The British pound couldn’t escape the European debt crisis, and the discussion about more QE in Britain. The upcoming week consists of two important PMIs among other figures. Here is an outlook for the upcoming events, and an updated technical analysis for GBP/USD.

British bonds did enjoy the failed German bond auction, but this wasn’t enough to lift the pound. And while Q3 GDP was reaffirmed at 0.5%, Q4 looks very worrying. We will get fresh data about November now.

Updates: GBP/USD rose on hopes for Europe. After starting with a gap higher, it now finds support above the 1.5530 line. The rally cooled down after CBI Realized Sales dipped to -19. A score of -12 was expected. Nationawide HPI and Net Lending to Individuals came out better than expected, helping the pound rise and top 1,56. The decision to cut USD swaps in order to aid banks (especially in Europe) gave a boost also to the pound. The rally stopped at around 1.5780. The pound is relatively stable around 1.57. Other currencies are gaining against the greenabck on high expectations for a positive Non-Farm Payrolls result – classic risk appetite.

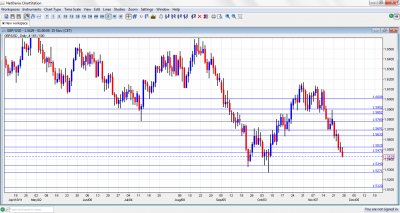

GBP/USD daily graph with support and resistance lines on it. Click to enlarge:

- Nationwide HPI: Publication time unknown at the moment. According to the Nationwide Building Society, prices have surprisingly risen last month by 0.4%. The figures tend to be rather stable. A drop is likely now.

- CBI Realized Sales: Monday, 11:00. A negative score has been recorded by CBI in the past 5 months. This reflects lower sales volume. On the other hand, the indicator managed to rise from -15 to -11 last month. Retailers and wholesalers are expected to remain negative, but a deeper dive isn’t likely now.

- Net Lending to Individuals: Tuesday, 9:30. More lending means more economic expansion. After one bad month that saw an expansion of only 0.4 billion, expansion has been remarkably stable at 1 billion. A similar figure is expected now.

- GfK Consumer Confidence: Wednesday, 00:00. This is a highly regarded survey of 2000 consumers. It resides in negative territory for a long time, expressing pessimism. This pessimism has deepened last month, with a drop from -30 to -32. Another drop is expected now.

- Manufacturing PMI: Thursday, 9:30. The first PMI for November comes from the struggling manufacturing sector. Purchasing managers sent the score under 50 points. This represents contraction in the manufacturing sector. A rise is expected from last month’s 47.4 points, but only a rise above 50 will really help the pound.

- Construction PMI: Friday, 9:30. The construction sector has done fairly well in October, printing a surprising rise to 53.9 points. A small slide is expected now, but this relatively stable sector will likely remain in growth territory, above 50 points.

* All times are GMT.

GBP/USD Technical Analysis

A first attempt to break under the 1.5633 line (mentioned last week) ended in a false break, but the second move was already successful, and the pound eventually fell below 1.5530 as well.

Technical levels from top to bottom

The round number of 1.60 was fought over and finally lost. It switches to resistance. Also this line worked well in both directions during 2011.

100 pips below, 1.59 was the bottom border then the pair traded lower, and couldn’t be reconquered. 1.5850 proved to be a tough line of resistance before the recent break higher and now returns to its previous role..

It is followed by the swing low of 1.5780, a minor resistance in 2010, which is minor support now. 1.5690 joins the chart after being the bottom of the crash in November. It capped the pair earlier.

1.5633 worked as support during September was only very temporarily breached in October. It is followed by 1.5530 which was the bottom line of the recent range, and had a similar role back in 2010.

Further below, 1.5480 was support and resistance in the past, and lately in September and worked quite well now. 1.5340 also had a role early in the year, and the pair bounced off this line in September.

The last line is the trough of 1.5271, which was reached after the announcement of QE2 in Britain. Even lower, 1.5120 is the final cushion before the very round number of 1.50.

Looking below 1.50, 1.48 is of significant importance, followed by 1.4650.

I remain bearish on GBP/USD.

As aforementioned, Britain is part of Europe, whether it likes it or not. The British government already admitted that it will not meet the deficit target, despite the high price paid in austerity measures. Even if inflation doesn’t drop, the road remains open to more QE.

See how support turned into resistance with GBP/USD (Elliott Wave Analysis).

If you are interested in GBP/JPY and technical setups for this pair with binaries, see this week’s GBP/JPY binary technical setup.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.