- Gold prices fell on Wednesday after peaking this week.

- Fed’s tightening policy and stronger NFP can send gold below the 1800 mark.

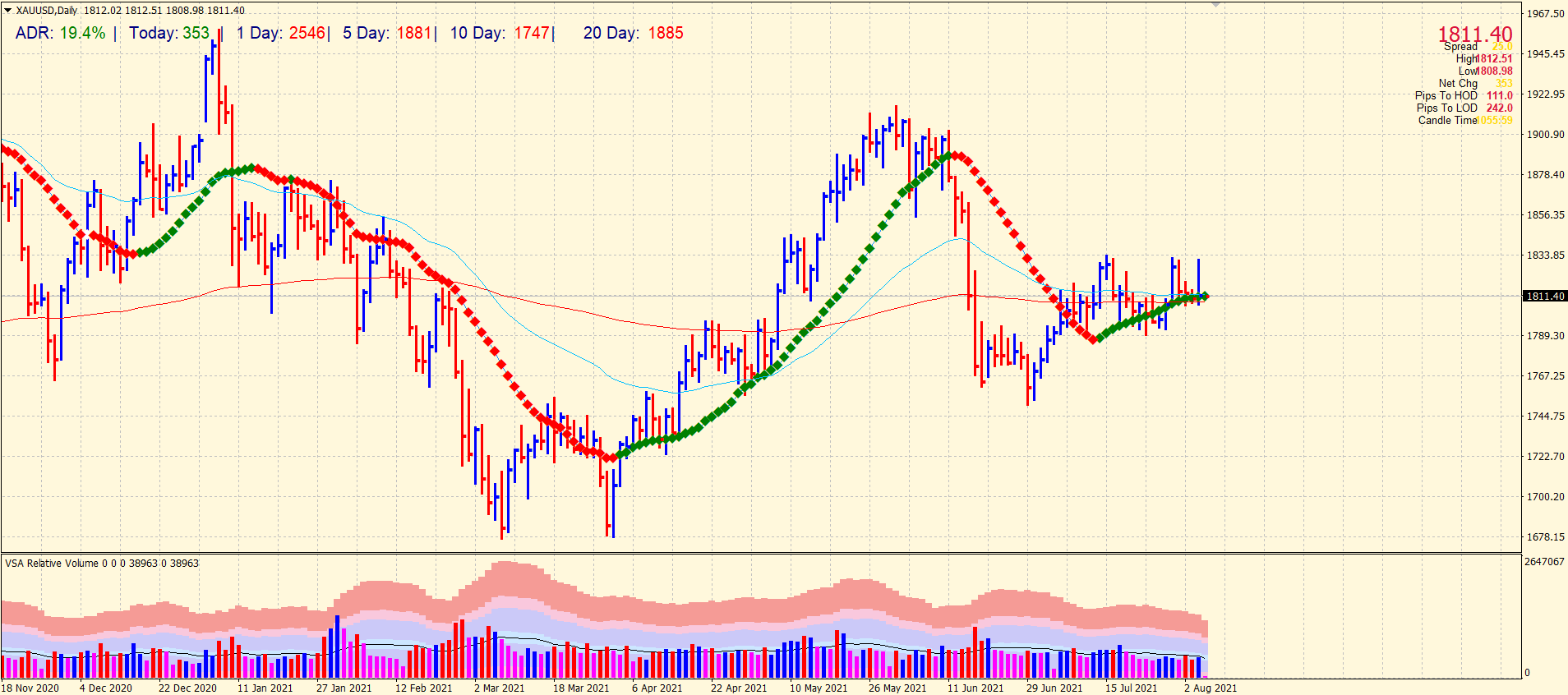

- A bearish death cross on the daily chart may help the sellers.

Gold analysis is bearish after yesterday’s fall. A surge in the US dollar helped knock gold off its peaks this week. Richard Clarida, the Fed vice chairman, took action on Wednesday to bolster the Fed’s rate hike plans. In light of Clarida’s comment, a possible schedule announcement may be warranted later this year if economic conditions continue to improve. As the transmission delta option grows in importance, seasoned economists recognize its increasing threat.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

As a result of the tightening of the already restrictive Fed rates, market participants bet on the US dollar bulls. Dollar strength pushed down gold prices. Because foreign investors face higher ownership expenses when the dollar strengthens, yellow metal prices tend to decline. Some people see gold as a hedge against inflation, although this feature is still on the table in many quarters. It is likely, however, that fast-tracked consideration to tighten the Federal Reserve will harm gold. Prices tend to be lower when interest rates are higher.

Despite this, inflation is unlikely to be a focus of gold for the time being. Moreover, there has been a general absorption of the temporary assessment of price increases by the Fed. Friday’s nonfarm payrolls (NFP) report is the big driver on the horizon for gold prices. According to analysts, 870,000 jobs will be created in July. Considering the Fed’s focus on the labor market, consensus data pressure is likely to be critical to monetary policy decisions. The stronger-than-expected NFP result should affect gold prices, contributing to dollar strength. Alternatively, a slip can benefit the yellow metal.

Gold technical analysis: Death cross can trigger more selling

Earlier this week, XAU prices looked higher but failed to hold above the 50-day and 200-day simple moving averages (SMA). The falling 50-day SMA has limited the uptrend over the past few weeks, and the death cross now appears to be looming on the horizon. This will likely put bearish technical pressure on gold, potentially bringing it back below the psychologically impressive 1800 mark.

–Are you interested to learn more about forex signals? Check our detailed guide-