- Due to a weakening dollar, gold has gained strength.

- The US jobs report did not impress the dollar, which fell as Fed officials reduced expectations of an aggressive rate hike.

- XAU/USD is set to fall further on the Fed’s hawkish stance.

The gold price forecast is mildly positive as the US dollar remains backfoot. However, improved risk sentiment may weigh on the metal.

–Are you interested to learn more about Islamic forex brokers?

Check our detailed guide- Market participants await policy announcements from the European Central Bank (ECB) and Bank of England (BOE) early Thursday as gold prices remained sidelined above $1,800.

As gold falls for the first time in four days, pulling back from a weekly high before major central bank events, the US Dollar Index (DXY) and Treasury yields contribute to risk-off sentiment. Gold buyers remain hopeful.

As of recent quotes from US presidential nominee Joe Biden and US Treasury Secretary Janet Yellen, stock futures and Asian stocks lagged since the start of the year as traders braced for tight monetary policy amid inflation concerns. The Eurozone initially helped with the inflation issue as the HICP headline hit a new record. Additionally, the UK inflation data indicates that Andrew Bailey and the company should announce a second rate hike.

Therefore, the central bank’s actions today will be crucial to monitoring the near-term direction of gold prices. In addition, XAU/USD traders will also be busy today with the release of the US unit labor costs for the fourth quarter to complement the January ISM Services PMI and December’s factory orders.

Business operations were disrupted by the skyrocketing number of COVID-19 infections, causing January’s ADP’s report to fall for the first time in a year. As a result, there were 301,000 job cuts in January. Compared to the 207,000 expected on private payrolls, this was a far cry from expected. In addition, the number of new jobs in December has also been revised down to 807,000 from 776,000 originally reported.

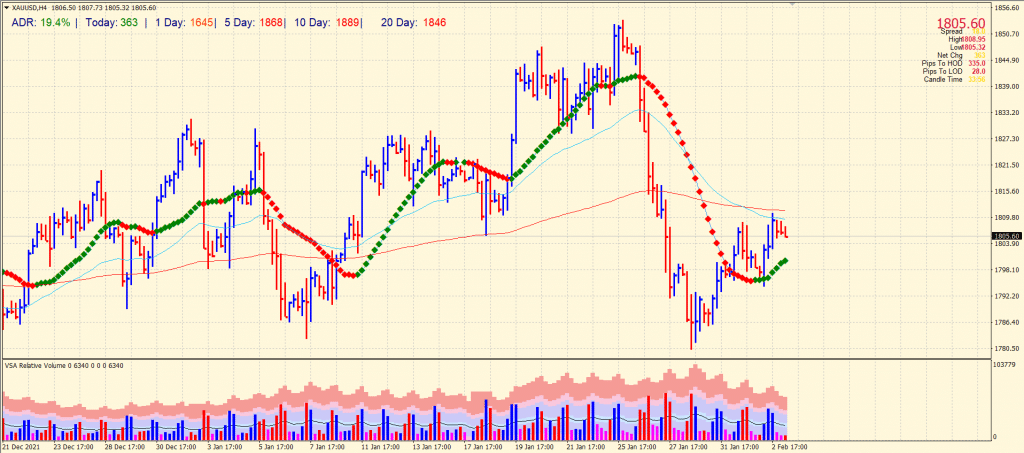

Gold price technical forecast: Bids above $1,800

The gold price manages to sustain above the 20-period SMA. However, the metal has found strong resistance around the confluence of 50-period and 200-period SMAs near the $1,810 area. The volume data supports the upside bias as the shakeout bar has a very high volume. The low of the bar continues to support the price.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The potential resistance levels for the metal are at $1,1815 ahead of $1,835 and then $1,860. On the flip side, the support levels come into play at $1,800 ahead of $1,780 and then $1,755.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.