USD/JPY advanced nicely on the back of a more hawkish Federal Reserve and plays around 110. The team at Danske sees potential for much more:

Here is their view, courtesy of eFXnews:

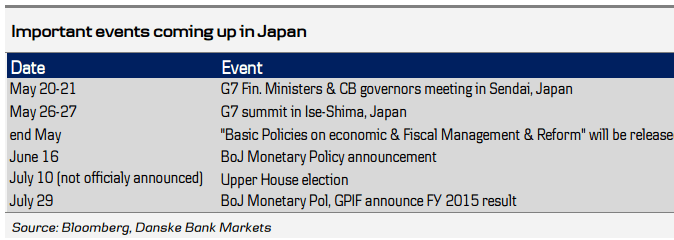

Politics is set to take centre stage in Japan in coming months with several important events ahead. Given the economic and political situation and, not least, this year’s surge in the JPY, we think the Japanese government will announce a fiscal stimulus package before end-May.

We expect the Bank of Japan to cut its policy rate by 20bp to -0.3% in July and to announce additional qualitative measures including a scale up of ETF purchases and a maturity extension of its government purchases.

We expect the combination of fiscal easing and monetary easing to lift USD/JPY back into the 112-117 range. We target USD/JPY at 115 in 3M and 116 in 6-12M.

We recommend investors gradually build up long USDJPY positions.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.