GBP/USD managed to recover on hopes for a softer Brexit and mixed movements in the USD. The services PMI and trade balance stand out in the first full week of September. Here are the key events and an updated technical analysis for GBP/USD.

The pound enjoyed talk of a softer Brexit, coming from a softening position from the government as well as a big move from the opposition. On the other hand, it seems that the EU is treating the UK like Greece. The dollar continued suffering as the echoes from Yellen’s speech in Jackson Hole reverberated but then recovered as data was looking good. US GDP beat expectations with 3%. However, the NFP report came out a bit on the soft side, weighing on the greenback.

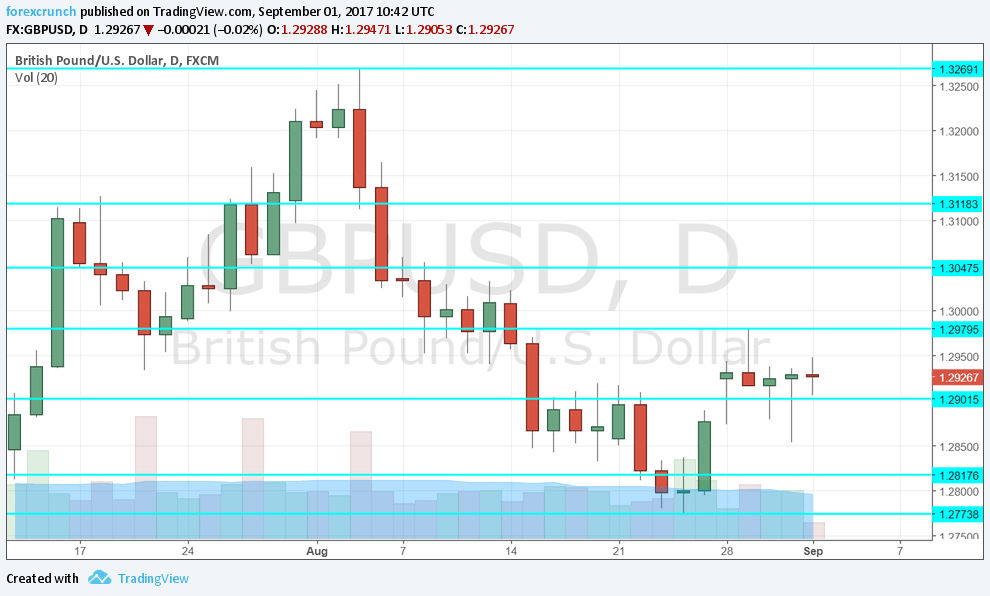

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily chart with resistance and support lines on it. Click to enlarge:

- Construction PMI: Monday, 8:30. The second purchasing managers’ index fell short of expectations in July, falling sharply to 51.9 points. Worries about house prices weigh on the sector. A score of 52.1 is expected.

- BRC Retail Sales Monitor: Monday, 23:01. This gauge by the British Retail Consortium rose by 0.9% y/y in July but shows general signs of weakness. We now get the figure for August.

- Services PMI: Tuesday, 8:30. The services sector is the largest in the UK and the publication has a significant impact on the pound. In July, the score stood at 53.8, reflecting OK growth, but falling short of the levels seen early in the year. Will it continue falling? A minor slide to 53.6 is expected.

- Halifax HPI: Thursday, 7:30. This is one of the earliest measures of house prices and has a significant impact. A rise of 0.4% was recorded in July, slightly above expectations. However, on a yearly basis, prices are not going anywhere fast. Since Brexit, the housing sector is struggling. A small increase of 0.2% is expected.

- Goods Trade Balance: Friday, 8:30. Britain is seeing a widening trade deficit, and this hurts the pound. This deficit reached 12.7 billion pounds in June. A similar level is projected now. A narrower deficit of 12.1 billion is on the cards.

- Industrial output: Friday, 8:30. The manufacturing sector does enjoy Brexit, as the weaker pound makes exports more competitive. Industrial production advanced by 0.5% in June and the narrower manufacturing production ticked up 0.4%. An advance of 0.2% is predicted.

- Construction Output: Friday, 8:30. With the growing focus on the housing sector, this measure by the ONS is eyed. A small drop of 0.1% was seen in July. However, it is important to note that recent figures have been revised to the upside. A slide of 0.2% is projected.

- Consumer Inflation Expectations: Friday, 8:30. While chances for a rate hike are diminishing, inflation expectations could push them back into the limelight. Consumers expect prices to rise by 2.8% in the next year according to the numbers released for July.

- NIESR GDP Estimate: Friday, 12:00. The National Institute of Economic and Social Research provides a monthly estimate of GDP growth. For the three months ending in July, NIESR saw growth worth 0.2%, at the bottom of the recent range.

GBP/USD Technical Analysis

Pound/dollar continued advancing early in the week and tackled the 1.2975 level (mentioned last week).

Technical lines from top to bottom:

1.35 was the post-Brexit high and remains the top level. It is followed by 1.3370 which capped the pair several times in 2016.

The 2017 high (so far) of 1.3270 is the next barrier. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

The slow pace of Brexit negotiations joins the slow pace of the economy. While the US economy has its own troubles, the pound remains under immense pressure.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!