- US jobs data came in higher than expected, showing a still-tight labor market.

- The unemployment rate in the US fell to 3.5%.

- Investors are awaiting US inflation data.

The GBP/USD weekly forecast is bearish as the Fed is expected to raise rates aggressively after US payroll data came in higher than expected.

-If you are interested in forex day trading then have a read of our guide to getting started-

Ups and downs of GBP/USD

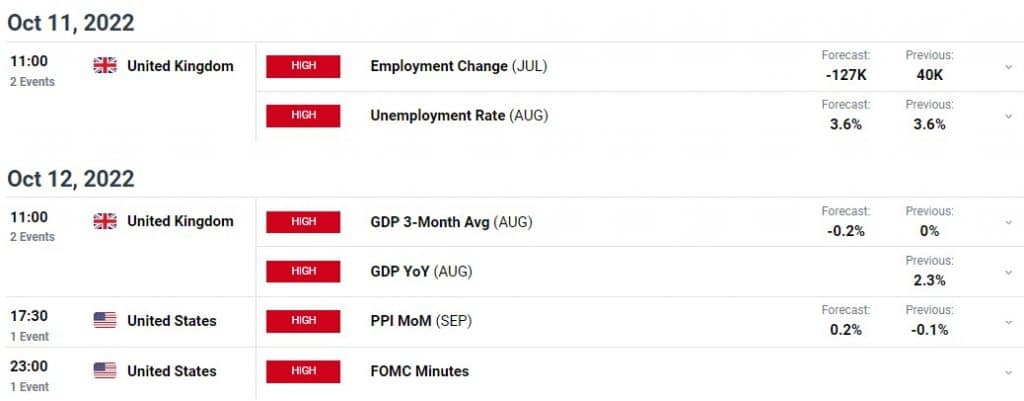

Sterling started the week on a high note after BoE intervened in the bond market but ended the week lower. Poor economic data from the US also supported the move up at the beginning of the week. As the week began, a drop in the ISM manufacturing PMI and JOLTs job openings saw the dollar weakening against most currencies.

PMI data from the UK also came in higher than expected on Wednesday, further boosting the pound. That marked the end of the pound’s strength as the dollar edged higher ahead of the nonfarm payroll report.

In September, job growth in the United States moderately slowed. Still, the unemployment rate fell to 3.5%, indicating a robust labor market that will likely keep the Federal Reserve’s aggressive monetary policy tightening effort going for some time.

Despite the Fed’s sharp interest rate increases and dampening demand, the labor market continues to demonstrate its resilience, which could mean more downside for GBP/USD.

“The labor market continues to run stubbornly hot,” said Michael Feroli, chief US economist at JPMorgan in New York. “The super-tight hiring conditions generate wage and nominal income growth inconsistent with getting inflation back down to a more acceptable rate.”

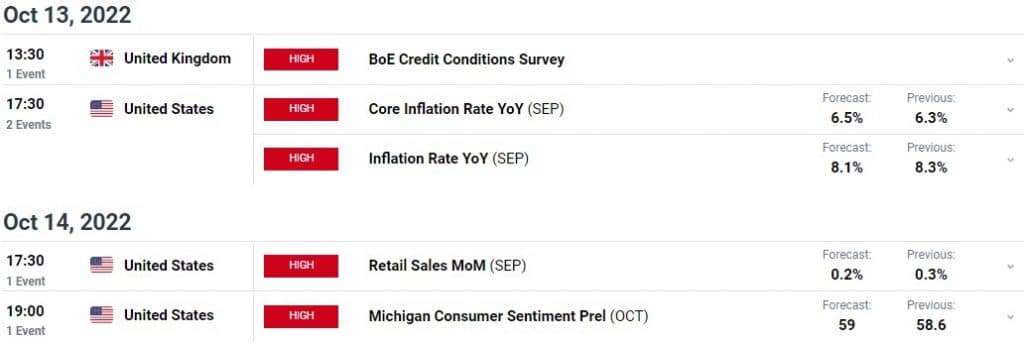

Next week’s key events for GBP/USD

The coming week is packed with important UK and US data. However, investors will pay more attention to the US inflation data, which carries much weight. It will provide a snapshot of where inflation stands and whether the Fed succeeds in pushing it lower.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

GBP/USD weekly technical forecast: Bears take over below the 22-SMA resistance

Looking at the daily chart, we see the price trading below the 22-SMA and the RSI below 50, showing bears are in control. Although there had been a lot of bullish momentum after the 1.0502 support level, bulls failed to break above the 1.1503 and 22-SMA resistance zone.

Bears are currently taking the price below the 22-SMA and might pause at 1.1005 before retesting the 1.0502 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.