- Gold’s price fell to 12-day lows in the overnight trade, signaling an end of the corrective bounce from $1,196.

- The price drop seems to have revived interest in put options.

Gold fell to $1,212 in the overnight trade – a level last seen on Nov. 16 – as the greenback picked up a bid on hawkish comments by Fed’s Vice Chair Clarida.

Notably, the drop to 12-day lows indicates the corrective bounce from the Nov. 13 low of $1,196 has likely ended at $1,230 and the bears have regained control.

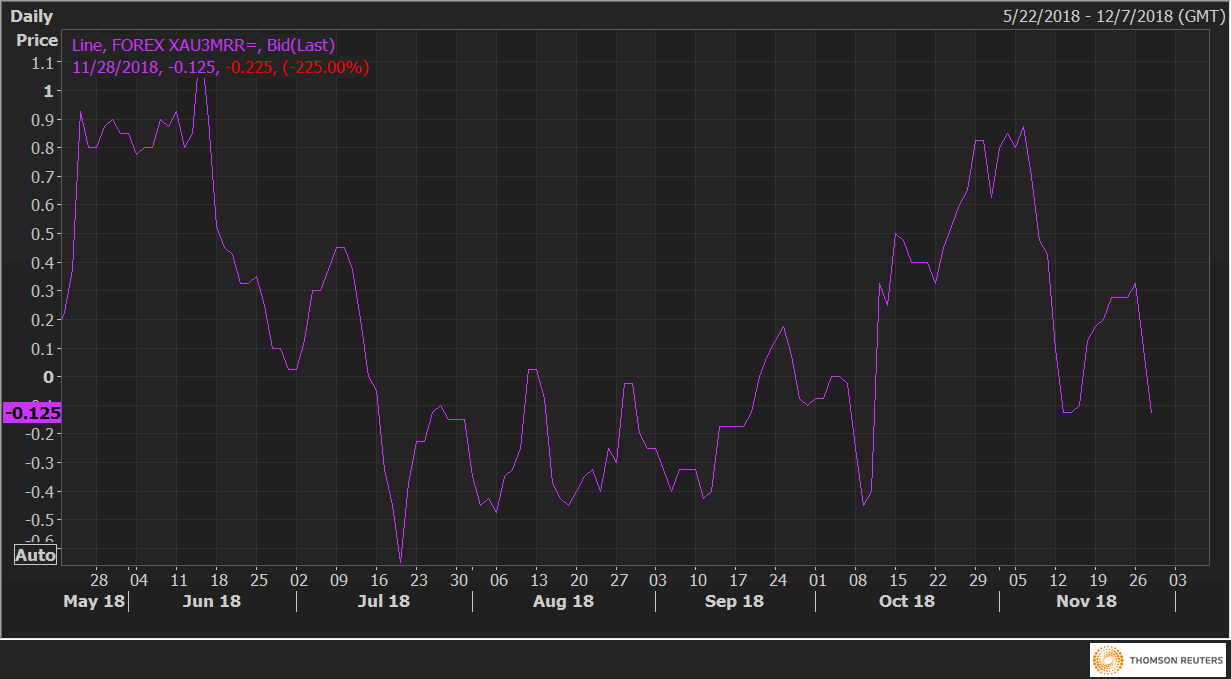

Adding credence to that view is the rise in implied volatility premium for the XAU put options. As of writing, the XAU/USD three-month 25 delta risk reversals are trading at -0.125 in favor of puts vs 0.325 in favor of calls seen on Nov. 26

The negative reading indicates the implied volatility premium (or demand) for put options is more than that for calls.

So, it seems safe to say that the options market has turned bearish on the yellow metal. In other words, investors are likely expecting a deeper drop in gold and hence are buying downside protection.

XAU3MRR