- GBP/USD can see a sharp decline after rising on Friday.

- Delta strain can result in an extension of lockdown.

- US data can negatively impact the pricing of the British Pound.

- Bears can dominate and target 1.3820s as the initial target next week.

The GBP/USD forecast fell victim more than once on Friday. In the morning, news began coming in from the UK that could only upset the markets and nothing else. It became known early in the morning that the number of infected individuals did not fall below 32,000 in the UK for two consecutive days.

Let me remind you that this daily value of cases is only two times lower than the highs for the last year and a half for the entire period of the pandemic. But last fall, on such numbers, the UK government introduced a “lockdown”, and now it wants to completely lift quarantine and allow the British residents not to adhere to the rules of distancing and wearing masks. There is something to think about, given that the UK is again the first in Europe regarding the number of new cases per day.

In addition, the economic statistics were not encouraging either. GDP in May grew by only 0.8% m/m, which is two times lower than the value that the markets were expecting to see. Moreover, industrial production in Britain rose only 0.8% in May, which is also below forecasts.

Andrew Bailey did not say anything important during his speech. Thus, personally, I believe that there are again economic and pandemic problems in the UK, no matter what the representatives of the Bank of England and the government may say.

GDP is growing slowly; the country is on the verge of the fourth wave of the coronavirus. Moreover, according to many experts, Brexit will negatively affect the economy for a long time to come. Thus, the UK seems to have all the necessary reasons to continue to decline.

– If you are interested to learn more about day trading, then look out for our detailed guide on it-

EUR/USD forecast: Key events to watch next week

Few key events can potentially bring volatility in the GBP/USD pair.

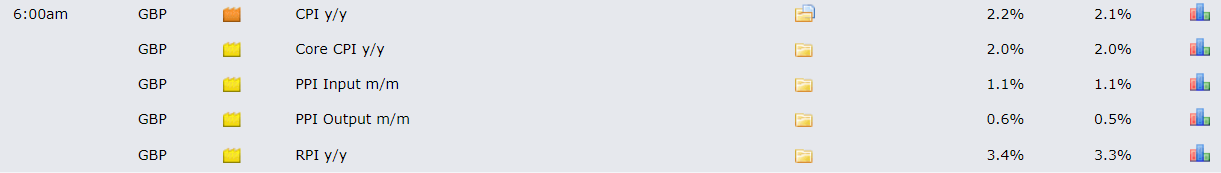

UK CPI and PPI

The UK CPI and PPI figures are due on Wednesday. Although the data is low impact, overall, it can change the mode of the market.

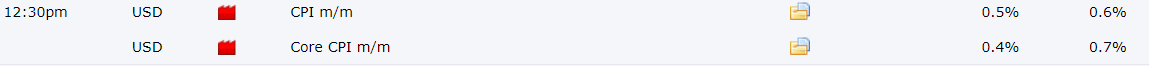

US core inflation

US core inflation figures are due on Tuesday. Although the inflation figures may weigh on the Greenback apparently it seems like the market has already discounted the effect of higher inflation.

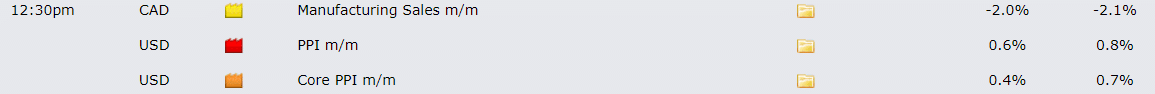

US PPI

US PPI

US PPI data is due on Wednesday, and it can impart a significant change in the pricing of the EUR/USD. We expect a positive release of figures.

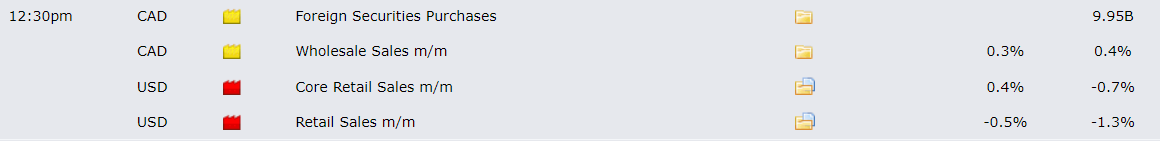

US retail sales

US retail sales figures are due on Friday. We expect a rise in US retail sales.

