- As the US dollar shows risk aversion, there is a downside risk for the XAU/USD pair.

- Fed policy calls for a 50 basis point rate hike in May.

- It is expected that interest rates will return to neutral sooner rather than later to curb inflation.

The gold price outlook is strongly bearish as the Fed’s aggressive stance weighs on the non-yielding metal. As a result, the US dollar remains a more appealing safe-haven asset.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

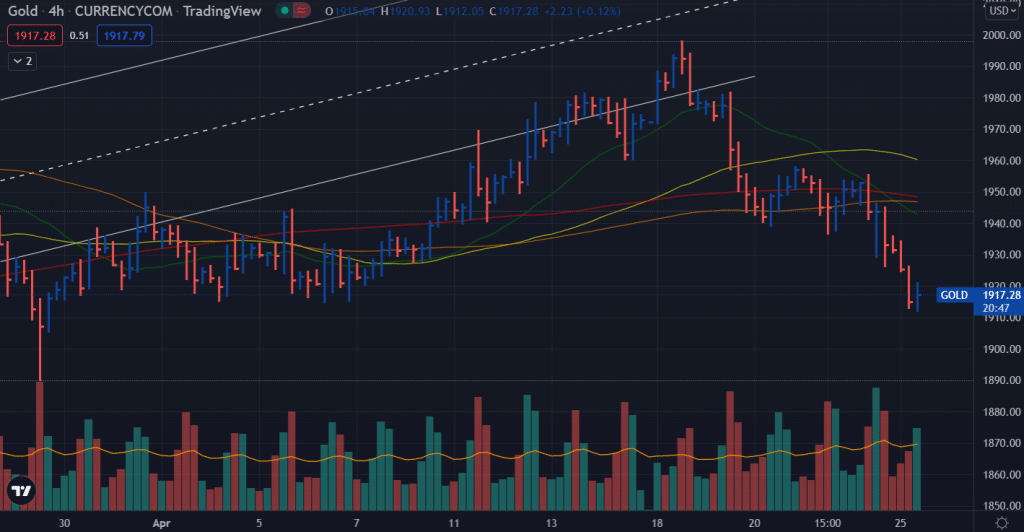

On Monday, gold fell for the third day from the psychological resistance of $2,000. At the start of the European session, spot prices fell to nearly a monthly low near $1,912 at the end of the fourth day of negative movement. Inflows into the underperforming yellow metal were held back by the prospect of more aggressive Fed tightening.

Last Thursday, Jerome Powell’s remarks to the International Monetary Fund (IMF) clarified uncertainty about May’s interest rate hike. Powell came close to confirming a monetary policy rate hike of 50 basis points on May 3. Powell also indicated four hikes during the year. The markets are now pricing in massive rate hikes for the next four sessions in May, June, July and September. As the Fed hikes rates to neutral, it will be crucial to monitor the momentum. In addition, the state of equilibrium reduction is also important to monitor.

In addition to the Fed’s hawkish expectations, the US dollar reached a more than two-year high, seen as weighing on dollar-denominated commodities. With an ongoing COVID-19 lockdown in China, these factors raised concerns about a slowdown in global growth and dampened investors’ appetite for riskier assets. Bull traders were not impressed by risk aversion momentum, and safe gold was not bolstered, suggesting that the path of least resistance leads to a decline.

There will be one more rate hike in 2022 for ten hikes throughout the year, suggesting a larger move above neutral. As the prolonged conflict in Ukraine has simultaneously aggravated both geopolitical uncertainty and inflationary risks, thereby increasing demand for safe-haven assets, we see few participants agreeing to buy gold amid an aggressive Fed.

Gold price technical outlook: Bears eying $1,889

The gold price is struggling to rise from the daily lows of $1,912. However, the 4-hour chart shows a strongly bearish perspective as the price is lying well below the key SMAs. Moreover, the volume data also suggests more potential to fall.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Therefore, it is prudent to watch the previous swing lows of $1,889, where the buyers may emerge for a minor correction. But, on the other hand, breaking the level is also quite high. So, a trading opportunity, either way, exist at those levels.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money