- The price of gold is holding up amid falling government bond yields.

- Currently, the price is in a consolidation range with a focus on a decline of $1,808.

- The stock market has started the week on a positive note, as traders await important US data this week.

In Asian trading on Wednesday, the gold outlook entered a period of upward consolidation above $1810 as bulls paused ahead of US ADP data and minutes from the December Fed meeting. This year, traders are reevaluating the prospects for a Fed rate hike, resulting in lower government bond yields and a stable gold price.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

As 10-year government bond yields rose to their highest level in over a month on Tuesday, the bright metal made an impressive comeback. Coronavirus cases are on the rise worldwide, with the United States setting a world record of nearly 1 million new Covid infections, underscoring gold’s appeal as a safe haven.

Markets that tend to err on the side of cautious optimism will be delighted by Omricon’s news. Researchers found that the more transmissible variant replicates less efficiently in lung tissue. So, scientists are using the term “softer” to describe the illness caused by the SARS-Cov-2 Omicron variant.

As Covid fears subside, investors look for a strong rebound, putting pressure on the Nasdaq, whose biggest drop was 1.4% since December. S&P 500 futures are virtually unchanged.

In November, US data showed that labor demand was high again, with 4.5 million Americans quitting their jobs as labor shortages continue to put pressure on employers. However, the impact of the recent virus outbreak is not yet clear.

With this in mind, US employment data this week and the pace of this growth about US economic growth will be crucial. The Federal Reserve, however, remains in place. The minutes of the last meeting will be released on Wednesday.

In a Federal Open Markets Committee meeting held December 14-15, Fed Chairman Powell confirmed the Fed’s plans to end quantitative easing in 2022. In response, the Fed could prepare to raise rates later this quarter if a rate hike is likely to cope with growing inflation.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

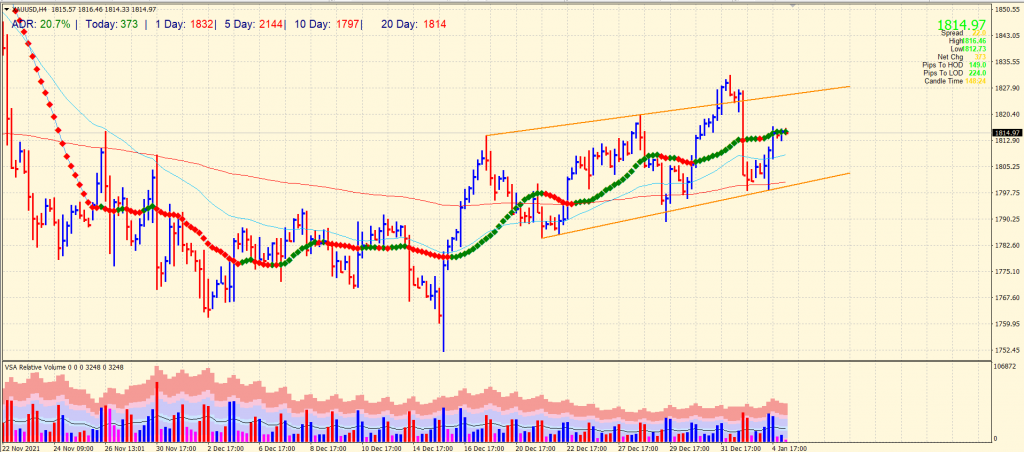

Gold price technical outlook: Consolidating losses

The gold price remains in broader consolidation, moving within the parallel uptrend channel. However, bearish bias holds more weight as we saw a widespread down bar on Monday, and the recent upside is only a pullback of that bar. The volume data shows no clear trend. However, the upside remains capped by the swing highs and 20-period SMA on the 4-hour chart. Bears need a breakout of $1,800 level to go further south.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.