GBPUSD Daily Analysis

GBPUSD (1.3022): GBPUSD has narrowed in its range but has managed to hold out near the 1.3000 handle with yesterday’s session closing in a doji. On the 4-hour chart, following a brief consolidation near 1.2960 – 1.2954 support, GBPUSD managed to bounce higher but is challenged by the resistance at 1.3067. Further gains can be expected only on a breakout above this level for 1.3200 initially. To the downside, price action could remain range bound within the current levels.

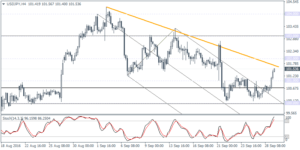

USDJPY Daily Analysis

USDJPY (101.53): USDJPY is seen extending gains today, with prices currently trading at a 6-day high. Resistance is seen at 102.00 which could temporarily keep a lid on prices unless we see a strong breakout above this level. The 102.00 resistance level shows a confluence between the falling trend line and the horizontal resistance. On the 4-hour chart, there are bearish signs as the Stochastics shows a hidden bearish divergence. Near-term pullbacks can be expected back to 101.00 through 101.60.

EURGBP Daily Analysis

EURGBP (0.8622): EURGBP continues to remain on the watch list as prices are currently showing a reversal off the 0.8600 support level. A near-term pullback could see EURGBP trim its losses with a retest back to the resistance level of 0.8671 – 0.8648. The overall bias is likely to remain to the downside if we get a confirmation of a reversal near the resistance level. However, mind the fact that the daily session in EURGBP closed with a doji which hints at a near-term recovery in the declines.