Just as we thought that the Trump administration’s hardline on China would be a thing of the past, the new Biden administration is taking over the baton from both the trade front and on the virus.

In recent headlines, the United States wants a “robust and clear” international probe into the origins of the Covid-19 pandemic in China, White House spokeswoman Jen Psaki said Wednesday.

She said it was “imperative we get to the bottom” of how the virus appeared and spread worldwide when she spoke to reporters overnight, highlighting “great concern” over “misinformation” from “some sources in China.”

US prior US president supported a theory that the virus could have originated in a lab at the Wuhan Institute of Virology, something China rejects.

In recent days, as the new US president was being sworn in, the State Department proclaimed the Chinese Communist Party’s “deadly obsession with secrecy and control and said that Its staff at the Wuhan lab had fallen sick with symptoms resembling Covid-19 in 2019 without making the cases known, concealing the present dangers, so to speak.

The new Biden government will be devoting significant resources of its own to understanding what happened and would not take the WHO report for granted, Psaki said.

Meanwhile, global Covid cases have topped 100 million as new strains emerge.

China, however, has reported its lowest daily increase in new COVID-19 cases in nearly three weeks on Thursday, suggesting aggressive countermeasures have helped slow a recent outbreak in the country’s northeastern provinces.

Whereas in the US, the nation remains the leader in recorded cases of the coronavirus with more than 25 million infections. India ranks second with more than 10.5 million cases, and Brazil third with almost nine million, according to John Hopkins.

Market implications

As can be seen, the commodity-fx complex is not in favour following the Federal Reserve’s obvious concerns about the new variant and a protracted economic recovery on a global scale after the FOMC and Jerome Powell’s presser:

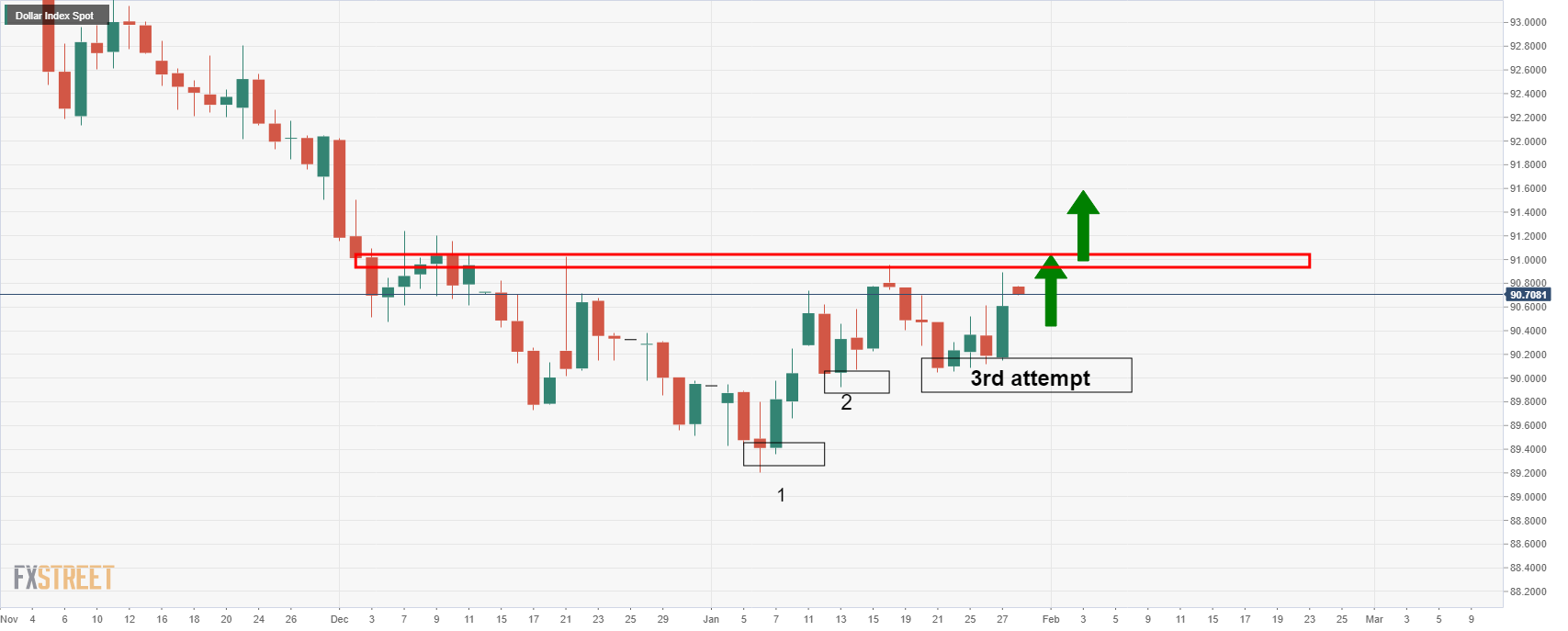

For this reading, the dollar has caught a bid as it attempts to break to the key resistance on the daily chart:

-637473946401919521.png)