- GBP/USD has been hovering below 1.37 as markets digest Biden and Powell’s speeches.

- The UK’s vaccination campaign and weak US data may push cable above strong resistance.

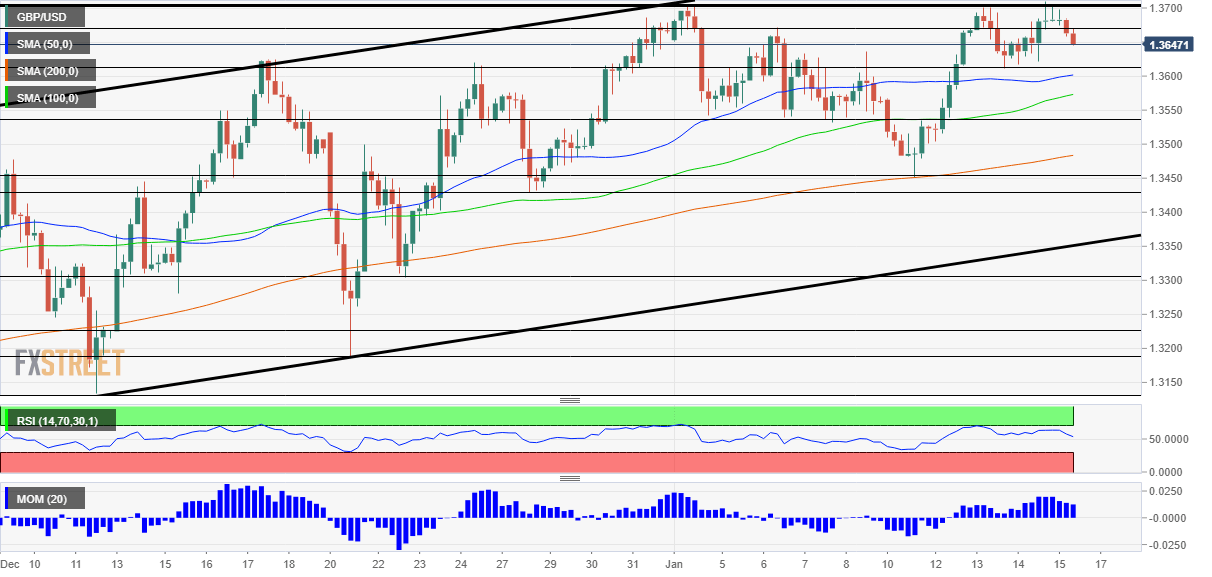

- Friday’s four-hour chart is painting a bullish picture.

Is President-elect Joe Biden going to raise taxes as his first move? That is highly unlikely, but markets are focusing on his comment that “everybody must pay their fair share” rather than the massive $1.9 trillion stimulus – news that had already been out earlier. The risk-off mood in markets is weighing on the safe-haven dollar.

Investors may have a rethink at Biden’s speech and also on one delivered by Jerome Powell, Chairman of the Federal Reserve. The world’s most powerful central banker put to rest speculation of an early reduction of the Fed’s bond-buying scheme. Prospects of early tightening pushed the greenback higher earlier in the week. On Friday, US ten-year bond yields continue their decline and may push the dollar lower.

The world’s reserve currency may also suffer from Friday’s data releases. Retail Sales figures for December may show ongoing weakness, and so can preliminary Consumer Sentiment data for January. The winter wave of coronavirus continues hitting the US hard and the lapse of government support programs was also being felt late last year.

- US Retail Sales December Preview: Sales will track job losses

- US Consumer Sentiment Preview: Expectations look rich, dollar could receive a (second) blow

On Thursday, jobless claims badly disappointed with a leap to 965,000, the worst since the summer and an ominous sign for the labor market. Additional weak data may, therefore, add to the case for more buying of bonds rather than reducing them.

In the UK, Prime Minister Boris Johnson is under pressure from a group of right-wing Conservative Party members who want him to loosen lockdown measures. While the focus is on political gossip, there may be the reason for optimism regarding loosening limits, as cases are falling.

Perhaps more importantly, Britain aims to supercharge its vaccination campaign, hitting 500,000 people per day from next week. Even if targets are not fully met, the national effort keeps the UK ahead of its peers.

All in all, cable has room to run higher.

GBP/USD Technical Analysis

Pound/dollar continues benefiting from upside momentum on the four-hour chart and trades above the 50,100 and 200 Simple Moving Averages. Critical resistance is at around 1.37-1.3705, which is now a triple-top after halting the pair’s ascent in once again.

Beyond 1.37, the next levels to watch are 1.3730, 1.3810, and 1.40 – all dating to 2018.

Support awaits at 1.3610, Thursday’s low, followed by 1.3545 and 1.3450.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits