The Eurozone’s largest economy is expected to see a slowdown in the third quarter with latest data on manufacturing and industrial production suggesting a sharp drop in output.

According to official data from statistics office Destatis, Germany’s total industrial output was down 1.8% in September on a month over month basis; reversing off the 3.0% gain registered the month before. Analysts were expecting to see a 0.6% decline for September.

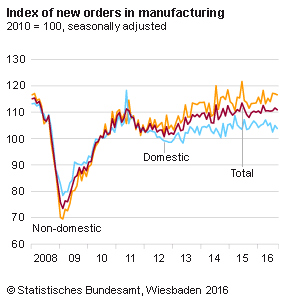

Factory orders were also down 0.6% during the month. However, officials caution that with the data staying volatile on a monthly basis, the quarterly trend continued to show a healthy pace of growth. In the three months ending September, industrial production is up 0.2% making a mild positive contribution to growth, while factory orders were seen rising 0.5% in the quarter, which was a positive trend following a 0.4% decline in the second quarter.

New orders in manufacturing fell 0.6% in September on a seasonally adjusted basis with August numbers being adjusted to show a 0.9% increase against initial estimates of 1.0%. Domestic orders in September fell 1.1% while foreign orders were down 0.3% from the previous month. New orders from the euro area were down 4.5% from the previous month while news orders from other countries increased 2.5% during the same period.

During September, consumer goods production fell 1.9%, while intermediate goods output was down by 0.5% and finally energy production was down 3.4%, attributed to the unusually warm period.

Other data from Germany showed that the trade surplus was lower than expected, registered 21.3 billion euro, which was slightly off the forecasts of 23 billion euro. Exports were seen falling 0.7% contributing to the lower than expected trade surplus data.

Despite the slowdown, Germany likely to see growth pick up in Q4

The data suggested that Germany’s GDP growth in the third quarter might have slowed and not keeping pace with the growth seen during the first half of the year. Germany registered GDP growth of 0.40% on a quarterly basis in the second quarter, after starting the first quarter with 0.7% growth.

However, some experts believe that Germany’s growth would be back on track by the year’s end. HSBC Sr. Analyst, Rainer Sartoris said, “Sentiment indicators do point to a pickup of activity at the end of the year.”

Many analysts remain positive on Germany’s growth noting that business sentiment in Germany has been resilient in recent months, even weathering the UK EU referendum results. Germany’s Ifo business sentiment has been rising for the second consecutive month, while the purchase manager’s index hit a three year high in September. Andreas Rees, an analyst with UniCredit, says that “German manufacturers could feel the tailwind from improving sentiment data in emerging markets.”

Germany will be publishing the third quarter GDP numbers this week with the average forecasts pointing to a 0.3% increase on a quarterly basis in the third quarter, which is slightly slower than Q2 GDP figures. But in the longer run, Germany’s growth is expected to pick up the pace by Q4 with preliminary estimates pointing to a 0.4% growth in the three months ending December 2016.

EU Forecasts: Eurozone growth to slow in 2017

Last week, the EU commission issued fresh forecasts but painted a grim picture on growth prospects. According to the release, growth in the 19-nation eurozone is expected to slow next year with risks emanating from Brexit and uncertain economic trends in China. The EU commission trimmed growth forecasts for 2017 to 1.5% from 1.8% previously and projected a 1.7% growth in 2018. For the current year, the commission raised the growth forecast from 1.6% to 1.7%.

“Risks to the forecast have risen in recent months and are clearly tilted to the downside, including as a result of the UK ‘leave’ vote, which has raised uncertainty and can be seen as an indicator of heightened policy risks in the current volatile political environment,” the European Commission said in its report.

On inflation, the EU Commission noted that inflation would rise to 1.4% in 2017 and 2018 but maintained that inflation would remain “below, but close to 2 percent.” Eurozone headline inflation currently stands at 0.3%.

For Germany, the EU commission maintained that while German economy will maintain the growth momentum, a short term slowdown is to be expected. For 2016, German GDP is forecast to rise 1.9%, and therefore moderate at a pace of 1.5% and 17% in 2017 and 2018.