- Initial jobless claims fell in the US, indicating a still-tight labor market.

- US retail sales rose but fell short of expectations.

- The UK jobless rate rose, easing some of the BOE’s inflation worries.

The GBP/USD weekly forecast is bearish as reduced Fed rate cut bets could keep lifting the dollar. On the other hand, gloomy UK data may further ignite selling.

Ups and downs of GBP/USD

After a volatile week, GBP/USD ended slightly lower. The week was characterized by releases from the US and the UK. The US released initial jobless claims and retail sales data, while the UK released employment data.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Initial jobless claims fell in the US, indicating a still-tight labor market. This saw investors reducing Fed rate cut bets, pushing the dollar higher. Retail sales rose but fell short of expectations.

The UK jobless rate rose, easing some of the BOE’s inflation worries. This drop prompted investors to lower bets on further BOE rate hikes, putting downward pressure on the pound.

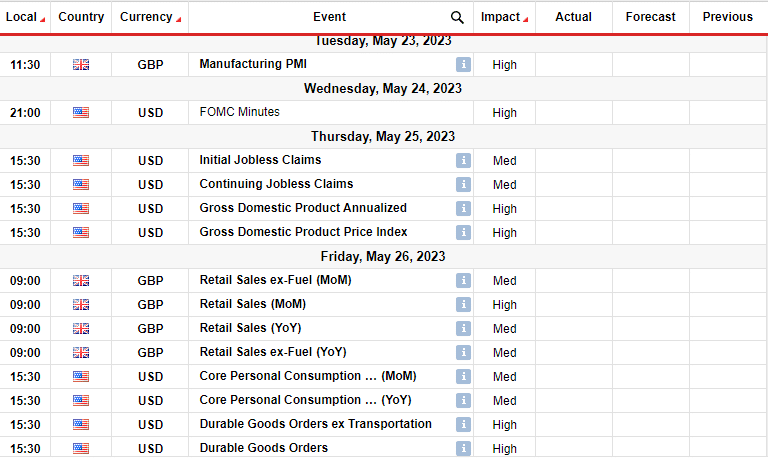

Next week’s key events for GBP/USD

A lot of data will come out next week that will affect the GBP/USD pair. The UK will release PMI and retail sales data, giving more insight into the state of the economy. The retail sales data, in particular, will show consumer spending trends in the UK.

From the US, investors will get the FOMC meeting minutes, the core PCE price index, and jobless claims data. These reports will show the Fed’s most recent meeting minutes and the state of inflation in the US and the labor market, respectively.

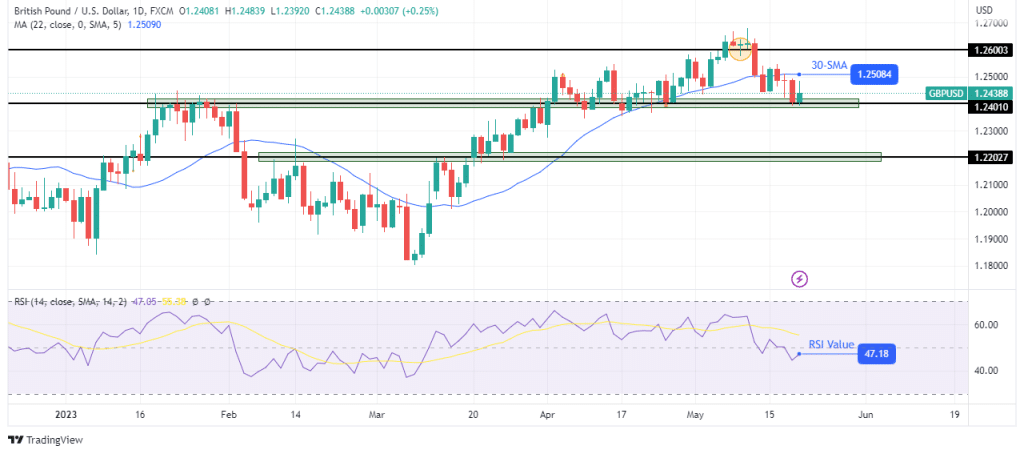

GBP/USD weekly technical forecast: Reversal relies on a break below 1.2401 Support

GBP/USD weekly technical forecast

There has been a change in sentiment for GBP/USD in the daily chart. The price has crossed below the 22-SMA, and the RSI has also crossed below 50. This is a sign that bears have taken control.

However, they are yet to confirm a trend reversal. To do this, the price must break below the previous low at around 1.2401 and start making lower lows and lower highs. It would also have to start respecting the 22-SMA as resistance.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

The price has paused at the 1.2401 support. Next week, bears will succeed in breaking below this level or fail. A break below would allow the price to retest the next support at 1.2202. On the other hand, if it bounces higher, it will break above the 22-SMA and likely retest the 1.2600 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.