- Following its largest daily decline since November 22nd, gold is seeing a pullback from its weekly low.

- Omicron tests traders ahead of Fed announcement, mixed inflation fears.

- The rating has already declined, but problems with viruses can throw a monkey wrench into the works.

The gold price outlook remains bearish as the price is heading down in anticipation of a hawkish fed and the expected rate hike.

During the European session, gold price traded near USD 1769-68, just above its week and a half low from the previous day. The US PPI, released on Tuesday, confirmed the Fed’s restrictive expectations and kept the price of the unproductive yellow metal steady.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Dollar-denominated commodities, however, were supported by the weaker US dollar. Furthermore, renewed fears of the economic impact of the new Omicron coronavirus variant helped limit further safe-haven losses, XAU/USD.

In addition, investors did not place aggressive bets, preferring to sit on the sidelines ahead of the FOMC policy decision later in the US session. As the market gauges growth potential through June 2022, investors will be looking for new clues about the Fed’s rate policy. It will be critical for determining the next phase of gold’s price movement. Meanwhile, traders can take advantage of the US retail sales to take advantage of some of the short-term opportunities associated with precious metals.

Comparatively, the 10-year break-even inflation rate of the St. Louis Federal Reserve (FRED) declined to an 11-week low compared with the PPI’s highest level for November to review the Fed hawks.

The monthly pace will double to $ 30 billion by mid-March, which will indicate the end of quantitative easing far earlier than mid-June. The statement’s tone, economic forecast, and scatter plot may also be changed to sound more restrictive. TD Securities expects the median fund rate to increase by 50 basis points in 2022.

Geopolitical and trade tensions between the US and China and between the US and Iran are also affecting market sentiment but are hardly responding to the Fed’s actions.

US Treasury and S&P 500 futures yields remain sluggish during these events, reflecting market sentiment ahead of the Fed meeting. APAC stocks exhibit a mixed performance as well.

As the Fed faces a major battle against inflation, gold prices will likely remain fragile. The wild card is still Omicron.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

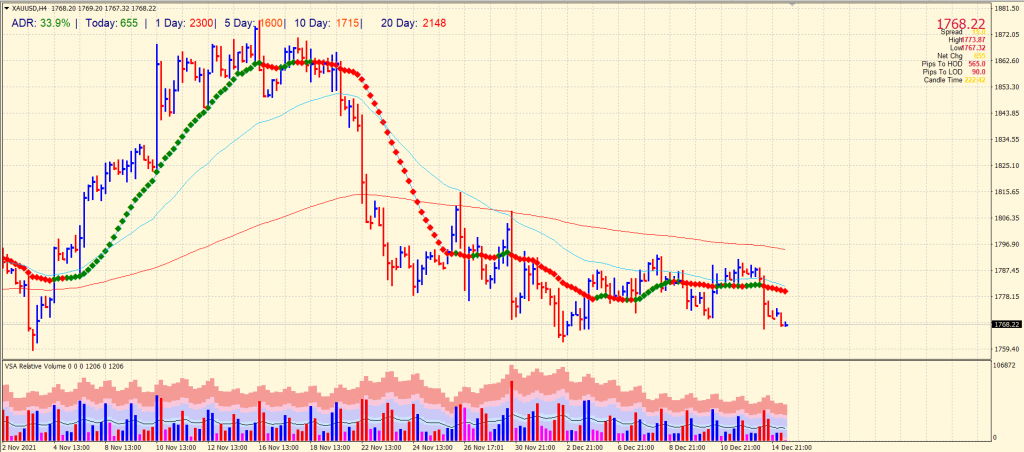

Gold price technical outlook: Heading towards range’s bottom

Gold’s technical outlook remains neutral to bearish as the price is heading towards the bottom end of its range. However, the bottom range can be broken as the price is well below the key SMAs on the 4-hour chart. However, the volume is quite neutral, suggesting that the gold price may support around $1,750-60 area. On the upside, $1,780 will be the key resistance ahead of the $1,800 mark.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.