Better than expected German inflation figures, which actually was not totally expected given the early releases from the various German states. Year over year, inflation in Germany is back in positive ground: +0.1% in the European HICP number and +0.3% in the national one, both +0.2% above predictions. The monthly figures are naturally also a beat: +0.8% in both the CPI and the HICP.

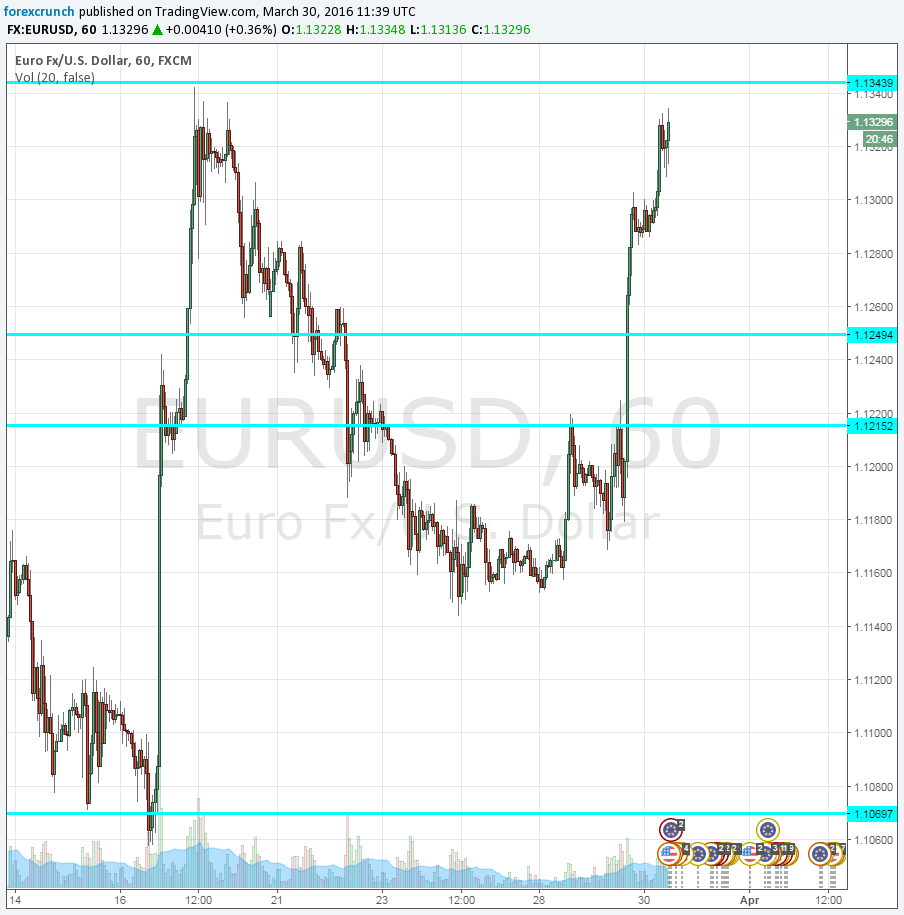

EUR/USD is quite stable, just above 1.1330.

Will the full euro-area figure return to positive ground? Will the ECB rest for a very long time?

Germany was expected to report slightly higher inflation rates in the preliminary release for March. The European standard HICP was expected to drop 0.1% y/y instead of -0.2% in February. Similarly, the national CPI carried expectations to advance from 0% to 0.1%. Month over month, both indicators rose 0.4% in February and carried expectations for 0.7% in the HICP and 0.6% in the national figure.

EUR/USD traded on high ground, around 1.1330, taking advantage of the weakness of the US dollar.

Fed Chair Yellen went dovish, once again, and in a stark manner. She warned about the global economy, said that caution is “especially” warranted and that the inflation outlook has become ever more uncertain. This hit the US dollar quite hard.

German inflation feeds into the all-euro-area inflation figures we will receive tomorrow. These showed a price fall of 0.2% in February and core inflation only at +0.8%. Small improvements are on the cards. The weak data in February probably contributed to the huge stimulus package introduced by the ECB. However, the impact was quite different once Draghi basically said they are done for now.

Here is a chart of EUR/USD: