- The GBP/USD flirts with a monthly high amid rising UK inflation and dovish Fed minutes.

- A tight UK listing and geopolitical concerns limit cable’s potential upside.

- Technically, the double top at 1.3641 may keep bulls under pressure.

The GBP/USD weekly forecast is mixed as the pair’s upside may be dampened by the risk-off sentiment and Fed’s rate hike in March.

–Are you interested in learning more about STP brokers? Check our detailed guide-

After posting three consecutive weekly gains, the GBP/USD begins as the top performer this new week. With higher inflation in the UK fueled by aggressive expectations for a Bank of England rate hike, the high beta British pound was resilient to the Russian-Ukrainian crisis that raged throughout the week. For new trade guidance, cable traders eagerly anticipate preliminary business PMIs on both sides of the Atlantic, the Bank of England’s Monetary Policy Report (MPR), and the Federal Reserve’s preferred inflation gauge.

The pound defied bearish forecasts for the third consecutive week, beating the dollar. Building on the previous week’s gains, the currency pair bought at bargain prices. However, at the start of a new week on Valentine’s Day, the bulls gave way to bearish pressure as risk-free trading resumed after the US reported a likely Russian invasion.

There was also the risk of a major sell-off in Russia-Ukraine tensions on Tuesday, with the main price falling to a two-week low of 1.3485 as US officials expressed doubts regarding the pullback of Russian troops from the Ukrainian border. In any case, the Russians gathered more troops. As the US dollar fell across the board ahead of the release of the Federal Reserve minutes on Wednesday, bulls helped orchestrate an impressive V-shaped recovery. The mixed job report in the UK didn’t seem to affect sterling traders much. The official UK unemployment rate remained 4.1% in December, versus 4.1% expected. In January, unemployment benefits were applied for by -31.9 thousand people.

The GBP/USD gained upside potential on Wednesday as UK annual inflation hit a new 30-year high of 5.5%, slightly above expectations of 5.4%. UK inflation has fueled expectations that the Bank of England will raise interest rates aggressively next year. However, the Fed’s January minutes disappointed the hawks and caused a fresh wave of dollar selling.

Due to ongoing military tensions with Russia and Ukraine, swap markets began to lower the probability of a Fed rate hike by 50 basis points (bp) in March. On Thursday, a risk-reducing market supported the greenback, which was boosted by Russian media reports that the Ukrainian military and rebels fired shells and mortars at four locations in the war-torn Lugansk People’s Republic (LPR) Donbas. Cable bull band capped at 1.3645 last week after US warnings of a possible Russian invasion of Ukraine triggered risk aversion.

As risk sentiment improved and war fears eased, sterling bulls failed to extend their control on Friday. Russian troops returned to their bases following the exercise, while US officials planned talks with their Russian counterparts, raising hopes of diplomacy and de-escalation. As geopolitics overtook looming Brexit worries, the Russian-Ukrainian conflict faded into the background.

