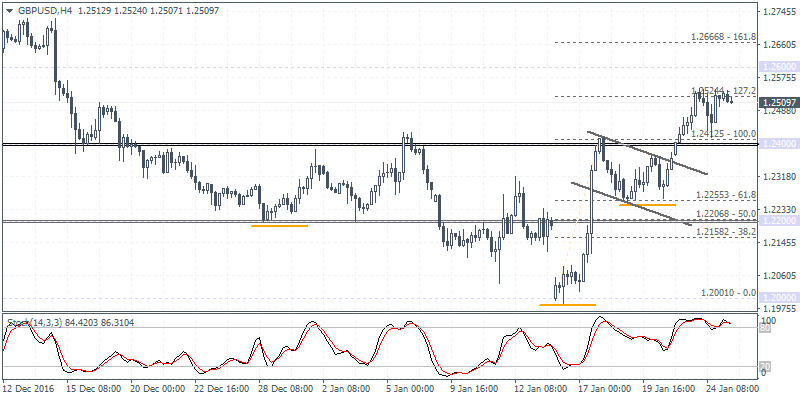

GBPUSD intra-day analysis

GBPUSD (1.2509): GBPUSD pulled back towards 1.2434 yesterday before reversing the losses. However, price action looks to be struggling near 1.2545 which indicates that GBPUSD could potentially slide back towards 1.2412 where support is likely to be established more firmly. Validating this view is the bearish divergence we see on the 4-hour chart for GBPUSD which shows the move back to 1.2412. This support level was previously seen as a resistance level of the inverse head and shoulders pattern. Therefore a retest back to 1.2412 will validate the longer-term corrective move towards 1.2670.

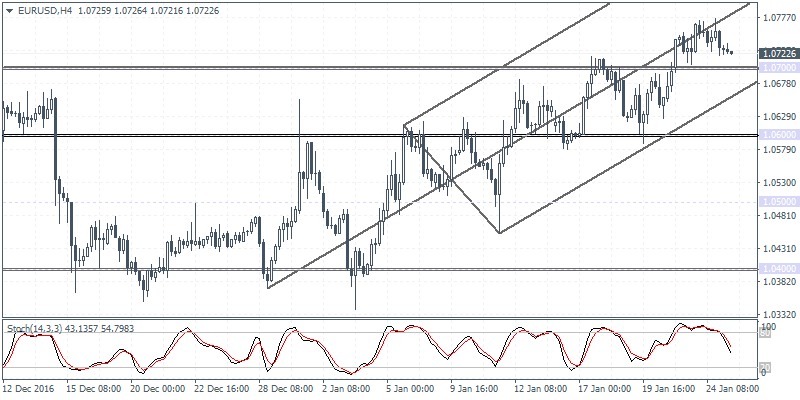

EURUSD intra-day analysis

EURUSD (1.0722): EURUSD was bearish yesterday after the previous rally saw prices run up to 1.0765 resistance level. A bearish follow through today below 1.0700 could signal further downside towards 1.0600 as the minimum target. On the 4-hour chart, watch for 1.0700 to hold out as support on the first time price falls to this level. A lower high following a minor bounce of 1.0700 will signal the confirmation of an impending move to the downside towards 1.0600.

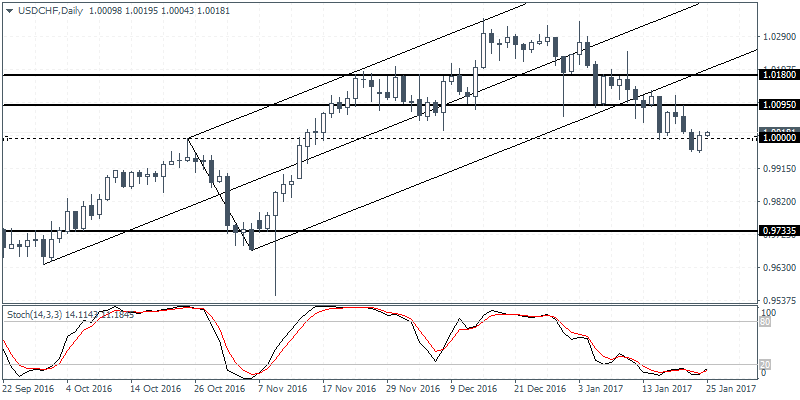

USDCHF daily analysis

USDCHF (1.0018): USDCHF is looking to retrace some of the declines posted since late December after the price fell to 0.9960 marking a two-month low. The current retracement could see USDCHF retest the breakout level between 1.0180 – 1.0095 from the rising median line. A retest back to this level could mark a new leg in the declines which will see USDCHF test the familiar support at the round number 1.0000 followed by a decline to 0.97335.