- The GBP/USD rose for the fourth week despite a late US dollar rally due to differences in monetary policies.

- Traders are bracing for key US Consumer Price Index (CPI) data and other economic releases that will determine the US dollar’s fate in short to medium term.

- Technically, the pair may correct lower before resuming the upside.

The GBP/USD weekly forecast is bullish as the Greenback remains weak while the pound shows resilience amid the hawkish BoE hike. Last week, GBP/USD continued to post gains for the fourth consecutive week despite a late rally in the US dollar. The differences in monetary policies between the US Federal Reserve and the Bank of England could play a role in the upcoming week for US inflation.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

Ups and downs of GBP/USD this week

The US dollar struggled as both the GBP/USD and EUR/USD pairs broke key resistance levels, leading to further weakness in the US dollar.

The Federal Reserve was expected to leave rates unchanged in May due to weak US economic data, while the Bank of England planned to hike interest rates by 25 basis points next month.

The US dollar started the week strong due to unexpected production cuts by OPEC and its allies, causing oil prices to rise and reigniting inflation fears. However, the US dollar’s strength weakened after the Institute of Supply Management (ISM) showed that manufacturing activity fell to its lowest in almost three years.

However, the US dollar regained its safe-haven appeal after US JOLTS jobs and factory orders data disappointed, pushing GBP/USD back to 1.2400.

The US JOLTS and ADP jobs data showed the first signs of weakness in the US jobs market, adding weight to the battered US dollar and reinforcing the view that the Federal Reserve may not need to raise interest rates much further.

The US Bureau of Labor Statistics released nonfarm payrolls (NFPs) data, which led to US 10-year bond yields rising more than 1%, strengthening the US dollar against its peers. The GBP/USD pair fell back into the 1.2400 area but managed to hold.

What will happen in the coming week?

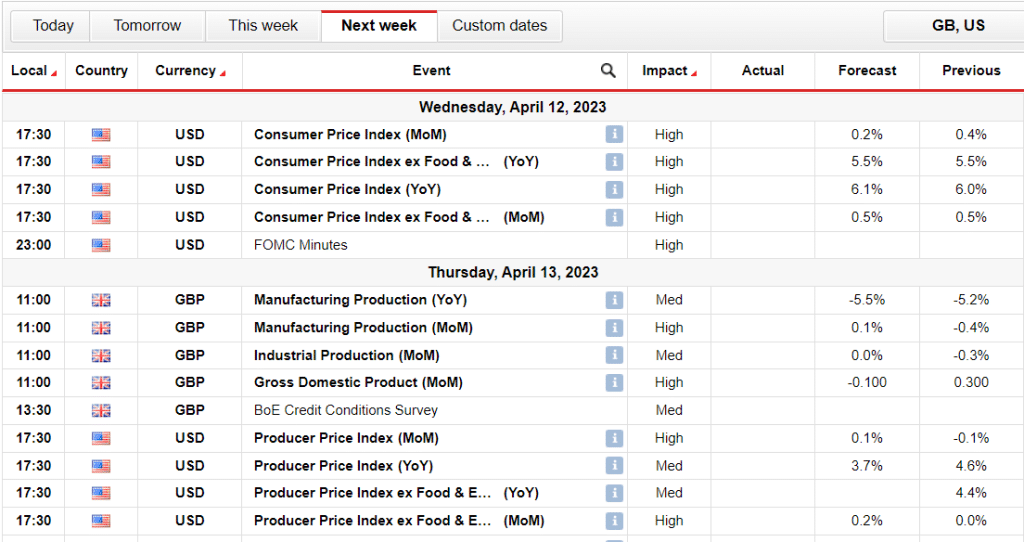

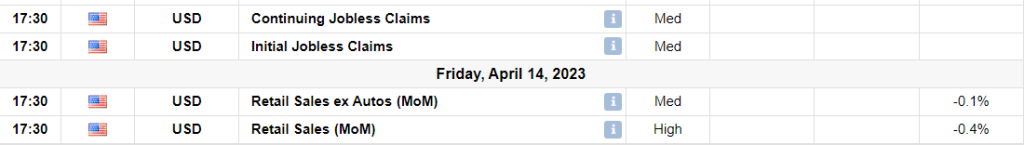

In the upcoming week, traders are bracing for key US Consumer Price Index (CPI) data to determine the US dollar’s fate in short to medium term. China’s CPI data is due on Tuesday, which may impact risk sentiment.

The US, University of Michigan (UoM) consumer sentiment and inflation expectations, retail sales data, and preliminary data will also be released. Federal Reserve policymakers’ comments will be relevant to the Fed reassessing its interest rate outlook.

GBP/USD weekly technical forecast: Correction before the upside

GBP/USD showed a solid recovery, hitting a 10-month high at 1.2525 on a bullish chart after the bulls finally broke the key resistance at 1.2450.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

The daily chart shows that the price briefly broke the resistance level. However, the pair could not stand above it. Moreover, the daily RSI has started retreating from the overbought zone. However, the pair maintains a broad bullish trend, lying well above the 30-day SMA.

The pair may experience a minor downside correction amid profit-taking. But the probability of a bullish trend resumption is high. The key resistance levels for the pair are 1.2500 ahead of 1.2550 and 1.2600. Conversely, 1.2400 remains strong support ahead of 1.2350 and 1.2300.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money