- Gold is mildly maintaining an upside bias after finding a bottom at $1793.

- The gold/silver ratio has reached highs around 124.

- Covid-19 and slow economic growth have been lending support to gold.

The gold outlook remains positive as it rallied to $1,823 an ounce, or 0.6% for the week, and a nearly $25 rise from a sudden weekly low on Monday.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Silver, by contrast, struggled to hold 10 cents above a 3-month low of $25 an ounce.

Together, it pushed the gold/silver ratio, a simple measure of the relative price of two former monetary metals, to 72. It’s the highest level since mid-January.

The gold/silver ratio skyrocketed during the first wave of the global Covid-19 crisis in the spring of 2020, reaching a World War II all-time high and briefly touching 124.

Since the US Dollar lost gold support 50 years ago, the average gold/silver ratio has been 59. However, over the past decade, the ratio has risen, and one ounce of gold has been worth almost 72 ounces of silver.

Given multi-year highs in inflation amid the deepening wave of the Covid-19 pandemic in the summer of 2021, the changing macroeconomic environment ultimately benefited gold following a sharp sell-off in mid-June.

The continued recovery in demand after the pandemic, together with supply constraints in key sectors such as construction and manufacturing, could lead to a sustained rise in inflation, the environment in which gold generally thrives.

Investment demand for silver will also benefit. At the same time, inflows to physically backed ETFs will remain stable and underscore the appeal of physical investment assets in a world of rising inflation and post-coronavirus uncertainty.

On Monday, Blackrock’s iShares Silver Trust reported the largest daily silver inflow needed to support the number of shares issued since the end of February. The growth was 224 tons.

SLV’s total precious metal reserves exceeded 17,451 tons, the highest in 3 weeks and two-thirds of the projected global mine production for 2021.

The demand is also increasing due to the use of silver in production.

Demand is growing for high-quality physical silver for industrial applications, including electronics, solar cells and ethylene oxide, while [physical delivery] premiums are rising on both sides of the Atlantic.

–Are you interested to learn about forex robots? Check our detailed guide-

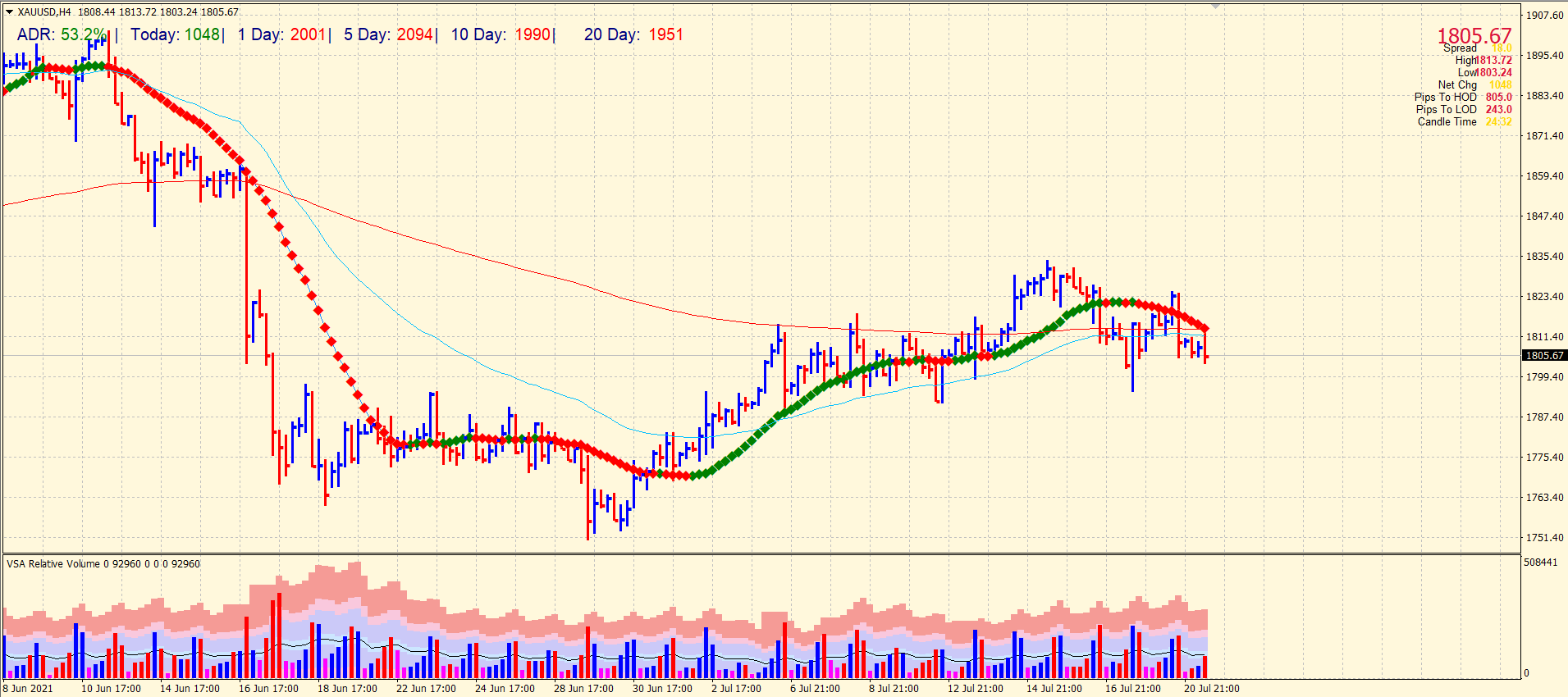

Gold technical outlook: Bulls shying below key MAs

Technically, the gold price is maintaining a mixed outlook. The volume is partially not supporting the recent minor downside correction. However, the price has not been able to sustain beyond the key 200-period SMA on the 4-hour chart. The 20, 50 and 200 SMAs have found congestion in a narrow zone of $1811 – 1815.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.