GBP/USD ended the year with a huge plunge of 190 points, closing last week at 1.4733. There are nine events on the schedule. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

Key US indicators could have been sharper last week, as unemployment claims and housing data missed expectations. There was better news from consumer confidence, which beat the forecast. There were no major British releases last week.

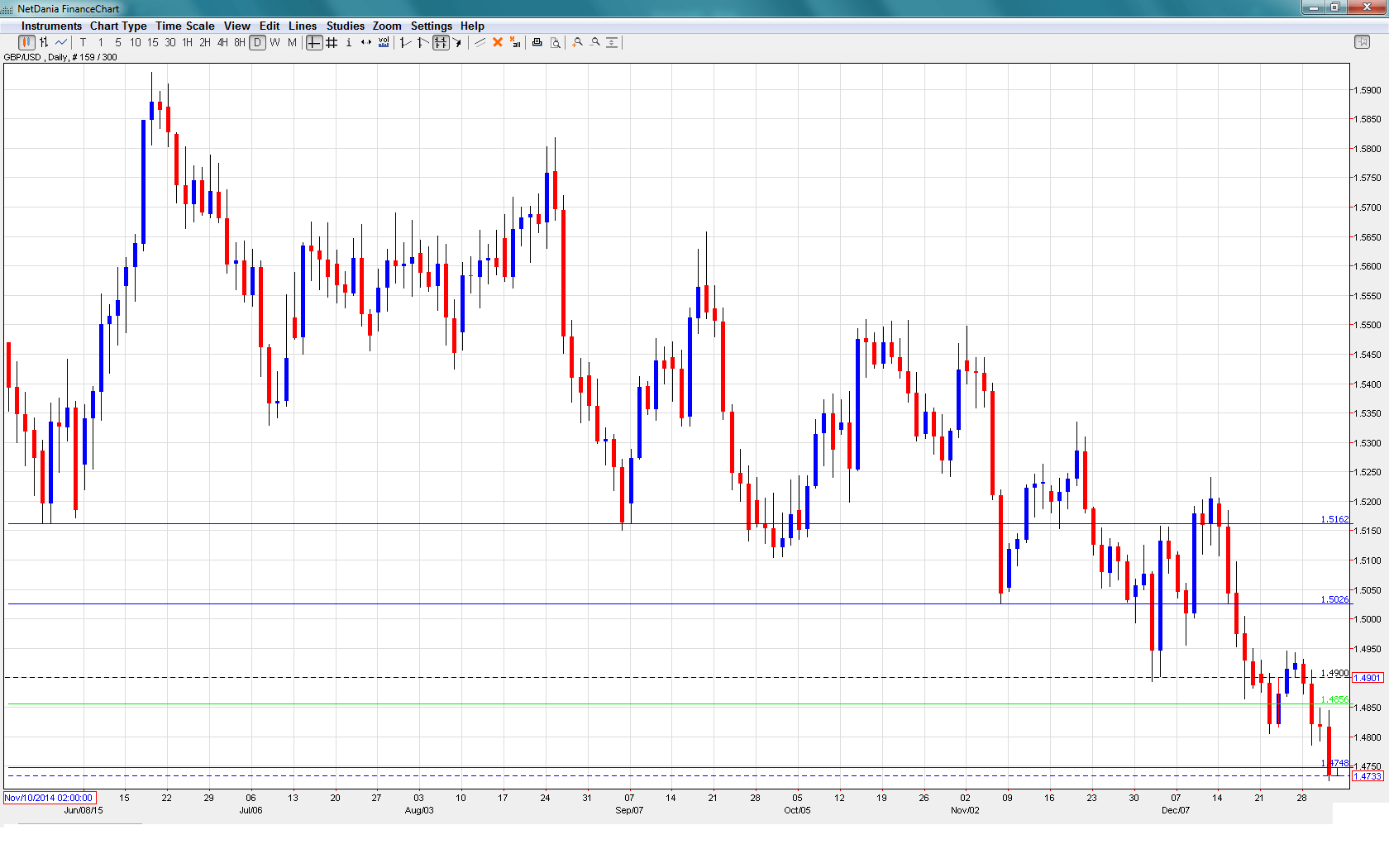

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- RICS House Price Balance: Tuesday, 00:01. This housing inflation indicator provides a snapshot of the health of the activity of the UK housing sector. The index has been steady, posting identical readings of 49% in the past two months, both of which beat the estimate.

- Manufacturing Production: Tuesday, 9:30. This is the first key event of the week. The indicator disappointed in November with a decline of -0.4%, weaker than the forecast of -0.1%. Will the indicator bounce back in December?

- NIESR GDP Estimate: Tuesday, 15:00. This indicator helps analysts gauge GDP, which is officially released only on a quarterly basis. The indicator has been steady, posting two consecutive readings of 0.6%.

- BRC Retail Sales Monitor: Wednesday, 00:01. This indicator provides a look at the change in retail sales in the BRC stores. Three of the past four readings have been declines, pointing to weakness in consumer spending.

- CB Leading Index: Wednesday, 14:30. This index has looked dismal, posting just one gain in the past six readings. The November release came in at -0.1%. Will we see an improvement in December?

- Official Bank Rate: Thursday, 12:00. The BOE is expected to hold the benchmark interest rate at 0.50%. The central bank will also release the vote on the November rate decision, which is expected to remain at 8 members in favor of holding the current rate level, and one member in favor of raising rates.

- Monetary Policy Summary: Thursday, 12:00. This report provides details about previous BOE policy meetings and could provide clues about future moves.

- Asset Purchase Facility: Thursday, 12:00. The BOE is expected to hold QE at 375 billion pounds. The vote of the previous QE decision will also be released. It is expected to remain unanimous, with all 9 members voting in favor of maintaining the current level.

- BOC Credit Conditions Survey: Friday, 9:30. Credit levels reflect the strength of consumer confidence and spending, so this report could impact on the movement of GBP/USD. The report is released each quarter.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4923 and quickly touched a high of 1.4931. The pair dropped sharply during the week, touching a low of 1.4725, breaking below support at 1.4752 (discussed last week). GBP/USD closed the week at 1.4733.

Technical lines from top to bottom

1.5163 is a strong resistance line.

1.5026 is next.

1.4856 has switched to a resistance line following sharp losses by the pair. This line had provided support since April.

1.4752 was also breached last week and has reverted to resistance. It is a weak line and could see further action early in the week.

1.4562 was an important cap in December 2001.

1.4346 is the final support level for now. It was a cushion in June 2010.

I am bullish on GBP/USD.

The US dollar remains the market’s darling after the Fed rate hike in December. The Fed is set to raise rates again early in the New Year, while any BOE plans to raise rates are on hold, perhaps until 2017. This monetary divergence and a strong US economy favor the dollar continuing to make gains against the pound, which many analysts believe is overvalued.

Here is our 2016 Financial Markets Guide:

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.