- GBP/USD has been edging up as another coronavirus vaccine candidate reports success.

- If speculation of a Brexit breakthrough gains ground, sterling could shine.

- Tuesday’s four-hour chart is painting a bullish picture.

“A possible landing zone” for a Brexit deal may spark a take off for the pound. According to The Sun, Chief UK Brexit Negotiator David Frost expressed optimism about reaching a deal shortly.

The report has helped stabilize sterling but skeptics remain. Headlines from the talks have been a see-saw between hopes for an imminent accord and fears of a collapse in talks. Deliberations continue in Brussels and both sides still aim to shake hands before a videoconference of EU leaders on Thursday.

Ireland’s Prime Minister Michael Martin said that the election of Joe Biden as America’s next president could push his counterpart Boris Johnson to a deal. Fisheries and state aid remain the points of contention.

Apart from Brexit, pound/dollar has been torn by hopes for a coronavirus vaccine and the grim reality of the winter wave. Moderna joined Pfizer in reporting an impressive efficacy of 94.% in its COVID-19 immunization candidate. While the UK only has a limited supply accord with Moderna, the interim results raise the chances that also Britain’s AstraZeneca would report robust results.

All three efforts use the same Messenger RNA technology. Moreover, the UK has a significant supply of vaccine doses in the pipeline, serving as another positive factor for the pound.

See What you need to know about the dollar in the post-vaccine announcement world

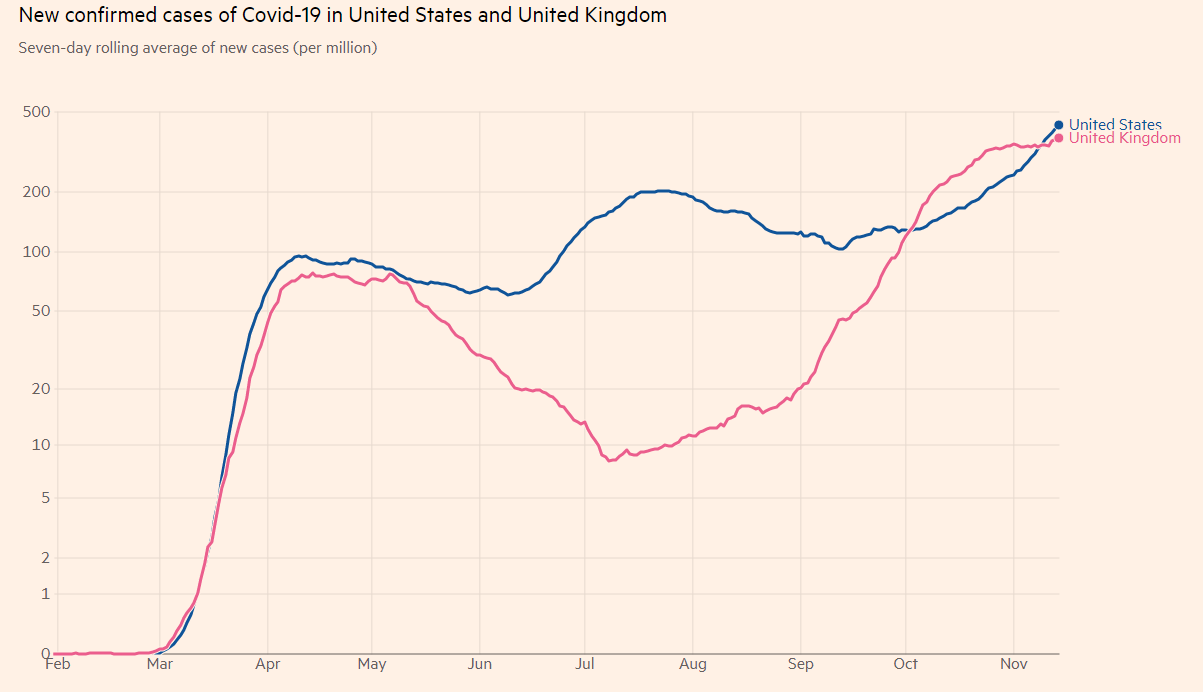

In the meantime, the virus continues raging on both sides of the pound. After flattening for several weeks, Britain’s covid cases have resumed their rises. In the US, hospitalizations have hit new highs and several states have imposed restrictions. The headlines from California, New Jersey, Iowa and elsewhere have weighed on sentiment and supported the safe-haven dollar.

Source: FT

Andrew Bailey, Governor of the Bank of England, will be speaking later in the day, and so will his peer Jerome Powell, Chairman of the Federal Reserve. Bailey oversaw the expansion of the BOE’s bond-buying scheme and Powell opened the door to mirroring that move. If the Fed steps closer to printing more money, the greenback could decline.

Ahead of Powell’s speech, US Retail Sales are of high interest. Economists expect a moderation in consumption in October, after a robust rise of 1.9% in September. The figures feed into growth calculations for the fourth quarter.

See Retail Sales Preview: Will curfews bring down consumer spending?

Overall, there are reasons to be bullish on cable.

GBP/USD Technical Analysis

Pound/dollar is trading alongside an uptrend support line that has been accompanying it since early November. Momentum on the four-hour chart has turned to the upside while the currency pair is holding above the 50 Simple Moving Average.

Overall, the trend remains to the upside.

Resistance is at 1.3245, a high point last week. It is followed by 1.3275, a temporary cap on the way to the November top of 1.3310, the next level to watch.

Support awaits at 1.3185, which is the daily low, followed by 1.3150, a swing low last week. Further down, 1.3105 is another cushion.