- The gold price is being pushed into a sell mode as risk aversion grows.

- Treasury yields continue to rise as investors flee to safety.

- The XAU/USD pair should test the $1850 level with US inflation on the rise.

The gold price outlook remains strongly negative as the hawkish Fed and aggressive rate hikes have raised the US yields, affecting the gold’s safe-haven status.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Risk-averse investors only turn to the US dollar for refuge at the start of a new week as gold prices fall with US Treasuries and global equities.

Amidst ongoing Chinese restrictions and fears about rate hikes, worries about global growth have returned amid a turbulent past week dominated by central banks. Its appeal as a safe haven keeps the dollar afloat during market panics and uncertainty.

Fed outperforms all other major central banks globally, so the dollar remains in demand. Although the Fed was less hawkish last Wednesday, it remains on track to raise rates by 50 basis points at its next two meetings as it begins to reduce its balance sheet.

Increasing Treasury yields are compounding the unrelenting yellow metal’s problems, as the dollar’s strength weighs heavily on gold’s dollar price. As a result of the Fed’s rate hike, the 10-year benchmark interest rate has risen to 3.185%, its highest level since November 2018.

Gold prices fell last week as speculative net short positions in the metal rose as investors instead flocked to the dollar ahead of the release of key US inflation data this week.

As gold prices continue to be influenced by yields and sentiment toward the dollar, yields will continue to be driven. However, Wall Street stocks might recover, giving gold bulls some breathing room and halting the dollar’s rise.

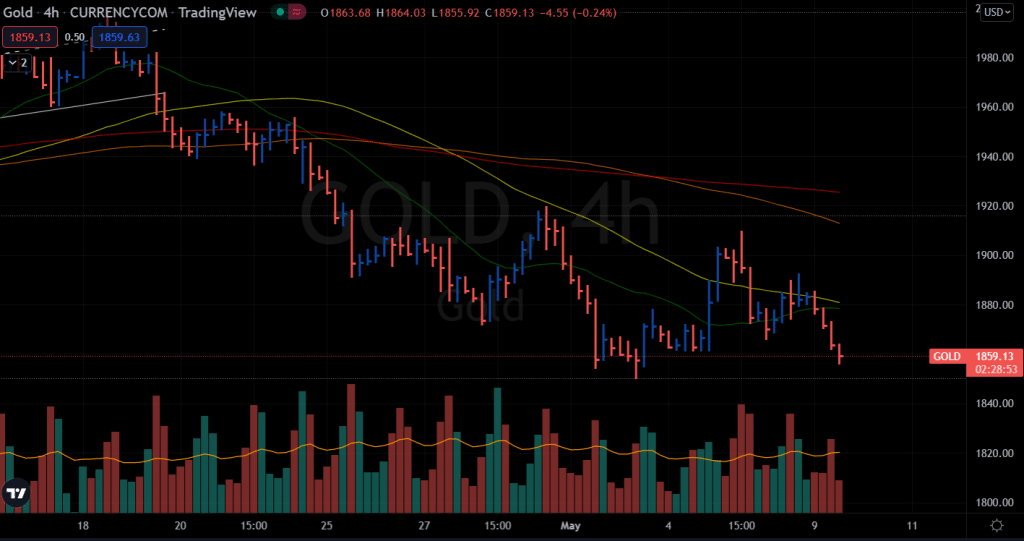

Gold price technical outlook: Bears eying $1,850 breakout

The gold price is heading towards a $1,850 support area. The support seems vulnerable and may be broken. The 4-hour chart shows a strong bearish outlook as the 20-period and 50-period SMAs will make a bearish crossover. The volume also shows a dismal scenario.

–Are you interested in learning more about making money with forex? Check our detailed guide-

However, it is prudent to wait for a breakout of $1,850 to find selling opportunities. Conversely, if the price recovers, we may see resistance around $1,870 ahead of $1,890.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money