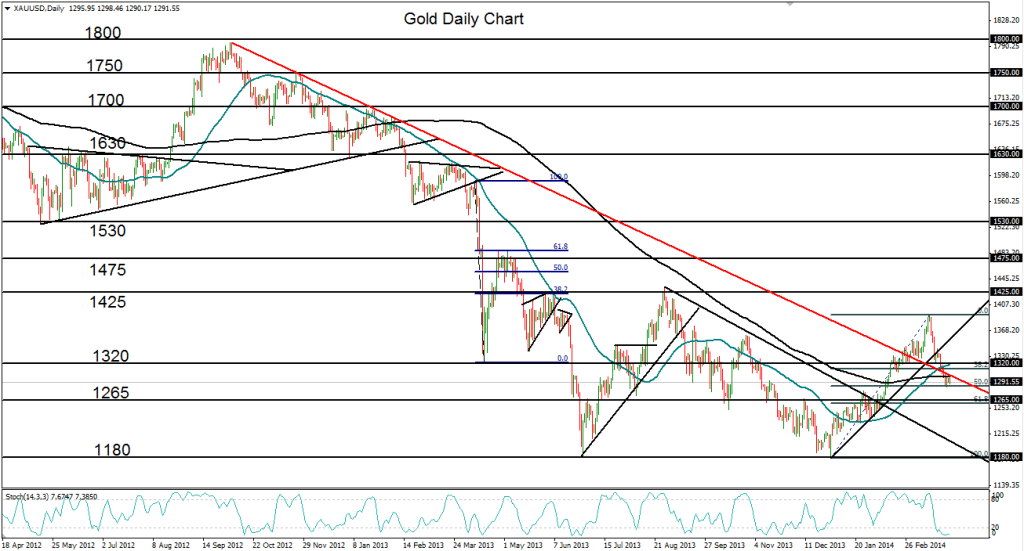

March 31, 2014 – Gold (daily chart) has given back 50% of its year-to-date gains as it has fallen swiftly within the past two weeks from its recent high of 1392 in mid-March. The precious metal’s advance during the first quarter of the year has been impressive, rising aggressively from a double-bottom, multi-year low around 1180 that was hit at the very end of 2013.

From that low, gold had been steadily targeting major upside resistance around the 1425 level, the double-bottom peak that was last hit in August of 2013, but fell short by turning back down at the noted 1392 mid-March high. When that high was reached, the 50-day moving average made a cross above the 200-day average, a bullish indication that had not been seen since late 2012.

Having just declined substantially and begun consolidating right at its 50% Fibonacci retracement level, the price of gold has now dipped slightly below its 200-day moving average as well as a major downtrend resistance line that has defined the bearish trend since the October 2012 1800-area high.

Any further pullback should meet key support around the 1265 level, which is also around the 61.8% Fibonacci level. To the upside, an eventual resumption of the recovery in gold should continue to target major upside resistance at the noted 1425 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.