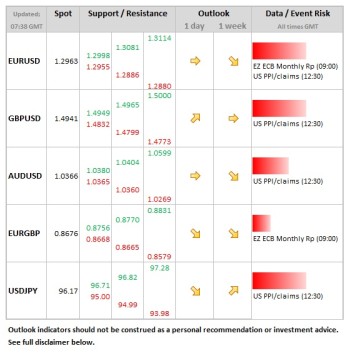

- USD: PPI inflation and initial claims data are seen today. The reaction to the retail sales yesterday confirmed the dollar’s tendency to rise on stronger than expected data, as the implications for potential Fed policy dominate any tendency for risk assets to rise (and the dollar to fall).

- EUR: The ECB monthly report is usually a low risk event, repeating the sentiments of the post rate meeting press conference.

- CHF: The recent comments from SNB officials have underlined the perception that the 1.20 floor to EURCHF will remain in place and as such today’s quarterly policy review brings with it low event risk for the market.

Idea of the Day

The two best performing currencies so far this week are the Aussie and sterling, but the reasons underlying could not be more different. As we talked about yesterday, sterling is all about recovery from oversold positions against a weak fundamental backdrop.

The Aussie meanwhile has been lifted by the latest unemployment numbers. The strongest monthly gain in employment for 13 years should be treated with some caution, as they can be volatile from month to month. Also, it’s worth noting that the majority of jobs growth was in part-time work.

But it has strengthened the perception that the central bank’s cash rate may have bottomed at the current 3.00%. Once again the Aussie has defied the doubters and is at a 5 week high vs. the US dollar, the only currency on the majors to be firmer against the Greenback over this period.

Latest FX News

- AUD: A strong set of labour market numbers allowed the Aussie to climb to a 5 week high at 1.0383. The unemployment rate fell to 5.4%, with employment rising 71.5k in February, the largest monthly gain for 13 years. The data is volatile month to month, but this release has strengthened expectation that the next move in the cash rate (currently at 3.00%) will be up, rather than down.

- KRW: Rates were kept on hold at 2.75% by the Bank of Korea, despite the signs of weakness in the economy and the problems caused by the weaker yen. The won was softer, USDKRW rising above 1,100 to a 5 month high at 1,109.

- GBP: Sterling has been putting up a fight this week, after the lows seen after Tuesday’s production data. Just the Aussie has outperformed it. The reasons are very different though, sterling’s predominantly on the covering of short positions. This could continue through 1.50 on cable, but the budget looms large next week.

- NZD: No surprise to see rates held steady at 2.50% by the RBNZ. The kiwi was softer on the news, currently 0.81890 from 0.8260 before the decision. The head of the central bank (Wheeler) referenced the ‘overvalued’ and said that rates are expected to be on hold for the remainder of the year. AUDNZD seen at a 14 month high at 1.2660.