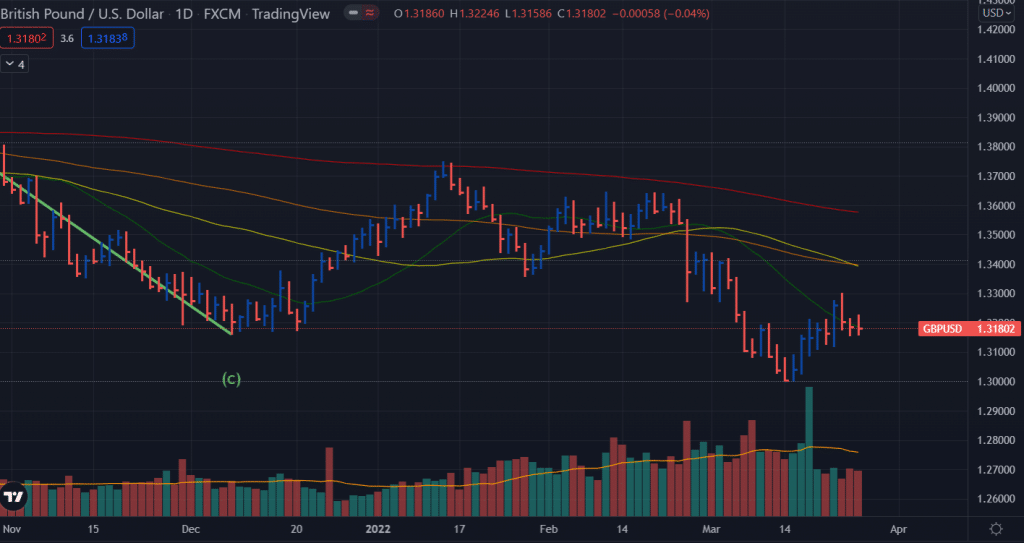

GBP/USD weekly technical forecast: Neutral around 1.3200

The GBP/USD is playing around the 20-day MA but failed to find bids above the 1.3200 handle. However, the price bars bouncing from the 1.3150 area are quite strong to protect the pair from further falling. The potential bearish crossover of 50 and 100 DMAs could exert bearish pressure. The pair is likely to maintain the range of 1.3130 to 1.3230.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money