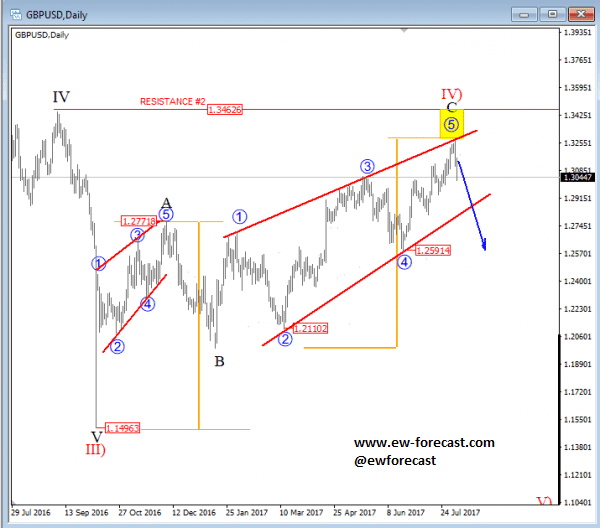

Below we have a daily count of GBPUSD. On it we have labeled a bigger three wave movement, that is considered an A-B-C correction. This correction is a simple zig-zag, which means it has a formation of a 5-3-5, meaning waves A and C are impulses and consist of five sub-waves, while the connecting wave B is a correction and consists out of three sub-waves. That said, we can also see that this big correction is ending, near the 1.3256 regions. A confirmation for a completed correction would be a five-wave fall.

GBPUSD, Daily

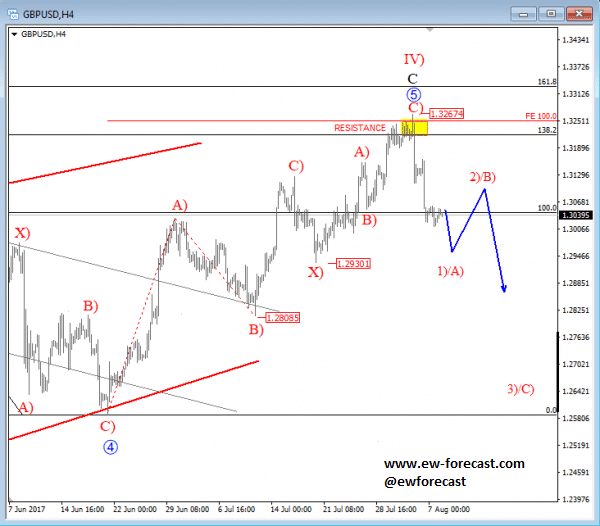

On the 4h chart lower, we can see a sharp and strong drop taking place from around the 1.3249 level, where various Fibonacci ratios (138.2 and 100.0) took place and pushed prices lower. These Fibonacci ratios suggest where recent sub-wave C) of five could end and make a sharp reversal lower. Well, we can see that market nicely reversed, which gives us an idea that maybe the bigger correction (seen on the daily chart) is also over, meaning more weakness can follow on the pair.

Ideally, the price will now unfold a new bigger five-wave drop on cable and approach levels near the 1.2700 and below.

GBPUSD, 4H

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All our work is for educational purposes only.