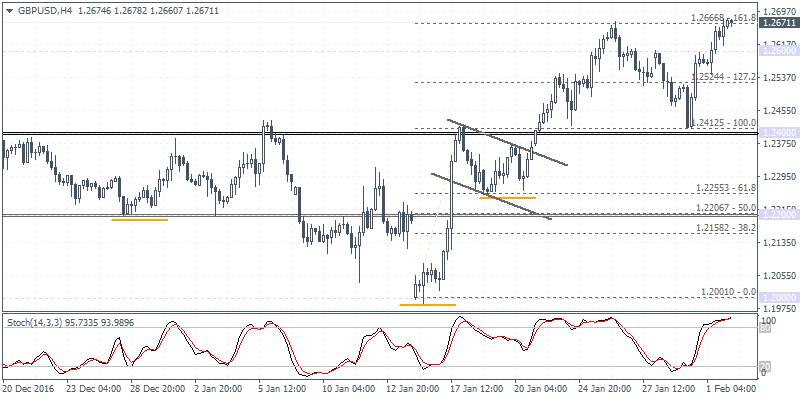

GBPUSD intra-day analysis

GBPUSD (1.2671): The British pound extended gains for the second day and looks poised to continue higher after closing above $1.2600 yesterday. The British pound held on to its gains despite strong US economic data. In the UK, British MP’s voted overwhelmingly in favor of backing the Article 50 bill which was supported by the Labour party. This clears the way for Prime Minster Theresa May to get the Brexit negotiations underway, which is expected to happen before March. The next main risk for the GBP today will, of course, be the BoE meeting, where no policy changes are expected. The GBPUSD could maintain the bullish bias as the target towards $1.2800 looks possible on the inverse head and shoulders pattern.

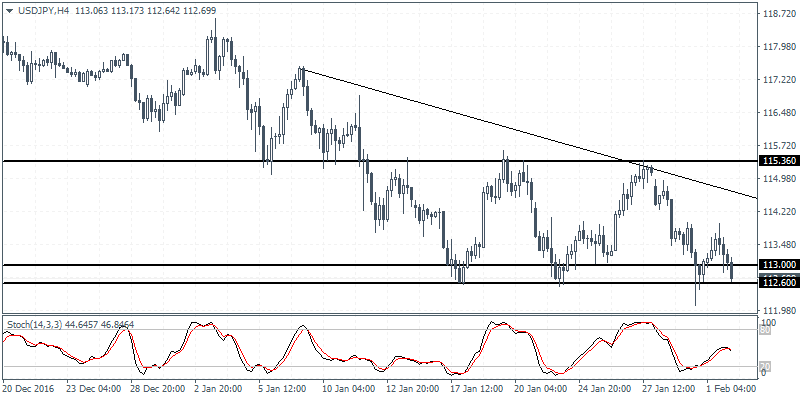

USDJPY intra-day analysis

USDJPY (112.69): The Japanese yen is continuing to look stronger with prices failing to keep the gains after briefly bouncing off the 113.00 – 112.60 support level. USDJPY has become the center of attention as earlier this week U.S. officials named Japan as one of the countries keeping the currency artificially devalued. The comments from U.S. officials saw Japanese officials defending their stance. Japanese PM Abe stressed on Thursday that the BoJ was doing only what the Fed and other central banks were doing. Speaking in the parliament, the Japanese PM said, “The Abe administration has never carried out intervention in the foreign exchange market. At the same time, however, I wouldn’t rule it out. I consider it an option for emergency cases. Still, that has never been done at least under my administration.” Watch for a potential breakout below the 113.00 – 112.60 support level which could prompt further declines to 109.75.

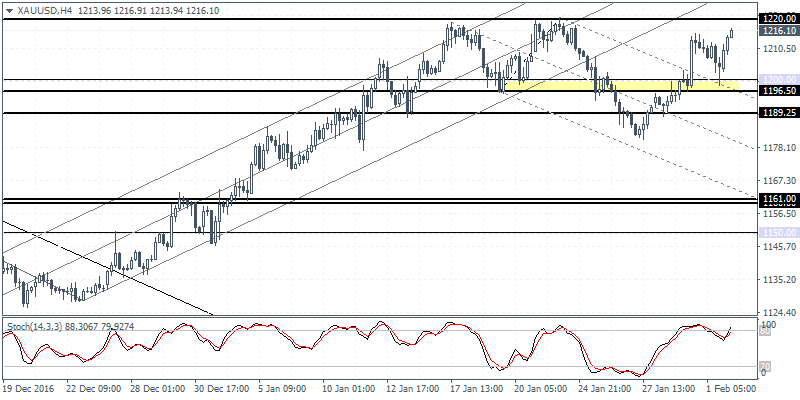

XAUUSD intra-day analysis

XAUUSD (1216.10): Gold prices are looking up as the precious metal is seen holding on to the gains despite the FOMC risks from yesterday. Gold prices fell briefly to test the $1200.00 handle yesterday but closed the day nearly flat at $1209.67. The early Asian trading session today is seeing some bullish momentum in gold prices, but traders should be wary of the bearish divergence that is shaping up on the daily charts. The price level of $1220.00 will come into focus after gold prices failed to breakout above this level since mid-January. Failure to post a new high above $1220.00 could signal the risks of a downside decline with $1200.00 likely to be tested again.