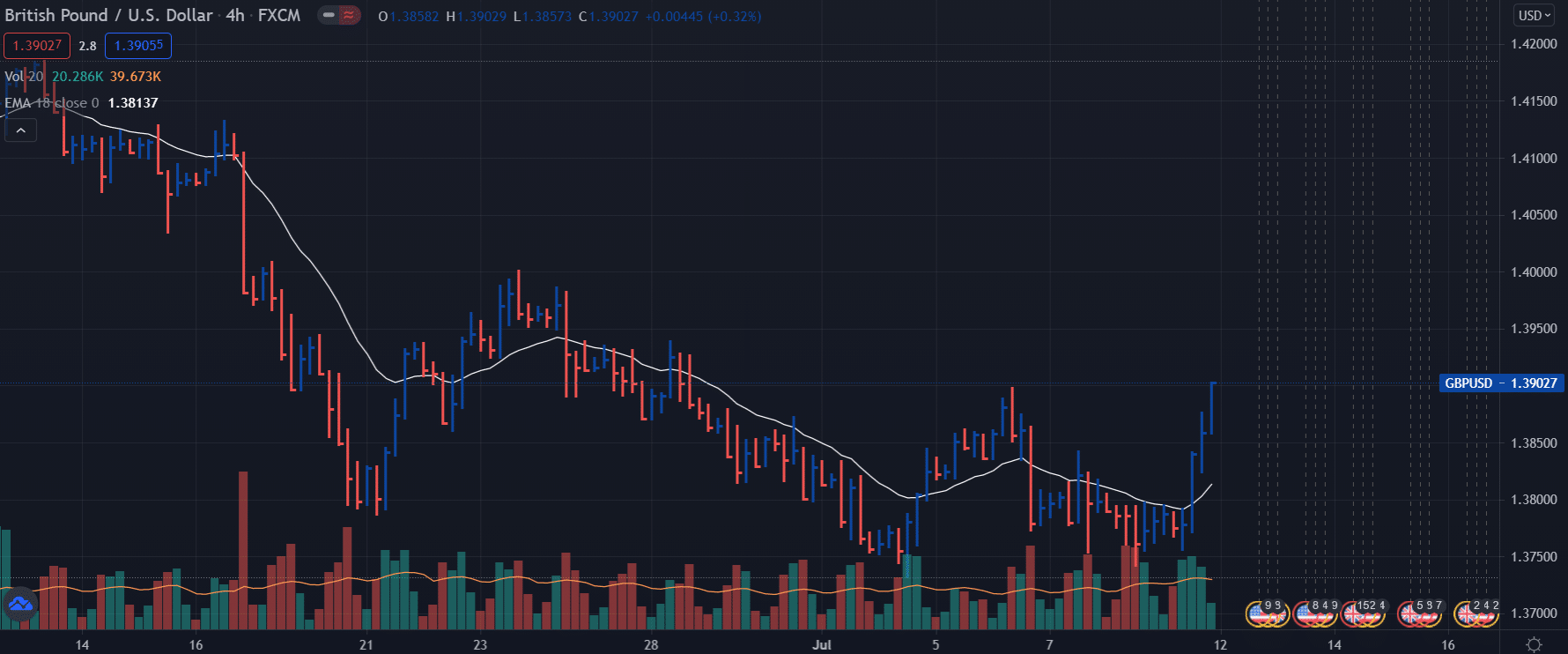

GBP/USD technical forecast for the week of July 12-16, 2021

The GBP/USD managed to close the week near the 1.3900 level. This is the same level that sent the price back to 1.3700s. The recent up-wave on the 4-hour chart came with a declining volume. This suggests that the upside is shallow and may run out of steam on Monday. The worst bulls could do is to target 1.3940. Bears will remain dominant and may target 20-SMA near the 1.3820 area. The forex signals are not clear but most players are looking at selling bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

US PPI

US PPI