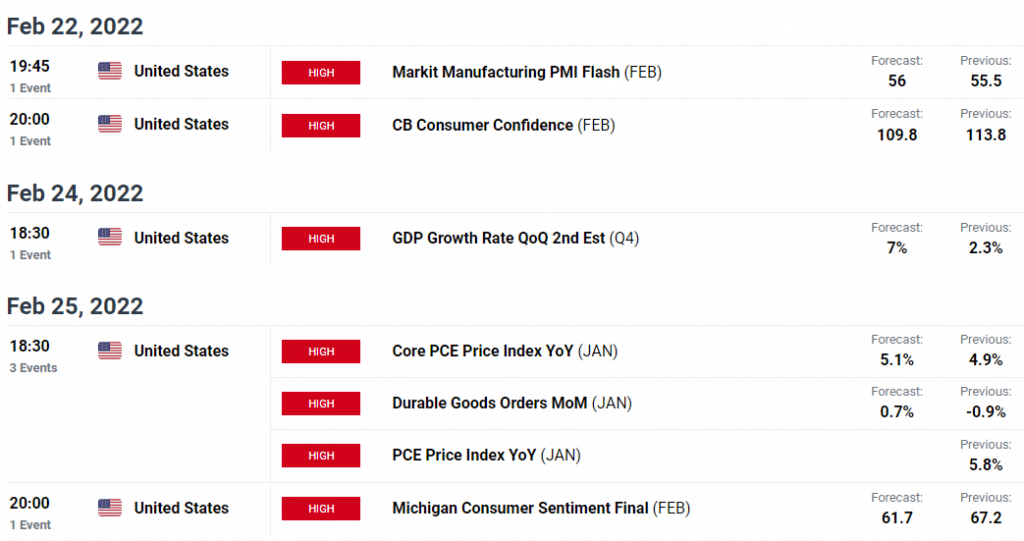

Key data/event for GBP/USD next week

Markit’s manufacturing and services PMI will be released on Monday, but it will be a slow start since US markets celebrate President’s Day.

The UK manufacturing order outlook and a speech by Deputy Governor Dave Ramsden fill a busy schedule on Tuesday. In addition, the preliminary indexes of Markit’s activities in the United States are now available.

On Wednesday, the Bank of England releases its quarterly MPR in advance of Central Bank Governor Andrew Bailey’s opening remarks at the Bank of England’s first annual BEAR conference. The second US GDP review for Q4 and weekly jobless claims will also keep traders entertained in the second half of the week.

US PCE Price Index and Durable Goods data, as well as a revised Consumer Sentiment Index, will be released on Friday. There is no UK data on Friday.

This week’s main topic is geopolitics between the United States and Ukraine, despite a relatively poor week of data. There will be a lot riding on the upcoming meeting between US Secretary of State Anthony Blinken and Russian Foreign Minister Sergei Lavrov.

–Are you interested in learning more about forex robots? Check our detailed guide-

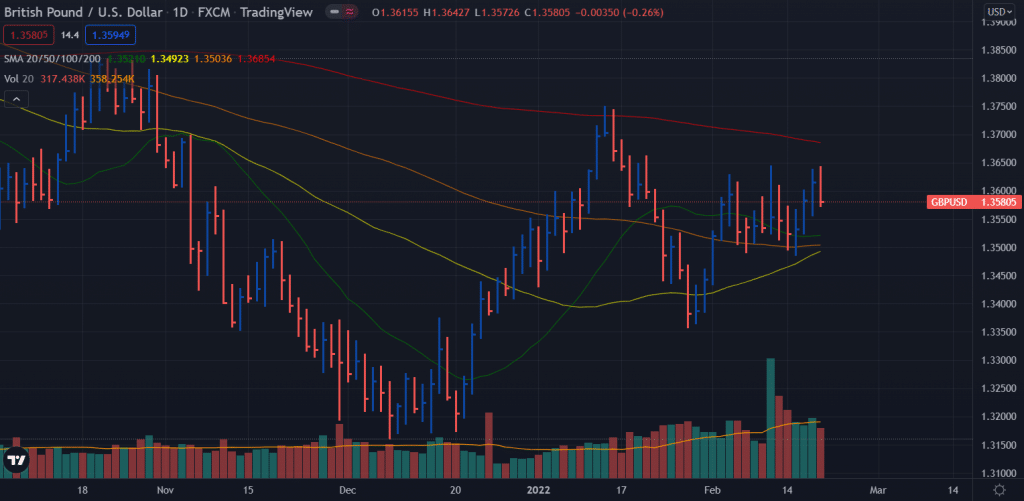

GBP/USD weekly technical forecast: Double top to decide the fate

The GBP/USD daily chart shows a double top at 1.3641, exerting a downside pressure. The price closed the week with gains but could not sustain above the 1.3600 level. The pair is expected to stay within the 1.3500 to 1.3641 range. Any meaningful breakout will be a great trading opportunity for the traders on either side.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money