- Gemini’s cryptocurrencies under custody doubled since January and reached a record high of $25 million.

- Institutional investors are increasingly participating in the crypto space, increasing the demand for Gemini’s services.

- Last week, the crypto market’s bullish price action pushed institutional assets under management of digital asset products to a record high.

Gemini Custody has hit a massive milestone as institutional interest continues to build around cryptocurrencies.

Gemini’s crypto under custody doubled since early 2021

The Winklevoss twins’ Gemini exchange announced that it had surpassed $25 billion in cryptocurrency held in custody for the first time. The digital asset custodian has doubled its cryptocurrencies under custody since the start of the year.

According to Gemini, along with the incredible price action seen so far this year, institutional investors are also increasingly participating in the crypto space. Gemini currently ranks the 14th by trade volume among cryptocurrency exchanges.

Gemini has long had the reputation of being one of the most compliant crypto exchanges in the market, being a New York trust company and a qualified custodian by the New York State Department of Financial Services.

The custodian services a wide range of institutional clients, including hedge funds, trading firms, corporate treasuries, and asset managers. Some prominent asset managers that use Gemini’s custodial services include BlockFi, Blockchange CoinList, and CI Global Asset Management.

In March, the crypto exchange launched Gemini Fund Solutions, with custody, clearing, trade execution, and capital markets services designed for cryptocurrency funds. Notably, the firm supports many crypto fund issuers, including Canadian crypto fund managers that have launched Bitcoin exchange-traded funds (ETFs).

Institutional crypto products AUM reach record high

Institutional crypto products, including Bitcoin ETFs, have seen growth in demand. Canadian regulators approved three Ether ETFs, following the success of the launch of several Bitcoin ETFs in the country,

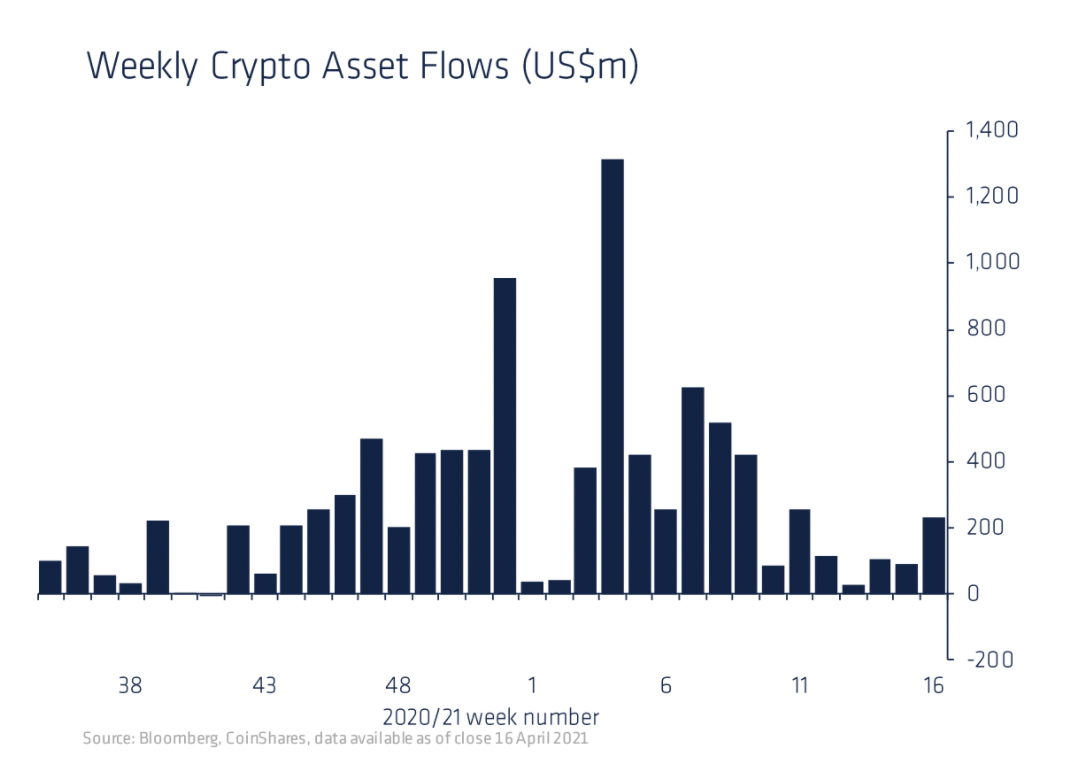

In the latest CoinShares weekly digital asset fund flows report, the firm noted that the bullish price action

witnessed last week pushed assets under management to a new record high of $64 billion for the first time.

Last week, cryptocurrency-related investment products accounted for $233 million, the largest inflows since early March. According to CoinShares, this could indicate a renewed appetite for digital assets, with the growing acceptance from institutional investors, and fear for inflation continues.

Weekly crypto asset inflows

Bitcoin continues to hold the largest share of inflows of $108 million, while Ethereum had $65 million, which is considered to be outsized inflows relative to its market capitalization. Above all, Ripple (XRP) has been the most popular with weekly inflows of $33 million, almost doubling its assets under management to $83 million.

Institutional trade volume also skyrocketed, surging by 59% week-over-week to reach $4.8 billion.