- The pound’s rough week ended with some recovery.

- The UK Government’s controversial plan back-fired big time.

- The September employment data from the US, and political developments in the UK, will weigh in on Cable.

The GBP/USD weekly forecast is tilted towards bearish, as market reaction to UK’s Government fiscal plan will keep weighing in.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

A wild week for the pound

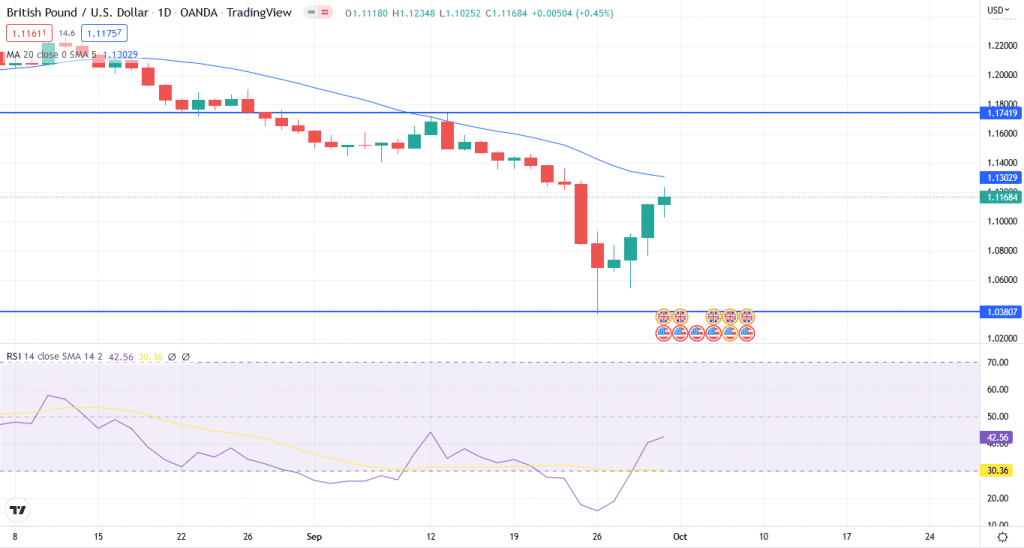

Following a record low of 1.0340 at the start of the week, GBP/USD reversed course and climbed past 1.1200 before ending the day at 1.168.

Despite losing its bullish momentum ahead of the weekend, the pair closed the week in positive territory.

Next week’s key events for EUR/USD

The UK government’s attempt to cut taxes and encourage economic development has completely failed. The Bank of England was forced to intervene on Wednesday after markets considered the government’s new economic strategy unfitting.

Economists and investors were quick to see through the fog. On Monday, the British pound hit an all-time low of 1.035 versus the US dollar. Traders were betting that looser fiscal policy would fuel inflation, compel quicker interest-rate rises, and damage the already fragile British economy.

With inflation currently raging across the UK, the intervention risks maintaining historically rapid price rises.

Meanwhile, statistics from the United States revealed that the Conference Board’s Consumer Confidence Survey’s 1-year Consumer Inflation Rate Expectations fell to 6.8% from 7%, restricting the dollar’s gains and allowing GBP/USD to remain in a consolidation stage.

The highly anticipated Nonfarm Payrolls (NFP) report will be released on Friday. Investors anticipate a 250K gain in the NFP following August’s better-than-expected increase of 315K.

The unemployment rate was 3.7% in August and is predicted to remain unchanged in September. Nonetheless, the market reaction should be obvious, with a positive NFP result impacting GBP/USD and vice versa.

GBP/USD weekly technical forecast: In a recovery mode?

GBP/USD traded up on Friday and hit the 1.2348 level before closing the week at 1.1168.

The pair is way below its 20-day moving average on the daily chart, and the RSI is above the 40 level.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

GBP/USD is now hitting the 1.1168 level. A fall below 1.0762 can bring the pair towards the 1.0539 support level. If the pair dips below this level, it will reach the next support level at 1.0353.

On the upside, the pair can go towards the next resistance level, around 1.1300. A break over 1.1460 will pave the door for a test of the following resistance level of 1.1741.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.