- GBP/USD lost 2.5% last week, plunging to 22-month lows.

- COVID restrictions in China keep the risk sentiment deteriorating.

- BoE and Fed’s policy divergence will keep the Sterling under pressure.

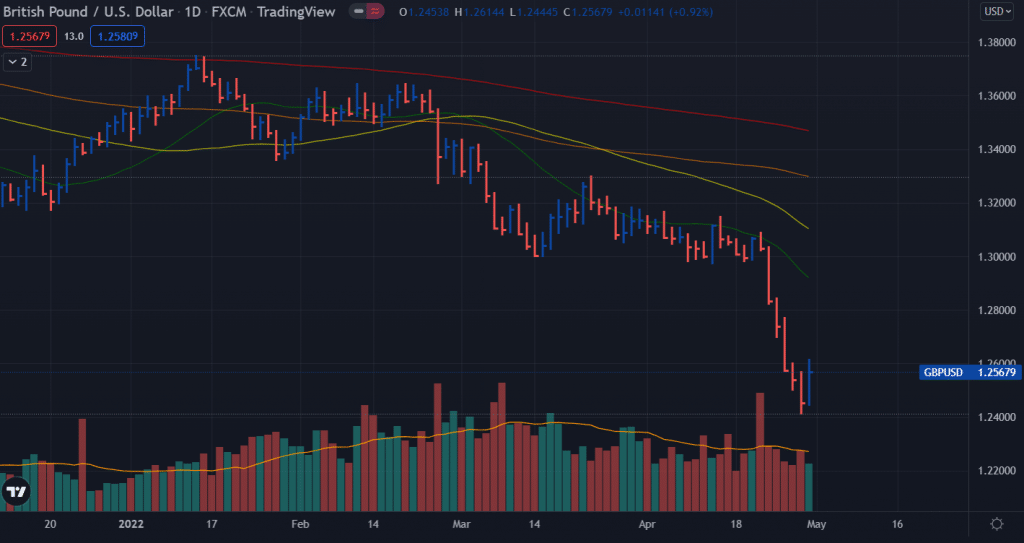

The GBP/USD weekly forecast remains bearish. The pair fell to its lowest level since July 2020 at 1.2410, as last week’s selling spiral gained momentum. In the G10 currency area, the dollar-dominated for the week amid rising volatility. Before policy announcements and US jobs data, divergences between the Fed and Bank of England will remain a key topic.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

Strongly bearish week for GBP/USD

The GBP/USD pair didn’t start the week the way it ended, plunging 200 pips below 1.3000. The past week, the currency pair lost about 2.5% to hit a 22-month low due to the US dollar’s strong performance amid a better market sentiment. Just missing the 104.00 mark, the US Dollar Index hit its highest level in 20 years.

Since there were no major economic updates out of the UK, major pairs were at the mercy of dollar price action. Nevertheless, the US dollar remained the top currency as the Fed’s aggressive rate hike expectations soared, with the CME FedWatch giving a 96.5% chance of a 50-basis point hike in May and an 85% chance of a 50-basis point hike in June.

COVID restrictions in China

Beijing has also been placed under lockdown, while hopes for a Shanghai re-opening have been dashed by a fresh infection outbreak. Moreover, throughout Europe, an energy crisis is looming amid a war between Russia and Ukraine, resulting in supply chain restrictions due to China’s lockdown. As a result, investors sought refuge in a safe haven in uncertain times and turbulent markets – the dollar. Moreover, the Bank of Japan’s dovish policy led to a sharp fall in the yen, contributing to the dollar’s inexorable increase.

BoE-Fed divergence

Additionally, the divergence between the Federal Reserve and the Bank of England persisted, keeping pound bulls at bay. In the first quarter of 2021, the US economy contracted by 1.4%, resulting in a decline in the dollar before the end of the week. This helped the pound breathe a sigh of relief, but it remains to be seen if more reasons will support the GBP/USD rally.

GBP/USD weekly event forecast: Fed, BoE, US NFP

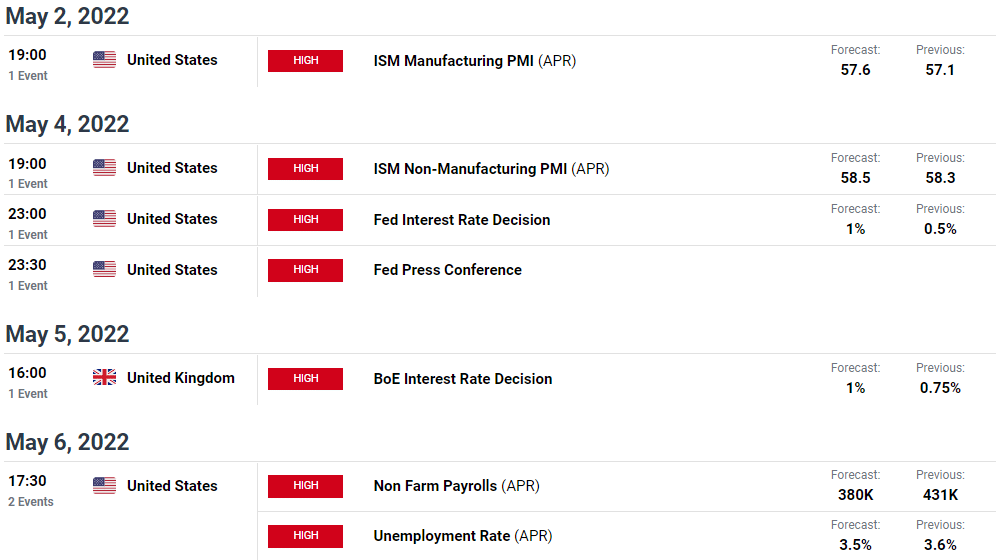

May’s first week is expected to be the busiest of the month, with midweek key rate decisions from the Fed and Bank of England, plus Friday’s US NFP report.

As the Chinese and UK markets are closed on Labor Day, the GBP/USD pair will likely remain weak on Monday. Due to insufficient liquidity, cable reversal can be accelerated. S&P Global Manufacturing PMI and US ISM may provide some stimulus, however.

US JOLTS jobs data and UK’s S&P Global Manufacturing PMI will have little effect on the pair as the Fed meeting starts on Tuesday. While the focus will be on the Fed’s decision and Jerome Powell’s press conference, the ADP US jobs report, due on Wednesday, will largely be ignored. Instead, the expectations of the Federal Reserve and the Bank of England ahead of monetary policy announcements will influence the pair.

It is expected that the US Federal Reserve will raise interest rates by 50 basis points, bringing its target range up to 0.75%-1%. On the other hand, the Bank of England will raise interest rates by 25 basis points to 1%. Therefore, both central banks need to provide forward-looking guidance on monetary policy, inflation and growth prospects if the GBP/USD moves in a new direction.

US April jobs data are due out on Friday, so markets will have little time to digest central bank events. However, the US job market remains resilient, justifying the Fed’s hawkish outlook.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

GBP/USD weekly technical forecast: Bears keeping dominance

The GBP/USD price posted a bullish bar on Friday with a lower than average volume. It indicates that the recovery attempts lack conviction. The key SMAs on the daily chart are pointing to the downside. However, the scenario can change if the pair closes the week in a net positive position.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money